Nippon Ichi Software Inc - A Deep Value, Profitable, and Growing Japanese Video Game Developer That’s Almost a Net-Net

Nippon Ichi Software Inc (NiS) is a $44m market cap video game developer based in Japan and trades in Tokyo under the ticker TYO: 3851. It is extremely cheap, growing, and profitable with TTM P/E of 7.12.

Extremely cheap with net asset value (book value) per share exceeding share price. Book value has grown from ¥585 per share in 2018 to ¥1,353 today (vs stock price of ¥1,150). Most of that is cash. If we back out the net current assets + securities, the market is valuing the operating company at about 555m JPY (~$4.3m usd), which is less than 1x the company’s trailing 12 month net profit.

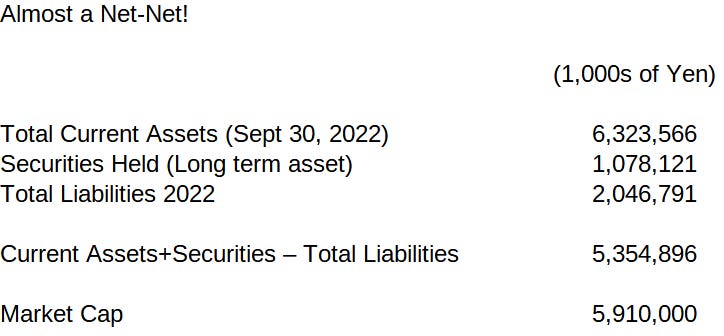

Almost a net-net with net current assets + small securities portfolio equaling 90% of market cap.

Large insider ownership with the founder owning 37% of the company.

The company’s founder became president last year which could be a catalyst for change. He’s already made some big changes which should yield results soon.

Nippon Ichi Software Inc Profile / New President

Nippon Ichi Software (NiS) is a Japanese video game developer and publisher founded in 1991. They’re publicly traded on the Tokyo Stock Exchange under the ticker 3851. They’re best known for their Disgaea franchise, but they develop and publish a variety of other games as well. A full list of their titles (along with near term releases) can be seen here.

While NiS is a small player in the industry (~$44m) market cap, their Disgaea franchise alone has sold over 5 million units worldwide. The company is also consistently profitable and has a history of steady growth.

A Catalyst For Change

Koichi Kitazumi, founder of NiS, owns 37% of the company through his asset management company Rozen Queen Shokai Co. He’s the single largest shareholder and has recently taken a more active role in the company. While maintaining his position as Chairman of the board he became president of the company in August 2022.

Mr. Kitazumi is replacing Sohei Niikawa who led the company as president and CEO since 2009. Mr. Niikawa resigned due to personal reasons and was a driving force behind the company’s hit franchise Disgaea. While the loss of his talents from the game design/production side will be missed, I think this change will prove to be a positive catalyst for the company. Having a talented producer run the entire business is a bit odd. Most game developers are headed by finance and business types who are often better at adapting to current industry trends. NiS has done little in the past to exploit the rising popularity of mobile games and with Mr. Kitazumi in charge, that could change. There’s also plenty of academic research that founder-led firms tend to outperform.

Mr. Kitazumi is Making Big Changes at NiS

NiS has historically been slow to adapt to changes in the industry. They’ve been mostly content doing the same thing over and over again. Just take a look at the screenshots below for the first game in the Disgaea franchise (released in 2003), Disgaea 5 (released 2015) and the newest game Disgaea 6 (released in 2021):

Up until 2021 the Disgaea franchise and every other game NiS developed focused entirely on 2D graphics. The newest release, Disgaea 6, while still mostly 2D utilizes 3D attack animations, a first for the series. The upcoming Disgaea 7, which is set to release later this month (January 26, 2023), will make much heavier use of 3D throughout the entire game. While I personally prefer the 2D models, NiS finally has the capability and willingness to develop 3D games, which should broaden their appeal. NiS established an internal subsidiary to create 3D graphics for their games in November 2022, shortly after the Founder became president. Pretty remarkable that it took them this long to begin working with 3D graphics.

Since Mr. Kitazumi took over as president, NiS is aiming to release games more frequently. Disgaea 4 came out in 2011, Disgaea 5 in 2015, Disgaea 6 in 2021, and Disgaea 7 is coming out in January 2023.

There’s a lot of change happening here and while Disgaea 7 isn’t guaranteed to be successful, the company’s willingness to finally try new things should serve them well in the long run. Future Disgaea games may very well remain 2D, but the company can finally develop new titles in 3D. In fact, once Mr. Kitazumi took over as president last year he specifically said one of his goals was to create new IPs as well as do graphical overhauls of its existing titles. NiS is no longer limiting itself to only 2D games.

Valuation & Why NiS is Attractive Today

While Japan is littered with extremely cheap companies, it’s rare to find one that meets all of the following: extremely cheap, profitable, growing, and transforming itself. NiS’s net assets per share increased from 585.64 in 2017 to 1,188.79 Yen per share in 2021. The company has been consistently profitable:

NiS is trading below book value (net assets per share in above graphic) and is almost a net net (net net being a company trading at a lower market cap than its net current asset value).

What I’m trying to illustrate here is that NiS is cheap. Very cheap. If we back out the net current assets and securities, the market is valuing the operating company at 555,104,000 JPY ($4.3m usd), which is less than 1x the company’s trailing 12 month net profit.

What an Upside Scenario Could Look Like:

NiS is cheap and unloved today but could offer tremendous upside with a single hit game. Just how much upside? Take a look at Bank of Innovation Inc (Ticker TYO: 4393) and Devsisters (Ticker KOSDAQ: 194480):

Bank of Innovation was a sleepy nanocap game developer in Japan that traded at ¥2,000 in early 2022 and shot up to ¥12,000 with the successful launch of a single hit mobile game (Memento Mori).

Dev Sisters is another example of what a single hit game can do for a nano cap game developer. The Korean game developer was valued at ₩8,200 per share in late 2020 and once they launched Cookie Run: Kingdom, which became a hit, the stock exploded to ₩129,000 per share within a couple of months and peaked at ₩187,400 per share in late 2021.

A single hit game could flip the narrative and NiS could become an exciting growth story.

Even without a hit game, NiS could keep chugging along continuing to grow their cash pile. Like many other Japanese companies, conservatism is built into the culture of NiS, so I don’t think they’ll do anything too drastic in terms of aggressive expansion or M&A. They’ll keep churning out new titles as they’ve done since 1993. This is my base case scenario. No hit game needed for shareholders to see a decent return from here. Downside risk is partially limited by the company’s massive net cash position.

Risks / Capital Return Issues:

The push to modernize and embrace 3D graphics may backfire, especially since the company is making their latest game in their flagship franchise fully 3D right out of the gate rather than first experimenting with their other IPs. Ultimately I think even if Disgaea 7 doesn’t perform well, they can go back to making this particular franchise 2D only while developing their other IPs in 3D. NiS has developed a lot of games over the years and it's remarkable that they didn’t have any 3D graphics capabilities until late last year. It doesn’t make sense for a game studio making modern games to simply not have 3D capabilities.

Given the conservative nature of the company, even if Disgaea 7 flops, the company will likely remain profitable due to their strong back catalog and low operating costs. Adding 3D development capabilities only expands their options for future titles.

The second major risk here is the same risk of owning any small Japanese company. Namely, these companies aren’t usually big on capital returns. While NiS does pay an annual dividend, it’s a paltry sum of just ¥4-5 per share (good for ~0.3% yield). More interestingly though, NiS did repurchase 32,500 shares last year (¥39m worth) and has an authorization to purchase another 17,500 shares. It was the first repurchase in many years and if the additional 17,500 shares are purchased, it will be a little less than 1% of outstanding shares. Still, with such a massive cash horde and cheap valuation, NiS absolutely should be buying back more stock. These tiny capital returns are better than nothing though.

Lastly, Japanese companies often get involved in unrelated businesses for some reason. NiS runs a small student dormitory business. The business is subscale and lost 23m yen last fiscal year (vs a companywide net profit of 1.2b yen). This was an improvement over the previous year’s 30m yen loss. This isn’t going to move the needle either way, but it’s possible the company could get distracted chasing other ventures, but I don’t think they will. Focusing on the core business was main message delivered by Mr. Kitazumi when he took over as president.

Why This Opportunity Exists:

NiS is a tiny $44m market cap company with over a third of shares owned by its founder. The float and daily volume is simply too small to attract attention from most funds. This is simply a pond that almost no one is fishing in.

Conclusion:

I’ve kept my eye on NiS for a bit and took a position late last year once the stock dipped below book value and came close to its net current asset value. While there are other net-nets or near net-nets in Japan, I find NiS a lot more interesting as a single hit game could flip the narrative to an exciting growth story, whereas that doesn’t happen for a Steel or Auto Parts company. Not a lot has to go right for NiS to work out. It could certainly stay cheap and become cheaper, but with the founder now in charge and the company expanding their capabilities to producing 3D graphics, I think NiS is an interesting investment and one I own as a part of a basket of extremely cheap gaming companies.

Disclosure: I own shares in Nippon Ichi Software Inc (TYO: 3851).

NiS is a nanocap stock that only trades ~20,000 shares a day, so use limit orders and be patient if you’re trying to build a position.

Small update:

DISGAEA 7 is well received in Japan. Fans in the U.S also seem to be very positive. Releasing in the fall in English globally on all platforms. Uptick in JP seems to be a bit slower than DISGAEA 6 which was not as well received. Hardcore fans disliked that installment, but D7 is much more universally liked, so sales will pick up.

They launched Labyrinth of Galleria: The Moon Society globally in English on all platforms. Well received and seems to be doing well! It's one of those games that you can sink hundreds if not thousand plus hours into!

Management maintained their earnings and sales forecast for the year (only 1 quarter left). I think they lowballing it because they held a 30th anniversary sale for their back catalog. Plus the launch of D7 in JP will be included in the Jan-March quarter.

My super conservative estimate for the stock is 1.4x book (NiS is 0.8) which is where Falcom trades at, so over 50% higher. I think Falcom is cheap and own it (but in smaller size). Falcom is the best comparable to NiS.

NiS is a hair over 5% position for me. I'm comfortable owning more and have been sizing in slowly. Will own about 1% of the company soon then just sit and wait. This is my largest single stock position for a JP listed stock. Checks a lot of boxes for me.

Small update (none of this is really relevant for the longer term hold):

Disgaea 7 launched in Japan a couple days ago and seems to be well received. Fans of the game are universally positive about the game on Reddit, whereas the last installment (Disgaea 6) was disliked by many. PS4/PS5/Switch physical versions all sold out on Amazon.jp, but this doesn't mean much. Most consumers are purchasing games via Nintendo/PlayStation store anyway (higher margin for NiS).

We'll likely get a Western release date on the 30th anniversary NiS stream https://nisamerica.com/event/nis30th/ which should also feature some other new game announcements (mostly on the publishing side of the business for NiS America).

Also in case anyone is curious, I'm at a little over 3% of my portfolio in NiS. I'm comfortable getting it to 5% slowly. As they compound their book value I expect some slow and steady returns with the possibility of an explosion to the upside if they get their act together and develop a good mobile gacha game.