Sapporo Clinical Laboratory Inc (TYO 9776) - A Cheap Yet Consistently Profitable Japanese Nano Cap at 0.3x P/TBV

This is a quick profile of one of the many Japanese stocks that have caught my interest and are in my cheap Japanese basket. I’ll be doing more frequent short write ups on names in this basket over the coming months.

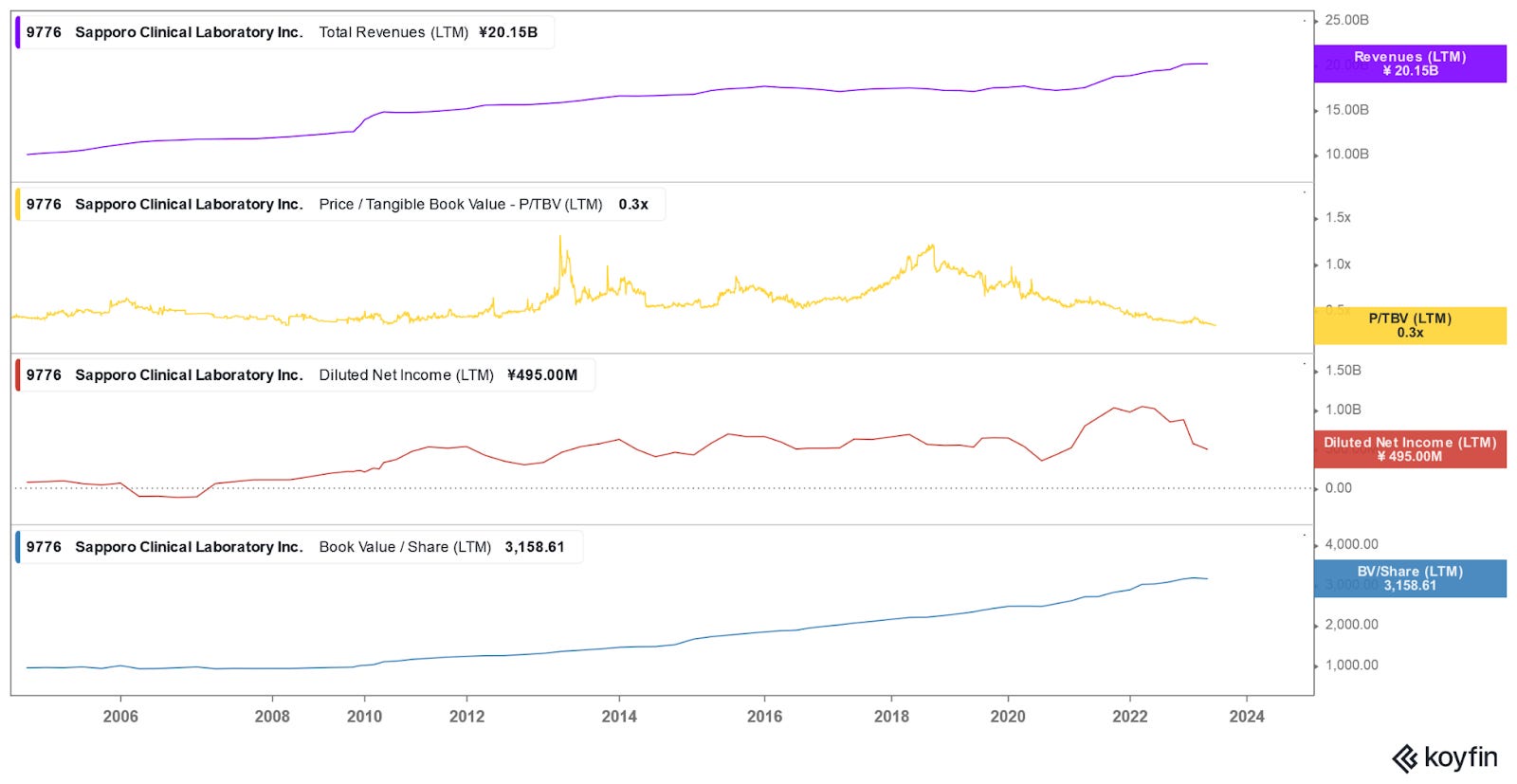

Sapporo Clinical Laboratory is a $24m market cap operator of retail pharmacies and clinical testing facilities across Hokkaido, Japan. They’ve been compounding tangible book value at 7% over the last 10 years and have a strong history of profitability. Growth is anemic, but they trade at 0.3 P/TBV and management has aimed to increase return on equity to 8% in the long run, which if successful would triple EPS.

Their biggest asset is a sleek new corporate headquarters (pictured above) which they moved into in 2021 which cost them ¥5.7B (vs a market cap of ¥3.5B). While management has plans to grow the business, this seems like an awful use of shareholder capital. Though arguably, it’s better than letting the cash pileup earning 0.5% in JGBs.

Capital returns are weak, but not terrible. The company has slowly been buying back shares over the years and they’ve doubled their dividend in 2021 (Yield is 2.2%). The company’s chairman is the biggest shareholder with 39.41% ownership.

No one is talking about or looking at this company. They’re so overlooked that they’re running afoul with listing requirements which demand at least 400 shareholders (they were at 392 when the violation was disclosed).

Sapporo Clinical Laboratory Inc (TYO 9776) is a cheap Japanese nanocap that operates retail pharmacies and clinical testing facilities across Hokkaido. They’ve been in business since 1965 and public since 1997. They’ve only ever reported a net loss in 2 years since going public (1998 and 2006). While this isn’t an exciting business, it’s been growing revenues and profits steadily and is cheap at ⅓ of tangible book value.

Key Metrics:

Revenue (CAGR 10 yr): 2.44%

Net Income (CAGR 10 yr): -0.68%

Book Value (CAGR 10 yr): 7.13%

P/E (TTM): 7x

P/TBV: 0.33x

Market Cap: $24m

Stock Price Today: ¥1,050

Business Overview:

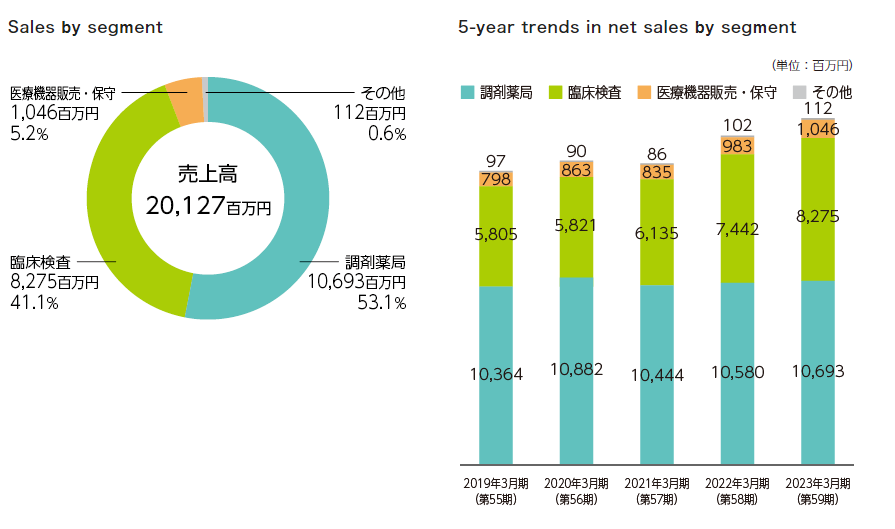

Sapporo Clinical Laboratory’s 3 main business lines are retail pharmacy (blue), clinical testing (green), and medical equipment sales/maintenance (orange).

The retail chain operates under the “Norden Pharmacy” name across Hokkaido prefecture and has 50 stores. They’re pretty bare stores that operate almost exclusively as pharmacies, unlike the hybrid convenience store model of U.S. pharmacies.

The clinical testing business does outsourced laboratory work for hospitals as well as clinics. Lab work includes blood work, urine testing, PCR tests (this was popular during covid), and more. The “clinical testing” business line is broad and also includes things like marketing support/research services for those looking to open their own clinics.

The medical equipment business is the smallest of their major business lines. It has grown 14% year over year, but reported a loss of ¥2m. They also have an “other” businesses category that includes “software for clinical testing systems” which is tiny but profitable (¥17m sales with ¥12m profit last quarter). Last year this small software segment did ¥112m in sales and ¥75 in profit ($517K USD).

Management forecasts a slowdown for FY April 1, 2023 to March 31, 2024 with revenue declining 2.8%, operating income declining 46%, and net income falling to ¥307M (down 45.9%). Net income per share is expected to be ¥92.28. The decline in profitability isn’t too concerning as the company earned ¥149M in subsidy income last year which makes the comparable look terrible. They began receiving this subsidy during Corona times and it looks to have ceased. Still, even adjusting for this, operating profits are declining year over year. One reason for this is the Japanese Ministry of Health revised drug prices lower which hurt pharmacy margins. PCR testing is also down year over year as COVID testing demand decreased.

Historically speaking, this is a profitable business. Revenues and profits will fluctuate, but book value seems to be compounding at a steady clip.

Under the Radar

There isn’t a single writeup of Sapporo Clinical Laboratory online. That’s not too surprising though as it's a nano cap with a market cap of just ¥3.5B (~$24M USD). This is a business that’s entirely ignored by investors. In fact, it’s so ignored that the company has run afoul with the Japanese Stock Exchange listing requirements, which require at least 400 shareholders! They only had 392 when they reported the listing violation in 2021, but aimed to cure it by 2025. My purchase earlier in the year likely helped a bit!

There’s at least discussion of improved financial metrics!

While net income growth has been anemic over the last 10 years (largely flat), this is a business that has compounded book value at a 7% clip over the last decade. They also doubled their dividend in 2021 to ¥23 per share (2.2% yield).

Like many Japanese companies, Sapporo Clinical Laboratory isn’t very profitable, but they’re at least talking about improving their financial metrics. Their “medium to long term management plan” aims for an ordinary profit margin of 5% and a return on equity of 5% with the goal of eventually getting this up to 8%. An 8% return on equity at today’s book value would be an EPS of ~¥253 (vs a forecast of ¥92 this year). Not bad, if they can get there.

The company also isn’t allergic to buying back their own shares; they’ve bought back 21% of their outstanding shares over the years. Most of that was done in 2014 with smaller repurchases happening over the last few years. Hitting their 8% return on equity target seems difficult, but it can be achieved through buybacks.

The company also discusses expanding their business through M&A and entering new businesses. The company entered 2 joint ventures in 2021 as 60% owners which contributed positively to sales growth over the last 2 years. Both of those joint ventures are with H.U. Group Holdings, which is a ¥150B listed healthcare company.

Ownership:

Sapporo Clinical Laboratory is 39.41% owned by its chairman Chuichi Date. Most of this is owned through his company Date Asset Management LLC. Management clearly has skin in the game!

Major Negatives:

The biggest asset on Sapporo Clinical Laboratory’s balance sheet is their new corporate headquarters which cost ¥5.7B (vs a market cap of ¥3.5B). While it looks beautiful (picture below), it seems like an obvious misallocation of shareholder resourcess when the company’s own stock trades at a massive discount to book. The company relocated to this new office in May 2021. It’s obvious management aims to grow this business, but spending so lavishly on a corporate headquarters isn’t a good look. On the flip side, it could be a better investment than letting cash pile up and earning 0.5% in Japanese government bonds.

Another drawback here is that while Sapporo Clinical Laboratory is cheap, it’s not net-net cheap. It trades at ⅓ of book value, but most of that book value is in their real estate. Total current assets are ~¥7.5B while total liabilities are ¥5.8B. Normally when looking at cheap Japanese companies I prefer net-nets, but I think this name is cheap enough as-is.

Conclusion:

Sapporo Clinical Laboratory Inc is obviously cheap and has a mixed record of capital returns. They’ve doubled their dividend and bought back stock over the years, but they could do a lot more. The company has never been cheaper on a P/TBV basis and management is at least talking about improving RoE. While I don’t think I’ll get rich off this name, I think future returns will be well above the 0.75% margin rate I’m paying at Interactive Brokers to borrow Yen.

While there are Japanese companies I’m more excited to own, I do own shares in Sapporo Clinical Laboratory as a part of my cheap JP portfolio. It’s trading at ⅓ tangible book value, pays a dividend, and has a strong history of profitability. The push by the Tokyo Stock Exchange to close the persistent P/B discounts in Japan could have an outsized impact on a company like Sapporo Clinical Laboratory.

Disclosure: I own shares in Sapporo Clinical Laboratory (TYO: 9776). This is a small position for me so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments.

Nothing on this blog is financial advice. This is a nanocap stock that’s thinly traded. Be careful and do your own due diligence!

Enjoyed this write-up. Something to add to the JP research list. P/TBV 0.3x and potentially 8% ROE in the future would put this stock in the extremely cheap category for me.

Wonderful writeup mate. Thanks for sharing. Keep up the good work.