Anycolor Inc - The Talent Agency of the Metaverse Has Explosive Growth and Is Extremely Profitable

Anycolor Inc (TYO: 5032) is a ¥168B ($1.3B USD) market cap talent management / entertainment company that specializes in a new and rapidly growing sector of entertainment called Virtual Youtubers (VTubers).

Led by its 26 year old founder who owns 45.33% of the company.

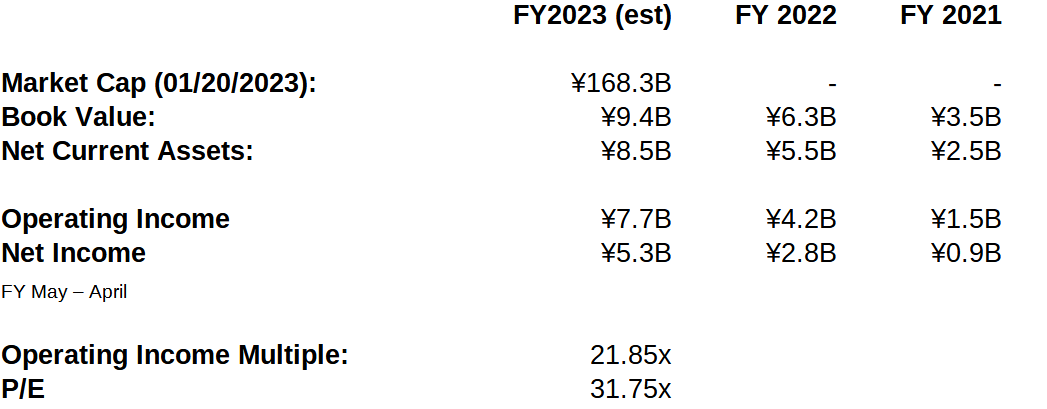

Rapidly growing and profitable business in an entirely new sector of entertainment. Net income rose from ¥0.9B in FY2021 to ¥5.3B in FY2023 (est).

Large growth runway with rapid expansion into English, Korean, and Indonesian language content. This is not just a weird Japanese niche. Anycolor’s English talent already earns more per VTuber than their Japanese counterparts.

Win-win business model for all parties involved.

Intellectual property rights for mobile gaming and anime licensing provide material upside in future years.

Growth in sales and profitability are incredible with Factset estimates for 2024 P/E of 17.9 (not bad for a hyper fast growth company!)

Anycolor Inc (TYO: 5032, Price: ¥5,610) is a talent management company that specializes in the new and rapidly growing sector of entertainment called Virtual Youtubers (VTubers). VTubers are live streamers who utilize virtual avatars in place of webcams which allow them to embody unique anime inspired characters. Much like popular personalities on Twitch.tv, they mostly create content in the forms of gaming, music, and vlogging. Additionally, they produce professional grade music videos and participate in higher production events organized by Anycolor.

VTubers are the new idols of the internet age and companies like Anycolor enable them to succeed. Becoming a VTuber for Anycolor’s agency NIJISANJI ensures talent has access to a unique professionally designed avatar, training, and marketing support.

NIJISANJI derived its name by mixing 2 words in Japanese, two-dimensional 二次元 (nijigen) and three-dimensional 三次元 (sanjigen). The name was inspired by the idea of a new form of entertainment that combines the real and virtual worlds.

Anycolor’s founder, Riku Tazumi, launched the business in 2017 when he was 21 years old while in university. Today, he’s 26 and owns 45.33% of the company, a stake valued at ¥76.28B ($590m USD). I like founder-led companies. The fact that Mr. Tazumi is so young makes this story even more interesting, especially since he’s been disciplined enough to grow the business profitably.

The concept of VTubing broke into the mainstream in 2019 and is currently a large and rapidly growing market. The professionally managed market is dominated by 3 major players: Hololive, NIJISANJI (Anycolor), and VShojo.

This is big business. Just take a look at some of the most popular content:

20M Views (Caution: A Bit Racey!) Featured VTuber: Marine from hololive Japan.

13.6M Views. Featured VTuber: Luxiem from NIJISANJI English.

Typical VTuber Content (3+ hour daily live streams)

Curious what some VTuber content looks like live? VRabi tracks and shows all current live VTubers. Check it out here.

Organic Growth and New VTubers

Anycolor is in the business of creating and cultivating digital idols. The larger their roster of idols, the more money they can earn. The company regularly adds new VTubers to their team through an auditioning process. Typically thousands apply and only a handful of the most qualified will debut with NIJISANJI each year. While Japan is the largest market for VTubers, the company’s English, South Korean, and Indonesian audience is quickly growing.

Those selected by the company to become VTubers go through training and are offered singing and dancing lessons to help make their content more engaging. Anycolor has created a factory for creating digital idols. They provide their VTubers with everything they need to succeed. With 169 active VTubers on their roster, NIJISANJI has developed an efficient process in recruiting, training, and growing their talent.

Becoming a VTuber for an agency like NIJISANJI is a win-win and is highly coveted. Most independent streamers and VTubers are lucky if they have 6 live viewers. In fact, having just 6 viewers puts you at the top 21% of all streamers. Building an audience on Youtube & Twitch isn’t easy and without 300+ concurrent viewers there isn’t much opportunity to earn meaningful revenue.

Being a part of NIJISANJI or Hololive is a more reliable way to earn an income, as talent is guaranteed exposure and doesn’t have to invest money creating a digital avatar (costs anywhere from $100-$10,000+ depending on the quality). Sure, they won’t have all the upside as revenue is shared with an agency, but this arrangement ensures that both streamers and agencies win. The value-add from securing sponsorships, training, and collaborations is tremendous. This value proposition is overwhelmingly good for talent as VTuber agencies are flooded with applicants every time they schedule auditions.

Like the real world, the biggest stars capture a disproportionate share of attention. Anycolor’s NIJISANJI has 169 VTubers yet the top 10 Vtubers contribute 36% of total revenues. While each VTuber develops their own fan base over time, NIJISANJI regularly cross-promotes their talent to create engagement and boost their newer VTubers exposure.

NIJISANJI’s two main competitors, hololive and VShojo, often have more popular VTubers, but have far fewer overall talent. Having a larger and more diversified pool of talent allows NIJISANJI to mitigate the risks of reliance on a single popular VTuber. As of this writing hololive has 71 VTubers and VShojo has 10.

Why AnyColor Inc is Interesting:

Anycolor is one of the market leaders in a brand new and rapidly growing industry. They’re already extremely profitable, expanding aggressively across multiple markets, and are founder led. The best part? They’re reasonably priced at 21.85x operating income or 31.75 p/e (based on management’s FY2023 estimates). This isn’t exactly a deep value name at these multiples, but with 50%+ year over year growth and even faster net income growth, Anycolor isn’t expensive.

They should be able to grow net income at least 50% next year which would put their forward P/E at 21. This may prove conservative though, as at least one analyst is forecasting much faster EPS growth which if achieved would put forward P/E at 17.9:

Source: Factset via Markets Insider

Anycolor’s revenue is growing quickly and the company is already profitable with an impressive (and growing) operating margin of 36%. Revenues for H1 FY2023 (May 2022 - October 2022) are up 92% YoY. Management expects FY2023 revenue to total 22,500 (million JPY), up 58.9% YoY, with operating profit of 7,700 (million JPY).

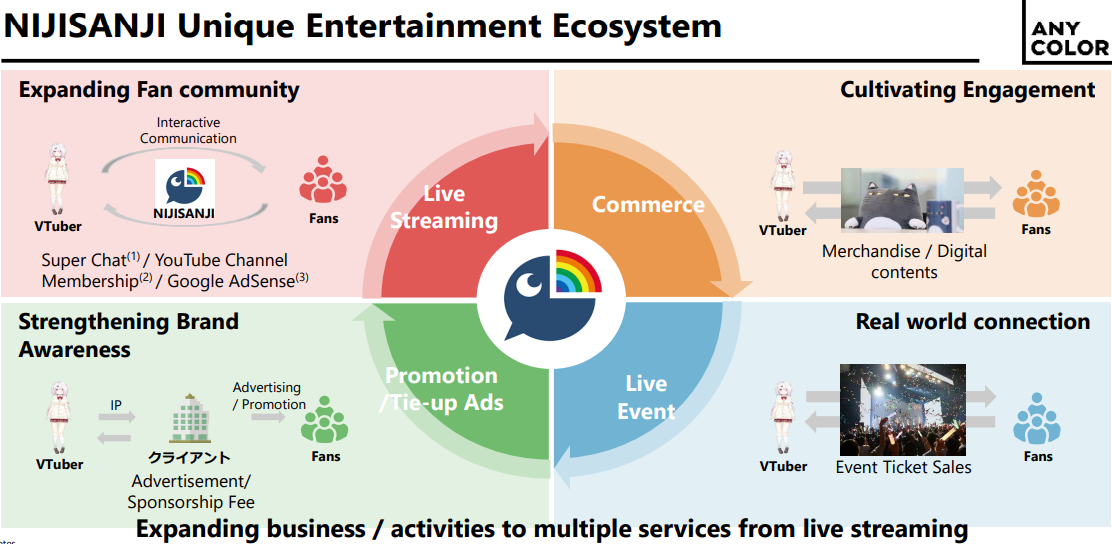

Revenue is generated through live streaming (advertisements and donations), commerce (merchandise), events, and promotions (direct sponsorships). The biggest expense associated with each of these segments is revenue share with the VTubers themselves. The company succeeds when its talent succeeds.

As fans become more and more enamored with their favorite VTubers, merchandise sales should continue to grow. Revenue per VTuber is growing: the company is getting better at monetizing each VTuber’s audience. Live streaming revenue should continue to grow, but the real growth engine here is merchandise sales which are up nearly 100% year over year. 1,000 viewers on a Youtube video for an English VTuber will typically generate about $4-$5 in advertising revenue, but a single fan can drop $100+ a month on merchandise supporting their favorite VTubers.

Merchandise includes items like a ¥12,000 ($92) stylish sweater, ¥3,500 ($27) Valentine’s day cards, and even high margin digital goods like character voice lines for ¥500 ($4). The official NIJISANJI shop has coffee mugs, keychains, stationary, and more. As people grow attached to their digital idols, they show their support by buying merchandise.

This Isn’t Just a Weird Japanese Phenomenon

Western audiences are increasingly tuning into VTubers. Gawr Gura (a Hololive English VTuber with 4.2m subscribers on Youtube) peaked at over 90,000 concurrent viewers in a live stream back in September, 2022. These are some of the biggest livestreams on all of Youtube and Twitch. Curious what VTubers are streaming right now? VRabi.net tracks all of them and notes their affiliation.

Splurging on merchandise to support your favorite digital anime idol isn’t a uniquely Japanese phenomenon. NIJISANJI’s English VTubers actually make more money per VTuber than their Japanese counterparts with the bulk of these revenues coming from merchandise sales. If you’re curious what kind of merchandise they offer, the English store is available here.

Promotions are a High Margin Business

Anycolor’s promotion business has been booming (¥263m in FY20, ¥1,038m in FY21, and ¥2,270 in FY22) and is much more profitable than its livestream advertising business. Typical livestream ads are short videos placed into streams by Google’s Adsense/Adwords product. They’re 15-30 second videos that play before and during a stream and Youtubers typically earn about 50% revenue share from these ads. They’re impersonal and disruptive to the viewing experience.

Promotions earn far more. Promotions are sponsorships Anycolor secures directly with a game company or brand. One promotion they ran promoted Konami’s eBASEBALL Powerful Pro Baseball 2022 game by organizing a tournament between their VTubers over 3 days. It was a smashing success that peaked at 310,000+ concurrent viewers.

VTubers are already streaming content for 2-4 hours each day and streaming sponsored content can be just as engaging. If done well, like the eBASEBALL promotion, it can be more engaging than a regular stream as it involves competition and collaboration between talent.

Growing Portfolio of Valuable IP

While Anycolor's hired talent contributes and shares in the success of the company, Anycolor itself retains full ownership of the VTuber’s IP. As VTubers grow in popularity, the characters themselves become valuable and can be licensed not just for merchandise, but for use in anime and games. Hololive, one of Anycolor’s competitors, licensed their characters to the #8 trading card game in the world Weiß Schwarz. Given the popularity of Hololive’s VTubers, the set quickly sold out. One of the most valuable cards in the set is a rare version of Marine (the saucy pirate girl from the music video) which sold for $1,600 on October 25, 2022.

The real upside here though is creating a mobile game, or licensing characters to an existing title. Successful mobile games are built off franchises with popular characters. VTubers, unlike traditional anime characters, are more ‘real’ and offer fans deeper connections, which make them ideal for mobile Gacha games.

The company’s TAM (tangible addressable market) is large, as VTubing encompasses gaming, anime, and music all wrapped into one immersive experience. The company’s 4 trillion JPY TAM figure cited in their investor deck is a bit silly, as not all music overlaps with anime. The market for VTubers is large and growing, but exactly how big it will be at saturation remains a mystery. The growing popularity of anime and live streaming should provide excellent tailwinds though.

Founder Isn’t Cashing Out

The 26 year old founder and CEO, Riku Tazumi, hasn’t rushed to cash out despite the company’s successful IPO. Since IPOing in June 2022, Anycolor’s stock more than doubled in late October to ¥12,700 per share, but the founder has only sold a paltry amount of stock (he held 46.86% at IPO and currently owns 45.33%) .

Several funds that invested in Anycolor in its early years announced on January 18, 2023 that they’re selling 3,268,200 shares of stock (a little over 10% of outstanding shares). Riku Tazumi did not participate in the share sale and voluntarily agreed to a lockup agreement which prevents him from selling shares until at least April 23, 2023.

Committment to Good Corporate Governance

Anycolor applied for a change of listing on the Tokyo Stock Exchange to the Prime Market segment on December 15, 2022. The prime market a small segment of the Stock Stock Market with the strictest corporate governance rules and according to the Tokyo Stock Exchange is the “market oriented to companies which center their business on constructive dialogue with global investors”.

There’s no guarantee their listing application will be approved, but it demonstrates the company’s commitment to being shareholder friendly and open to dialogue.

Risks to the Business Model:

One big risk to Anycolor’s business model is that the VTuber phenomenon could be one big fad. I don’t think this is likely though as it's built on the popularity of Japanese animation and the growth of live streaming, two industries that are rapidly growing. It’s not hard to see how the ever growing population of anime fans could become enamored with a particular VTuber. These characters are professionally designed and talent trained to hook their audiences. They’re idols that aren’t bound by physical imperfections! I don’t think this is just a fad.

Another risk: talent could decide to quit agencies like NIJISANJI and Hololive. While having a professionally developed character and marketing support is nice, it’s not required to succeed. There are thousands of independent VTubers who regularly stream without any affiliation to groups like NIJISANJI or hololive that own their own characters, but by far the biggest VTubers belong to one of these groups. Anycolor mentions that their talent retention rate is 98%, meaning only 2% of their talent quits or is removed by the company each year. Typically the underperformers quit, so the churn is healthy for the business.

Given that all of the most successful VTubers belong to the big talent agencies, this risk seems manageable. Talent can’t easily quit and go independent: the characters they use on stream are owned by Anycolor. They would have to start fresh with a new character and channel. Anycolor can also offer a higher cut of sales to their best performing talent to retain them if needed.

Conclusion:

Anycolor is a pioneer in a new and rapidly growing industry. They’re growing quickly, have a conservative balance sheet with a net cash position, and are already profitable. Paying 31.75x seems steep, but analyst estimates for next year is an EPS of ¥313.68, which puts forward P/E at a much more palatable 17.9, which is cheap for such a fast growing business. The Factset estimate for 2025 earnings per share of ¥517.14 seems too optimistic to me, but is possible given the growth of the industry.

While the concept behind VTubing is new, the foundation is old. Anycolor is transforming the proven business model behind idols by taking the concept digital and global.

What’s the business worth today? I’m not entirely sure, but I’m interested. I think growth slows down in FY2024 and 2025, but profitability should improve.

Disclosure: I own shares in Anycolor Inc (TYO: 5302).

To illustrate the deep connections between VTubers and their audiences I recommend checking out this video and its comments (A few of them are captured below):

Lastly, these VTubers can sell out big venues as well for ‘live’ performances. Just take a look below (timestamped to show the venue):

The fandom being built by hololive, NIJISANJI, and VShojo is not something I entirely understand, but it’s obvious that this content has struck a chord with millions. Audiences care deeply about their favorite VTubers.

Further Reading: Latest Earnings/Investor Slide Deck, FY2022 Annual Report, hololive Wikipedia, NIJISANJI Wikipedia

I sold most of my Cover. Insane run up. I think long term these names do very well and trying to 'trade' this position is likely suboptimal and likely a mistake, but I hope to buy it lower.

Anycolor's earnings came out strong and they're projecting EPS of ¥291.3 for next year. Growth company with no net debt @ a little under 25x multiple. Slightly under the factset estimate embedded in the article though.

I remain more bullish on COVER. Relative outperformance of Cover since my comment on March 27 has been enormous. Anycolor operates more efficiently, but engagement KPIs are similar between the 2 companies. The valuation gap has narrowed tremendously though and now I think both names are worth owning.