Imagineer - A Deep Value, Profitable, and 3.4% Yielding Net-Net Japanese Game Developer With 17+ Years of Dividend History

Imagineer is a $77m market cap video game developer based in Japan and trades under the ticker TYO: 4644. They have a long history of profitability, are a net-net, and have a TTM P/E of 10.15. They also have a dividend yield of 3.4% with a history of growing their dividend steadily for 17+ years.

They are a net-net with NCAV (net current asset value) of $84m (Over 90% of this figure is cash and accounts receivable). Net current assets per share stands at ¥1,059 today vs a stock price of ¥966.

Net income per share has grown from ¥51.75 in 2018 to ¥92.82 for FY 2022. Management forecasts FY2023 EPS will come in at ¥69.81 (FY 2023 ends March 31, 2023). Company has committed to investing more in R&D to create more titles which should pay off in the coming years.

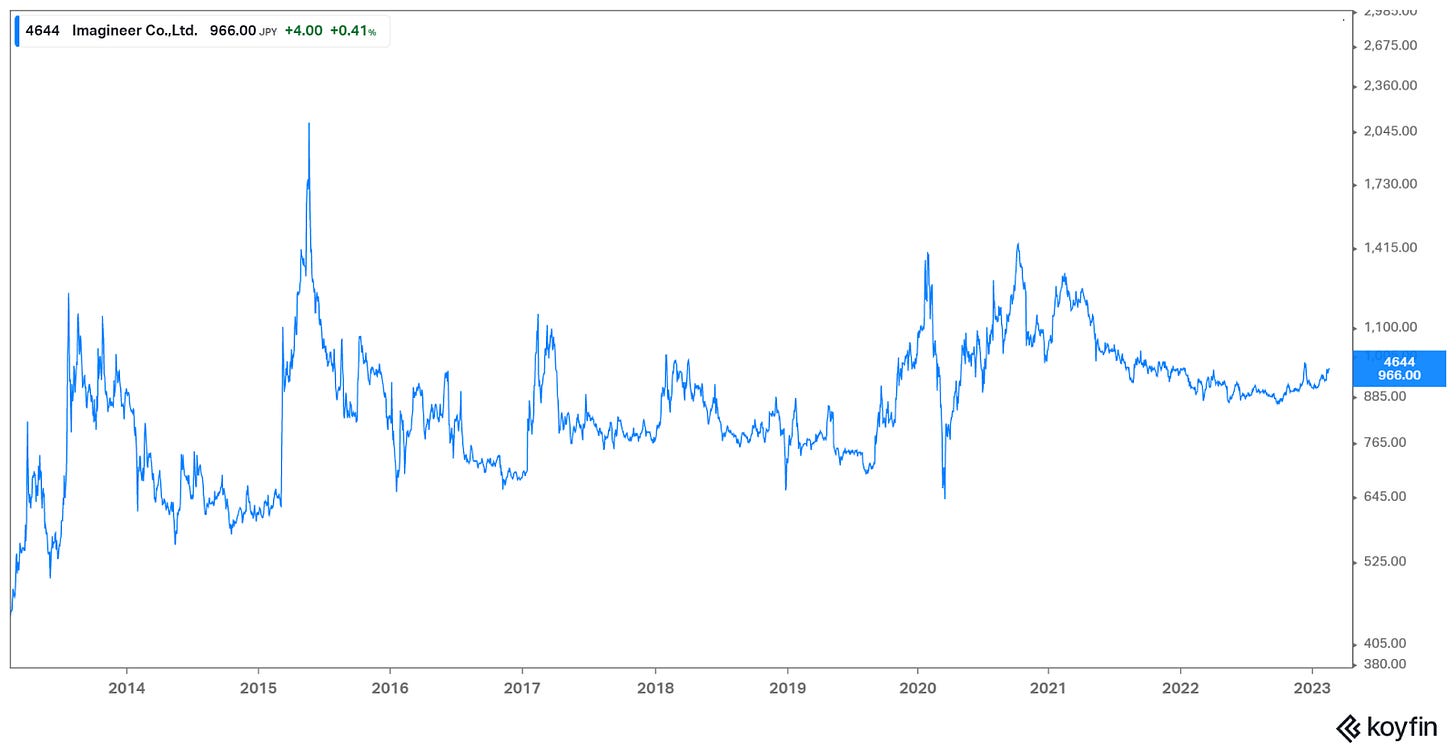

Imagineer stock has gone basically nowhere in the last 9 years, but book value per share increased over 50%, all while paying a reasonable dividend.

Excellent carry trade. I’m borrowing JPY from Interactive Brokers @ 0.75% to buy Imagineer stock yielding 3.4%. I view this position as a low risk medium reward play with a call option kicker in the event of a hit game or management buyout.

Imagineer is a Japanese video game developer founded in 1986 and are publicly traded on the Tokyo Stock Exchange under the ticker 4644. They’re a typical ultra conservative Japanese company with zero debt and a massive cash position. Their net current assets minus all liabilities is ¥1,059 per share vs a market price of ¥966. The market is valuing their operating business at nothing, but unlike many net-nets, the core business here is pretty good. Imagineer has a long history of profitability and has grown their book value per share consistently over the last decade. While the company doesn’t repurchase stock, they do pay a dividend of 3.4% (which has been growing over the years).

Book Value Per Share (mostly cash) has grown consistently:

Imagineer also develops console games with their most successful game being Fitness Boxing for the Nintendo Switch, The game has sold 2.3 million copies worldwide and is releasing a spinoff titled “Fitness Boxing: Fist of the North Star” in March which uses the Fist of the North Star IP. The company also recently (Feb 10, 2023) licensed the game to Tencent for release in China in the near future.

Investment Thesis: Extremely Cheap Low Risk Carry Trade with Upside:

Imagineer’s stock has gone nowhere in the last 9 years and has been mostly pretty steady. The stock price hasn’t really declined at all, it just became much more attractive as the company stockpiled more and more cash. There’s little risk in owning the equity here below its net current asset value. Besides the 3.4% yield, investors also get a free call option in the off chance they develop a hit game. I’m borrowing JPY at 0.75% interest (via Interactive Brokers) to buy a sleepy game developer below its net current assets that yields 3.4%.

Let me be clear: I own shares in Imagineer because of the carry. I don’t think there’s much downside in terms of share price, but there isn’t much upside either. If I couldn’t use borrowed funds, I wouldn’t own this name, but because I can, I’m happily long. The chance of the stock rerating much higher is low, but every video game developer has a chance of making a hit game and if it does happen, the upside is enormous (I illustrated the potential of a single hit game on a small game developer in my article on Nippon Ichi Software).

Just look how little Imagineer has moved over the last decade:

What’s the risk here? Imagineer has been around since the 80s and have been making video games since the days of the NES. They’ve had success in mobile games as well with 4 games that each have over 1 million downloads on Android alone. They’ve been able to adapt to the times and have remained relevant for nearly 4 decades. They’re also consistently profitable. They’ve grown their net income per share from ¥51.75 in FY2018 to ¥92.82 in FY2022. Just take a look:

The dividend has also been growing (albeit slowly) since FY 2013:

While Imagineer has no dividend policy tied to any one metric, they seem committed to steadily growing their dividend. The company boasts that they’ve paid annual dividends of 20 yen or more per share for 17 consecutive years and have not decreased their regular dividend during this period. 2015 and 2020 both include a special 10 yen per share dividend for the company’s 30th and 35th anniversary.

The founder/CEO owns 45.7% of Imagineer through his holding company IIB and 3.1% directly for total ownership of 48.8%. This is up from 46.31% in 2015. There’s been an uptrend in M&A / management buyouts in Japan over the years, so that’s another way for this trade to work out.

Why This Opportunity Exists

This is a company most people don’t follow or care about. All of their financials / investor communications are only available in Japanese which further limits investor interest, but data aggregators like Factset/Koyfin/etc provide accurate information. Underlying fundamentals have improved steadily over the years, but the market doesn’t care. Imagineer is just too small ($77m market cap) for bigger players to care about and daily volume is tiny at less than 20,000 shares/day.

Risks/Downside:

This isn’t an exciting investment, so both downside and upside are largely limited outside of extreme events (like a hit game or the company totally blowing their cash). Neither of these events are likely and I think the most likely outcome is for Imagineer to continue producing net income and growing its book value per share as it has done for decades. Net income for FY2023 is expected to come in lower (at ¥69.81) due to additional investments in R&D / game development.

Imagineer doesn’t own much IP as most of their games are developed using third party IP. This isn’t a big deal as using famous IP typically means they can get away with spending less on marketing, but on the flip side margins are lower as they share revenues with IP holders. They do own the Medarot (Medabots in North America) IP, but their mobile game built on this IP only has 100k+ downloads.

Conclusion:

This is a no brainer long position for me. We have a net-net video game developer that’s been paying a decent and growing dividend for 17+ years with a history of profitability. Yes, they’re overly conservative and you’re not going to get rich owning this name, but it’s a name I can comfortably hold for years. Even if the cost of carry increases, the company will earn more on their massive cash holdings which should boost interest income.

Disclosure: I own shares in Imagineer (TYO: 4644).

Imagineer is a small cap stock that only trades ~18,000 shares a day, so use limit orders and be patient if you’re trying to build a position.

I use Koyfin for looking at historical data, screening, and visualizing financials. Koyfin offers real value for me and I have been a paid user long before they offered me an affiliate link with a 20% discount. The free version is excellent as well.

I view this as a low risk medium reward play. I own a much larger position in Nippon Ichi Software as it has much more upside, and while both names don't have much downside, Imagineer seems to be safer. Another cheap Japanese game developer I own is Falcom which Mokapu Capital already wrote up: https://mokapucapital.com/nihon-falcom-small-cash-rich-niche-video-game-developer/

I love to own these names in a basket as any of these names have the potential to release a hit game and return multiples of their current price. While I've written up several gaming companies now, Japan makes up only around 20% of my portfolio, but I've been finding a lot to like there.

Hey, it's been a year; has anything changed about this name that I should know about? Price is still sitting around 1000 yen. The positive carry is still available at 1.5% from IBKR. Still looks like a I don't lose much bet, and if they produce a hit game, the stock could increase quite a bit.