Full Cheap Japanese Portfolio Positions / Sizing Update

Taking advantage of Tokyo Stock Exchange's push to close the price to book discount of listed securities

I’m a big believer in the thesis I laid out in my previous post about cheap Japanese stocks. I’ve constructed a basket of stocks to take advantage of this theme. A quick summary of the thesis is as follows:

Many Japanese companies are net nets (net current asset value exceeds total liabilities+market cap). Net nets tend to outperform.

The Tokyo stock exchange and the Japanese government are pushing companies to address their massive price/book discounts and low return on equity.

Since writing that post up I’ve increased my positions significantly. The basket includes names that on average trade at ~0.5x P/TBV, are consistently profitable, and pay dividends.

I sold out of a few big winners already by selling out of Endo Lighting TYO: 6932 and Kuribayashi Steamship TYO: 9171 at over 100% gains. I also trimmed a few other big winners. My rule of thumb is as these names approach 1x book, I’ll begin selling.

This entire portfolio is funded by cheap JPY margin loans through Interactive Brokers at 0.75% to fund these positions. My portfolio as a whole is not leveraged, but the benefit of funding these positions with JPY margin debt is it reduces currency risk (JPY assets funded by JPY liabilities). These cheap JP names represent ~35% of my portfolio.

While all of the larger sized positions in my portfolio are extremely cheap, I’ll provide a very short thesis on some of them below.

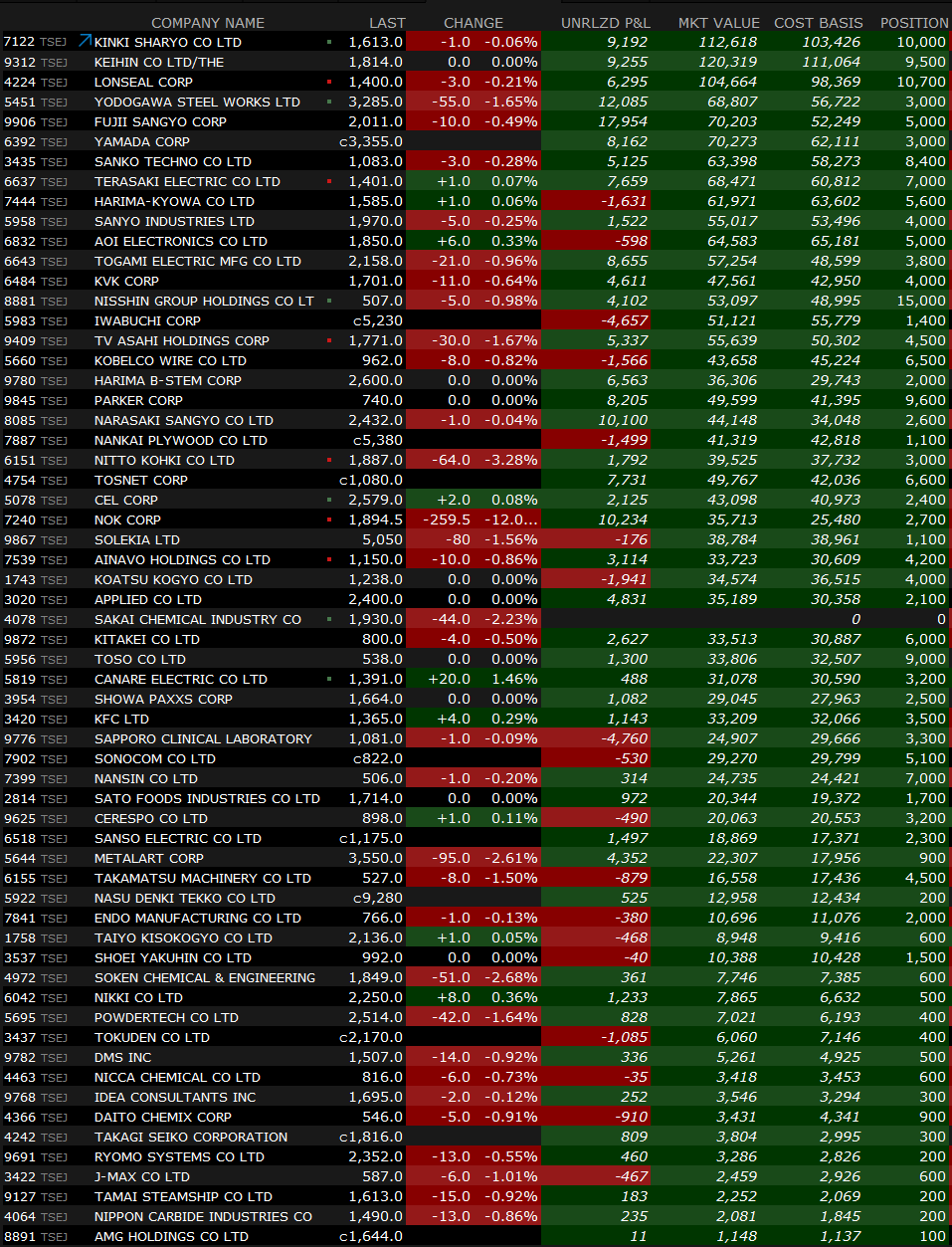

The Cheap Japanese Basket (Aug 3, 2023):

Update September 27, 2023: Updated with most recent positions. Made some small adjustments, took some gains on a few over concentrated positions. Added Kyowakogyosyo Co (TYO 5971). I remain bullish. Since original post, my allocation to this theme has increased to ~50% of my portfolio.

Kinki Sharyo (TYO 7122):

This is a listed subsidiary of the much larger Kinetsu Group (TYO 9041) which has a market cap of ¥925B vs Kinki Sharyo’s ¥10B. Kinetsu already owns ~44% of outstanding shares and will likely eventually buy out the entire company. Kinetsu Group acquired another one of their listed subsidiaries last year at 1.3x book (Kinetsu World Express). There’s an ongoing trend of parent companies acquiring their listed subsidiaries and given the relatively tiny size, it should be easily doable. The push by regulators and the Tokyo Stock Exchange to address P/B discounts is an added impetus for an eventual deal.

Kinki Sharyo is projecting a 27% increase in EPS to ¥218 this year. Net assets are currently ¥3,966 vs current market price of ¥1,438. It’s trading at ~0.4x TBV. It is almost a net net with total current assets of $281m vs $212m in total liabilities and a market cap of $71m.

Lonseal (TYO 4224):

This is a listed subsidiary of Tosoh (TYO 4042) which has a market cap of ¥547B vs Lonseal’s ¥6.2B.Tosoh owns 38.4% of Lonseal and is a logical acquirer of the entire company.

Lonseal has been consistently profitable well over a decade and has paid a decent dividend the entire time (over 4% yield). It’s trading at ~0.3x P/TBV. It is also a net net with $127m of total current assets vs $53.4m of total liabilities and a market cap of $43.86m.

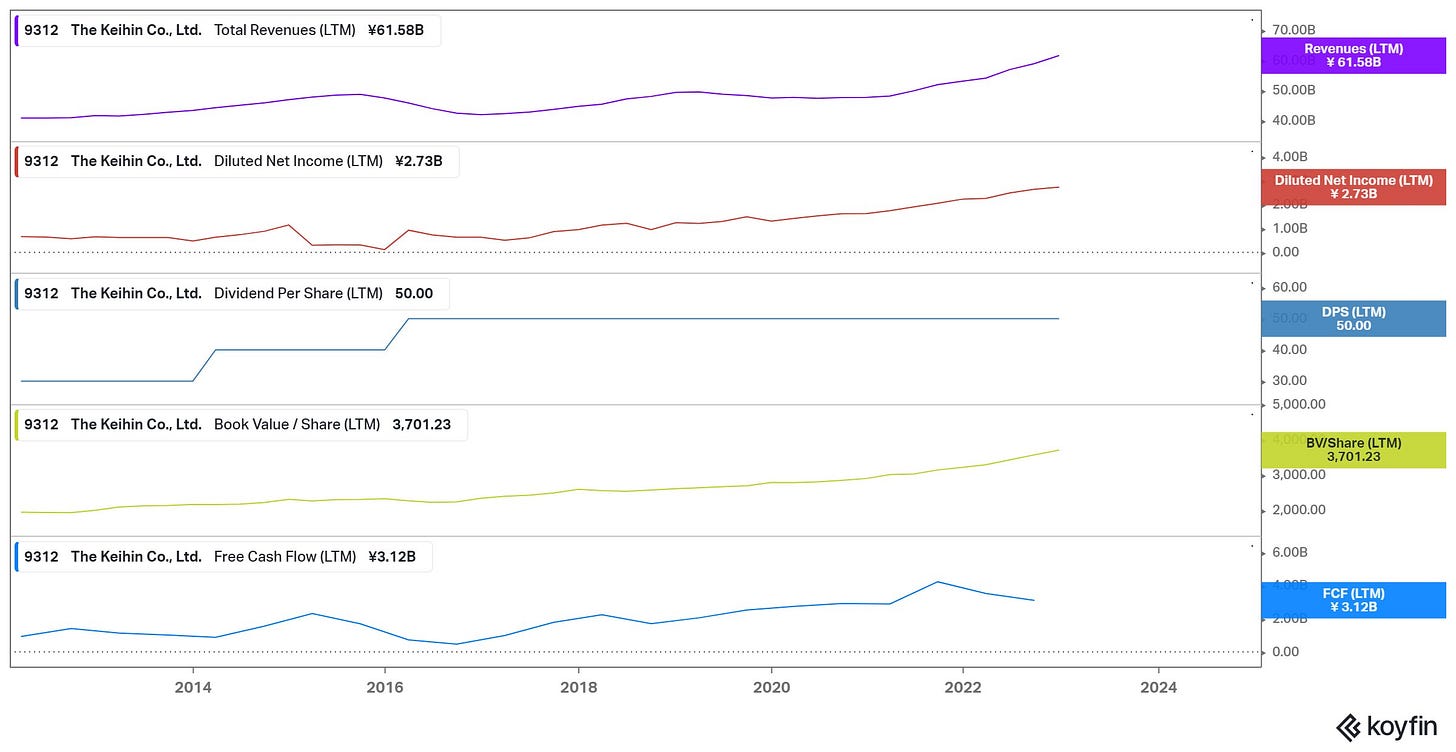

Keihin (TYO 9312):

This is one of the only non deep value names on my list (it isn’t close to a net-net) and has a heavy weighting due to its incredible metrics. It’s trading at 0.5x P/TBV and while it’s not a net-net, it has some impressive growth. It’s trading at 4x P/E, Over 3% dividend, over a decade of growing profitability. Price has remained flat over the last 5-10 years, but the following has:

book value (5yr CAGR: 7%, 10yr CAGR: 6%)

revenue (5yr CAGR:5% / 10yr CAGR: 4%)

net income (5yr CAGR: 23% / 10yr CAGR: 15%)

I never would have purchased Keihin a decade ago at its current price, but today’s metrics are incredible. They also recently increased their dividend for the first time in 7 years.

Keihin operates as a logistics company and owns Warehousing / Distribution Centers in Tokyo as well as several other major cities. These facilities are recorded at acquisition cost on the balance sheet and depreciated and likely undervalued as well. These are operating assets, so a sum of the parts is irrelevant, but they provide some additional value cushion.

Yodogawa Steelworks (TYO 5451):

This is just an incredibly cheap net-net. I’ve reduced my position sizing here 50% already since its had a healthy runup. For a good writeup on this one see Otto Oehring’s writeup here:

NOK Corp (TYO 7240):

This name announced a minimum of ¥67.5B of capital returns over the next 3 years vs a market cap of ¥336B. I’m up significantly on this name but it’s been a consistent winner since they announced increased capital returns. I expect similar capital return announcements from other names in this basket in the near future. I’ve tweeted about this name when they first made this announcement.

https://twitter.com/AltayCapital/status/1648632465328840704

Nisshin Group (TYO 8881):

This is a net net that jumped 11% today after announcing a new dividend policy which raised their payout ratio from 30% to 50%. The stock remains extremely cheap given that they have:

Total current assets $793m

Total liabilities $415m

Market Cap $153m

I haven’t calculated my total return for my Japanese holdings as I’ve made many additions/subtractions. The basket as-is is a bit top heavy and I plan to add to my other positions to balance it out a bit more. I’m also not super concerned with keeping score. Anything above my cost of borrow (0.75%) is a win and I’m currently well ahead of this.

I’m also long several other companies in Japan not mentioned in this post as they aren’t in the same ‘extremely cheap’ bucket. For example I own both Nippon Ichi Software and Imagineer, but both trade at about 0.8x P/TBV, which is cheap, but not stupid cheap like many names in this basket.

I’ve also tweeted extensively about Cover Corp (which is up 70%+) since end of trading day on its IPO (Mar 27, 2023). I’ve been pounding the table on this one on Twitter and in the comments of my Anycolor Inc substack article. I remain long, but the ‘easy’ trade is mostly over given its massive outperformance vs Anycolor.

Do you own any high conviction cheap (less than 0.5 p/tbv) cheap Japanese companies? Let me know which ones you like in the comments so I can put it on my research pile!

The charts in this article are from Koyfin, an excellent free resource for visualizing financial data and screening. I use it everyday and the free version is top notch.

Disclosure: I own shares in most stocks mention in this article. Many of these stocks are illiquid, so use limit orders and be careful if you’re considering building a position. None of this is investment advice. Do your own due dilligence.

Thanks for sharing. We have a lot of overlap in our Japanese Value portfolios... The only material position I own that I don't see on your list in 1879 Shinnihon, a condo developer with its own construction arm. 25 years of positive EBIT, 10-year sales CAGR of 7%, ¥75b cash vs. ¥66b market cap (i.e. negative EV), 0.6x P/B, 5.4x P/E. They could easily increase their dividend pay-out ratio to 100% (from ~15% today) given their rock-solid balance sheet -- that would be a 19% dividend yield...

Great update, thank you. I've owned Japanese net nets for 12+ years now after buying after the Fukushima event. It's great to see the regulatory nudge and potential catalyst. I'm curious, you mentioned that you borrowed in JPY in your IB account. Is that a U.S. account? If so, how did you go about borrowing in JPY and how much leverage is allowed with IB? Thanks again