Okayamaken Freight Transportation (TYO 9063) - A Nanocap Logistics Company With A Lot of Undervalued Land at 0.3x P/B, 9x P/E, and 14 Years of Consistent Profitability

Last year they sold 2 properties with a book value of ¥172m for ¥2,552m. That's a gain of ¥2,379m on a 7.2b JPY market cap. They still have ¥18b of land on their balance sheet.

KKR’s subsidiary offered to buy Alp Logistics (TYO 9055) last week at 2.5x book and 57x LTM p/e, which got me interested in looking at logistics companies again. Alps Logistics started the year at ¥1,694 and is being bought for ¥5,774/share. Clearly KKR sees some hidden value in Alps that the market didn’t. Perhaps there’s value in the smaller logistics companies too.

Okayamaken Freight Transport is a Japanese logistics company that primarily provides trucking, freight forwarding, warehousing, air transport, and customs services. They’ve been around since 1943 and became listed in 1992.

Stock Price: ¥3,555

P/E: 9.12 (Management forecast FY2025)

P/B: 0.32 (Book value 11,094/share)

Dividend: ~2% (¥70/share, 18% payout ratio)

Book Value (CAGR 10 YRs): 7.36%

Total Return (CAGR 10 YRs): 11.5%

Market Cap: ¥7.2B JPY (~¥14.7B Enterprise value)

The investment thesis here is straight forward. This is a cheap stock that also happens to own A LOT of industrial real estate. They own 250,986 m2 of land which is carried on the balance sheet at ¥17.9B, but is likely worth much more. Last year they sold 2 properties with a book value of ¥172.3m for ¥2,552m. That's a gain of ¥2,379m on a 7.2b JPY market cap company and there’s plenty more real estate assets. Just how much value is hiding in the ¥17.9B of land on the balance sheet?

Since 2010 Okayamaken Freight Transport’s topline has fluctuated quite a bit, but they’ve been consistently net income profitable for the last 14 years. Next year’s forecast doesn’t include any asset sales and management projects 24.9% increase in operating income. Net income is obviously expected to decline as last year’s numbers included gains on the 2 properties they sold.

A look at last year’s asset sales:

Transaction 1:

Transaction 2:

The combined land sales adds up to 13,485 m2 which corresponds to this asset (from the company’s last annual securities report):

Carrying value of the land was ¥172.3m and the building was ¥65.7m. It was sold for ¥2,964 (total gain of ¥2,726m)

After the sale, land on the balance sheet decreased just ¥199m (which is what these assets were carried at). I wonder how much more value is hiding in the remaining ¥17.89b land on the balance sheet.

How much land does Okayamaken Freight own? A lot. Excluding the 13,485 m2 sale above, the company still owns 250,986 m2 of land. Selling just 5.3% of land (by sqm) they recognized a gain of ~¥2.5B. I’ve included a snapshot of all major facilities owned by the company at the end of this post along with their size and location (taken from their last annual securities report).

Before we get too excited, some of this ¥17.9B of land includes purchases made recently. Looking back at the oldest financial statement I could easily find, the company had ~¥15B in land on its balance sheet in 2009. Whatever they purchased after that likely doesn’t contain any material undervaluation. Still, there’s likely a lot of hidden asset value here. I’m not going to research each property, but a quick glance at size + location should make it obvious that many properties are carried on the balance sheet at well below market value.

For example, the company’s Fukuoka city property below is likely worth materially more than ¥429m for the land and ¥196m for the building.

We can get a ballpark idea based on what Japanese REITs appraise similar properties in Fukuoka. Fukuoka REIT corporation owns a few industrial properties nearby, namely LOGICITY Hisayama, which they purchased in 2017 for ¥5b and is currently appraised at ¥5.95b. This is a much larger property though and it sits on 16,156.23m2 of land and includes the building. The original purchase document for the property in 2017 allocated 38.1% of the purchase price to land value, which would value the land today at ¥2.27B (5.95B x 0.381), or ¥140,316/sqm. The Okayamaken Freight property (pictured below) at the same price per sq meter would be worth ¥1.36B (land only) vs ¥429m carrying value. These aren’t perfect comparables, but it still serves to illustrate that there’s likely a lot of hidden value in Okayamaken Freight’s balance sheet. And for what it’s worth, it looks like the Okayamaken property is much better located (on the harbor):

Another data point we have is IIF Fukuoka Hakozaki Logistics Center I owned by another J-REIT. This property is likely a better comparable as it sits on the same harbor as the Okayamaken site. Fukuoka Hakozaki Logistics Center I sits on 13,400.00m2 of land which the REIT values at ¥5,770m. 68% of that is attributed to the land in the original purchase price of ¥5,170 in 2017, which values the land then at ~¥3.5B or ¥261,194/sqm (significantly more than the 1st comp we used). At this price per sqm, the Okayamaken’s property would be worth ¥2.53B (or nearly 6x the carrying value of the land). While this seems like a better comparable to me, I’m far from an expert on logistics real estate in Fukuoka, Japan. Even going with the lower valued comparable, it’s clear that the Okayamaken property is worth much more than what its carried at.

I haven’t done an asset by asset valuation, as I think it’s unnecessary. I suspect there’s a lot of hidden asset value here and even if we ignore it totally, the company has a good history of growing book value per share. I don’t expect them to liquidate anytime soon, but in the meantime we can own a company that pays a consistent dividend and grows book value per share.

While the market cap may be too small to attract an activist, there aren’t any controlling shareholders or anyone with a large enough stake to block any future activism. Future compliance with the new Tokyo Stock Exchange governance rules could also provide a near term tailwind.

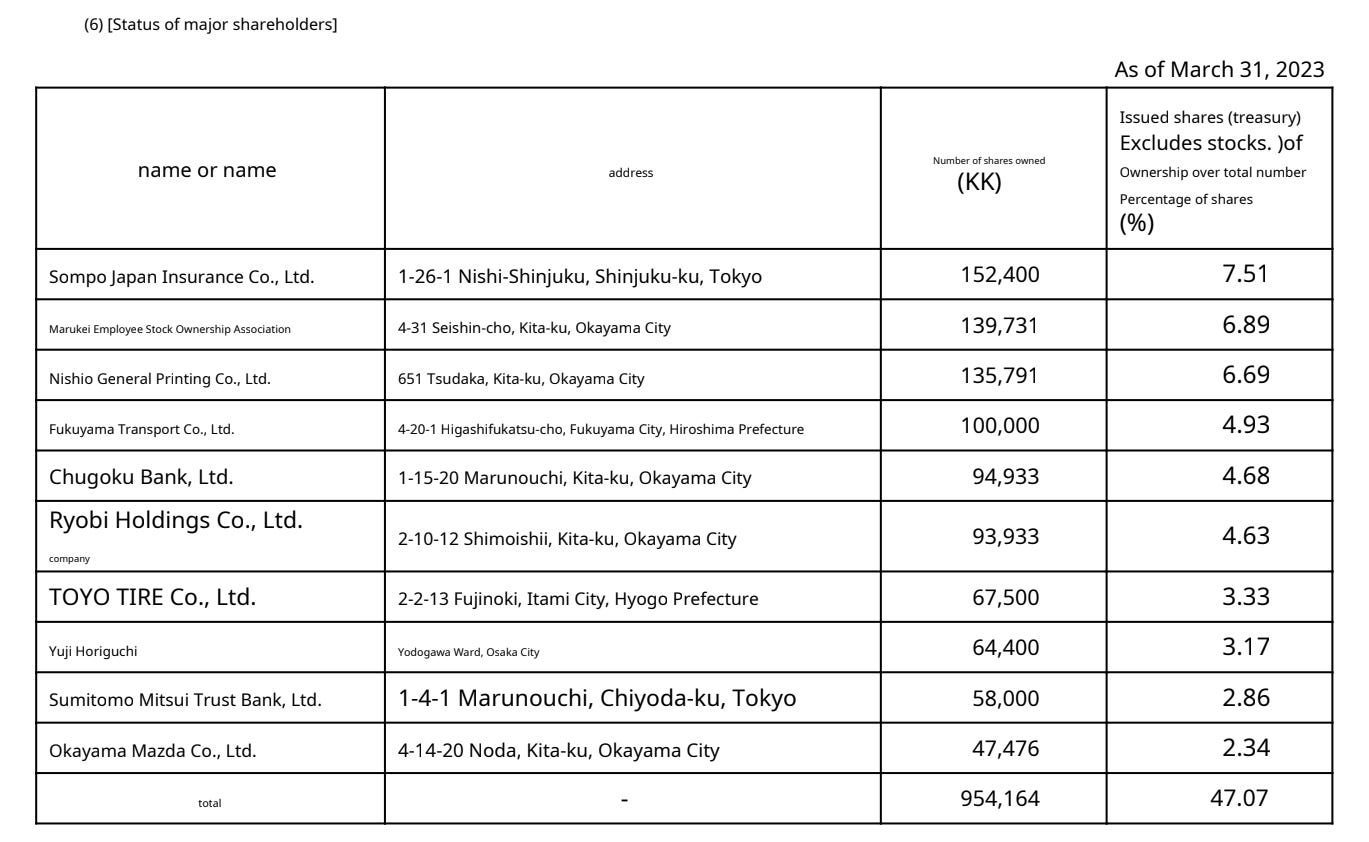

Major Shareholders:

Conclusion

Okayamaken Freight Transportation is a cheap stock. You’re not going to get rich off it, but some day an activist could unlock value or they could begin returning more capital to shareholders. I own some as part of my cheap Japanese basket along with several other cheap logistics companies. I own 9063, 9087, 9361, 9311, 9312, and 9066. I’ve written about similar undervaluation in my Asagami (9311) writeup and also wrote up Keihin (9312).

Negatives: This is a capital intensive industry and Okayamaken Freight does carry debt. Minimal insider ownership. Illiquid small stock with little volume (average ~1,500 shares a day).

Positives: Very cheap (0.32x book) with consistent history of profitability. Owns a lot of land that is likely undervalued on the balance sheet. No controlling shareholder leaves room for activism. Company has bought back shares in the past (but the last major buyback was in 2016). Consistent dividend payments that have slowly been rising. No one is talking about this company (can’t find any English writeups and yahoo finance JP message board for the stock is totally dead with just 3 comments in the last 3 months)

Disclosure: None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due dilligence.

Appendix:

Facilities owned by Okayamaken Freight with carrying values for land + buildings.

Great find again 👏

Really like these companies. Just wondering how do you get proper English translations? 🤔

Have you looked into less asset intensive companies like San Holdings or BML Inc?

Thank you for the amazing write up and analysis. Great find. Do you know where I can find the specific properties/land that they own, would like to do further research lol