Super Cheap Japanese Stocks - 43 Names I Own as a Basket (0.5x P/TBV, 2.1x EV/EBITDA)

Taking advantage of Tokyo Stock Exchange's push to close the price to book discount of listed securities

Thesis: Extremely cheap Japanese stocks (many of which are net-nets), tend to perform well. Backtesting a basket of Japanese net-nets almost always results in a positive return (all net-nets tend to do well as a basket).

Summary: Extremely cheap stocks (net nets in particular) tend to outperform.

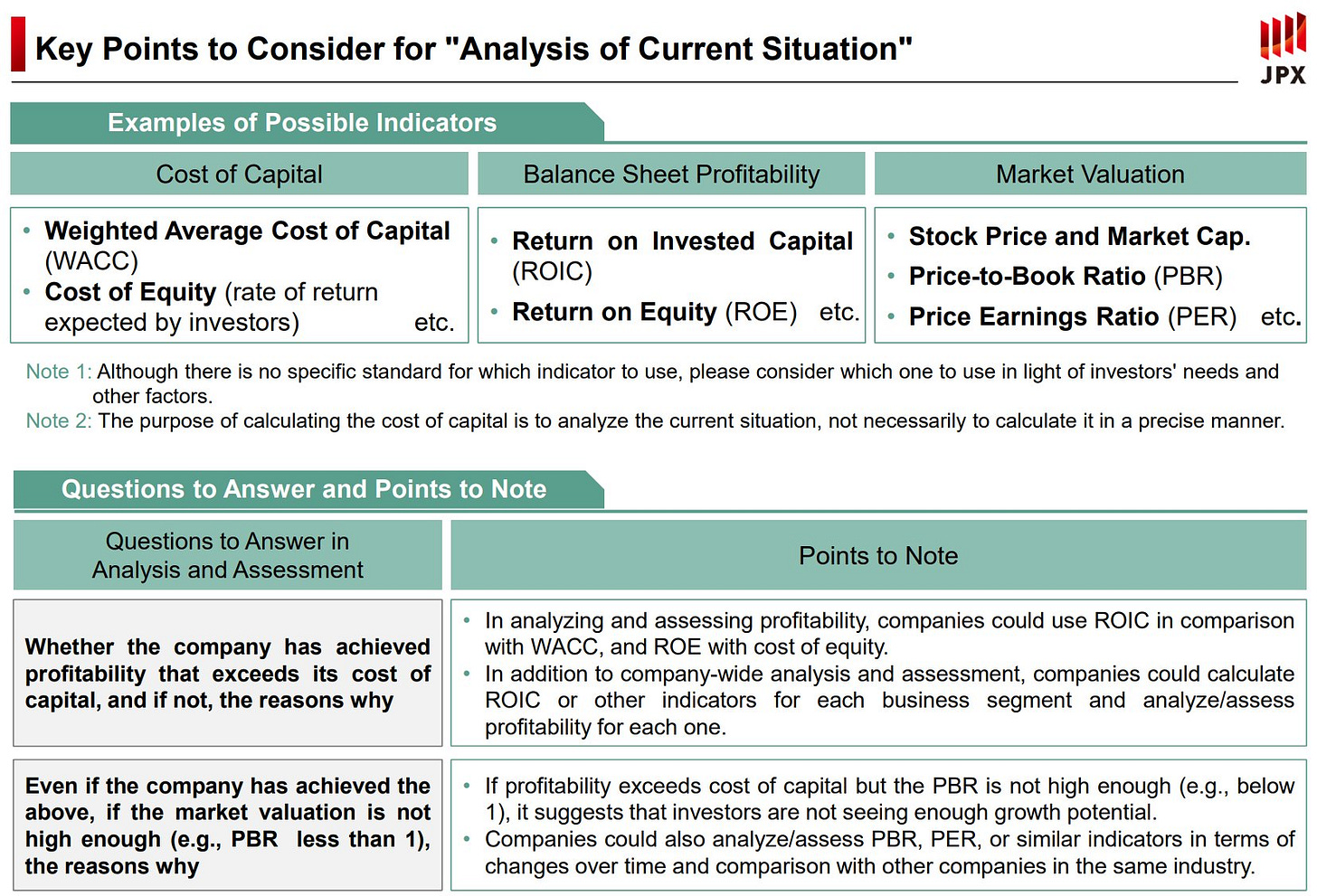

Thesis 2: The Tokyo Stock Exchange has been trying to encourage listed companies to improve corporate governance as well as various financial metrics, most notably return on equity and price/book. Here are some major changes happening to try address the long standing cheapness of Japanese stocks:

Source: Tokyo Stock Exchange Jan 30, 2023 Presentation

So how serious are these corporate reforms? I’m not sure. While these rules don’t seem to have an enforcement mechanism, Corporate Japan seems to have taken notice. According to a Reuters corporate survey, 49% of companies have implemented or are considering implementing P/B measures while 60% said they were doing the same to improve ROE. Even without specific enforcement, social pressure in Japan could lead to compliance.

Thanks to Japan_too_cheap for tweeting this out (an excellent follow for cheap JP equities)

Summary: Cheap P/B names should outperform as more and more Japanese companies begin addressing this discount. Historically many JP names have traded at big discounts to book, but this is the first time we’re seeing a push by the exchange to close this discount.

I’ve constructed a basket of Japanese stocks to take advantage of the simple investment thesis I laid out above. Not all of these names are net-nets (net current assets exceeding all liabilities + market cap), but many are. The non net-nets are all trading well below book value and have a history of profitability.

Portfolio Characteristics:

Market Cap Average: $59.86M

EV/Ebitda (LTM): 2.1x

P/TBV: 0.5X

P/E (LTM): 6.5X

Tangible Book Value CAGR (3Y): 8.49%

Tangible Book Value CAGR (5Y): 8.01%

Tangible Book Value CAGR (10Y): 7.24%

Revenues CAGR (5Y): 3.21%

Dividend Yield: 2.72%

Total Components: 43

I own every name in this list. Position size is about $2k-$6k per name, but I am overweight several names by multiples of this (Lonseal, Kinki Sharyo, and a couple others). I expect to adjust weighting as I dig into each name a bit further.

Portfolio Components:

Source: Koyfin (An excellent free site for screening and visualizing financial data). I strongly recommend trying them out. Screening is top notch as well.

I did not include Nippon Ichi Software or Imagineer in this portfolio despite writing them up in the past as their P/B is close to 1.0 already.

So long as this portfolio outperforms my cost of borrowing JPY (0.75%), I’ll come out ahead. I expect this portfolio will perform quite well though given its incredible cheapness and the recent push by the Tokyo Stock Exchange to get listed companies to address their historical price to book discount.

Keep in mind, the minimum lot size for Japanese stocks is 100. So the absolute minimum buy in for a name like Taiyo Kisokogyo Co (TYO 5922) is 6,110 x 100, or 611,000 JPY or ~$4,700.

Update 03/30/2023:

While no enforcement mechanism exists, social pressure can be effective, especially in Japan. The Tokyo Stock Exchange is reaching out to every company trading below 1 P/B to address the discount. I suspect these cheap names will out perform materially in the coming years. I’ve mentioned several other names I own in the comments which are a bit bigger (market cap wise) that I didn’t include in this article as it would have skewed the averages.

Update: 04/7/2023:

I’ve increased this basket to a 30% position portfolio wide. The risk/reward just seems too good as the Japanese government has also joined the push for companies to improve their valuation. I’ve also added a few other names to my list including TYO 5660 (A listied Subsidiary of Kobe Steel) and TYO 5983.

Update: 04/18/2023:

The Tokyo Stock Exchange related additional information on their push to get listed firms to close their RoE and P/B discounts.

I’ve included several new names to my basket. One of the cheaper ones is Nankai Plywood (TYO 7887).

Disclosure: I own shares in every stock mention in this article. Many of these stocks are illiquid, so use limit orders and be careful if you’re considering building a position.

Thanks for posting! I have a similar Japanese small cap value basket approach as part of my broader portfolio. Albeit slightly more concentrated (20 names currently) and with a little more focus on business quality (ROIC, FCF) in the screen, which brings the basket valuation up slightly (0.7x P/B) as some of the super cheap names get filtered out. Some companies in my portfolio that are not on your list are 5078 CEL, 9872 Kitakei and 1879 Shinnihon. They might be worth a look. The first two are trading below net cash (negative EV) and the third has net cash at 80% of market cap… Only in Japan!

I'll likely provide a year end update to this portfolio. I've since shuffled a lot of names around and added some much cheaper names that I have higher conviction on.