The Keihin Co (TYO 9312) - A Consistently Profitable and Growing Small Cap Logistics Company at 0.5x P/TBV and 11% RoE

This is a quick profile of one of the many Japanese stocks that have caught my interest and are in my cheap Japanese basket. I’ll be doing more frequent short write ups on names in this basket over the coming months.

The Keihin Co is a ¥10.94B ($74.7m) market cap logistics company in Japan that owns and operates warehouses and distribution facilities mostly in and around Tokyo. They’ve been profitable for 19 of the last 20 years and have compounded tangible book value at 6.5% over the last decade while growing profits.

Stock has gone nowhere over the last decade despite compounding tangible book value and net income at a respectable clip. Net income increased over 4x during this time frame and current P/E (LTM) sits at just 4.5x.

This is a growing business that earned over 11% RoE over the last 2 years.

Balance sheet holds ¥6.8B in land which is likely worth well over ¥16.5B as it was purchased many decades ago. Their first warehouse was opened in 1948!

Recently increased its dividend to ¥63 per share, up from ¥50 which has been paid since 2016. The current dividend yield is 3.76%

Management called out price/book discount (0.4x) for the first time in their last securities report, likely to comply with new Tokyo Stock Exchange rules.

Shareholder activism is a possibility since the largest shareholder owns only 9.4% of the company.

The Keihin Co (TYO 9312) is a cheap and consistently profitable Japanese logistics company founded in 1947 that owns and operates warehouses mostly around Tokyo. They’ve been listed since 1969 when they merged with Taiko Unyu Co Ltd, but most data providers only show their trading history since they changed their name to Keihin Corporation in 1984. Keihin is one of the larger positions in my cheap Japanese basket as its fundamentals are totally disconnected from underlying value. It’s also a company nobody has written up or even tweeted about (at least in English).

Keihin has been profitable for 19 of the last 20 years with only a small loss during the great financial crisis. Unlike many cheap Japanese stocks, Keihin offers both solid growth and value with a respectable return on equity of 11.8% in FY2023 and 11% in FY2022. The company trades at a dismal 0.5x P/TBV despite the impressive metrics below:

Key Metrics:

Revenue CAGR 10yr: 2.75%

Revenue CAGR 5yr: 5.64%

Tangible Book Value CAGR 10yr: 6.52%

Net Income CAGR 10yr: 14.49%

P/E (LTM): 4.5x

EV/EBITDA (LTM): 2.1x

Dividend Yield: 3.76%

P/TBV: 0.5x

The business:

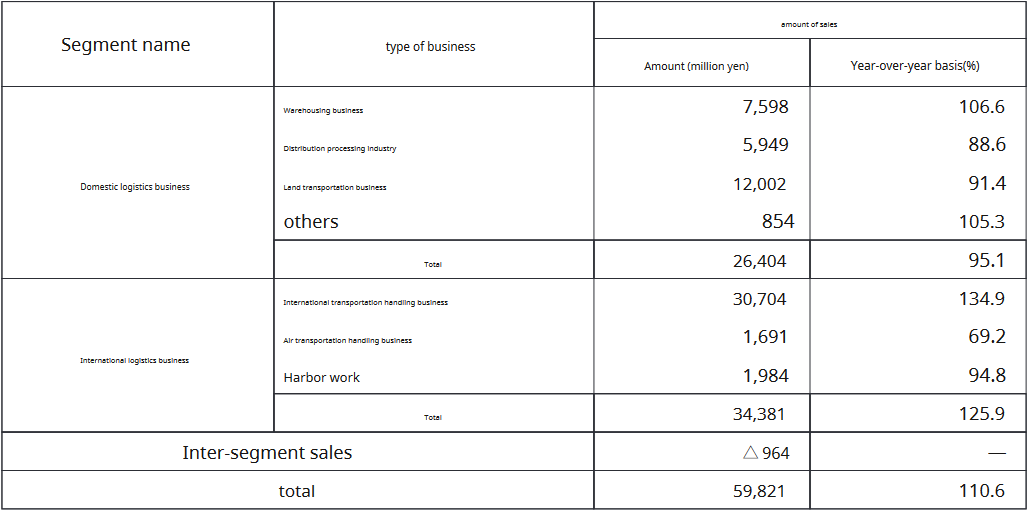

The company has 2 major divisions: Domestic Logistics and International Logistics with each contributing about 50% of companywide profits.

Revenue for domestic logistics was ¥26.4B (down 4.9% YoY) with operating income at ¥2.67B (also down 4.9% YoY). Keihin provides warehousing, distribution, and land transportation for their domestic customers.

Revenue for the international logistics business was ¥34.38 (up 25.9% YoY) with operating income at ¥2.73B (up 38.8% YoY). In this division, Keihin provides marine cargo handling, air transportation handling, customs clearance, and port work for their customers.

FY2023 (May 1, 2022 - April 31, 2023) Revenue By Segment:

While Keihin has been growing revenue and profit steadily for the last decade, the company did forecast lower FY2024 numbers. Revenue is expected to shrink 8.1%, operating income down 11.6% and net income decrease 11.3%. I don’t consider this a cause for concern as the company has a history of executing and outperforming their own forecasts. For example, FY2023 numbers outperformed their initial estimates substantially. Revenue was 13.5% better than expected and net income was 48.2% better. Even if FY2024 is a down year, as management expects, EPS should come in at ¥367.6 (down from ~¥414.2) for a forward P/E of 4.56. Still a bargain.

I don’t have a strong view on the logistics industry, but Keihin has historically done an excellent job of compounding tangible book value over the last decade.

Stock has gone nowhere:

Despite compounding book value and net income for the last 10 years, Keihin stock has gone absolutely nowhere. It closed at ¥1,750 on August 16, 2013 and is ¥1,675 on August 25, 2023. Total shareholder return remained positive during this period though due to dividend payments.

I wouldn’t have considered Keihin an attractive investment a decade ago when it earned around ¥630m and traded near tangible book (0.9x) vs ¥2,704m and 0.5x in FY2023. Net income went up over 4x while tangible book value was almost cut in half and the stock went nowhere.

Book Value Is Understated (¥6.8B of land is likely worth over 2x carrying value)

Keihin has been around since 1947 and is an asset heavy company which owns significant real estate, specifically warehouses and the land they sit on. These lands, acquired decades ago, are listed on the balance sheet at their original purchase prices, which are likely far below their current market values.

For instance, the company’s main office in Minato Ward (Tokyo) sits on 2,097㎡ of land which is valued at only ¥39m on the balance sheet. However, its market value today could exceed ¥4B, a potential 100x increase from its carried value.

Similarly, the company’s Koto Ward (Tokyo) warehouses, with 18,979㎡ of lands, are carried at ¥649M but are likely worth at least ¥4B. In Yokohama City, they have 68,606㎡ of land carried at ¥4.5B, but it's worth at least ¥6B. Their Kobe City lands are carried at ¥1.5B but are likely worth over ¥2.5B.

In total, Keihin's land assets could be worth around ¥16.5B, in contrast to the ¥6.8B recorded on the balance sheet. Remember, the company's entire market cap is just ¥10.94B.

I came up with these land valuations using Utinokati’s average land price by ward. This is likely fair for the office asset, but overestimates the land value underneath their warehouses in industrial areas, so I just divided the value by 3 and rounded down. While industrial land is always going to be less per sq meter on average, Keihin’s larger properties are located near ports and will always be in demand.

These lands could be worth much more, but I wanted to be conservative. According to JLL’s Tokyo Logistics Market Summary, capital values for these kinds of assets are up 30% since Q4 2018 and are expected to rise further by the end of the year. The company also invested a lot in these land assets building and rennovating their distribution centers and warehouses which would factor in any future sale.

While book value is clearly understated, these are operating assets that are needed to run the business and can’t be sold off if the company wants to keep growing. Still, the land provides some downside protection if the business goes south and strengthens the argument that Keihin is cheap.

Capital Allocation

Unlike many of the net-nets and cheaper companies I often write about, Keihin isn’t sitting on an enormous amount of cash. They’re regularly reinvesting into the business while still maintaining a conservative balance sheet. Cash and cash equivalents are ¥8.96B and total current assets are ¥14.61B vs total liabilities of ¥20.12B. The company consistently generates a lot of free cash flow (¥3.36B LTM), which is reinvested in the business.

While expanding the business isn’t an awful use of free cash, especially since RoE was 11.8% in FY2023, buying back stock would be better. Unfortunately, Keihin has bought back only a token amount of stock over the last 10 years (less than 0.1%). On the positive side, the share count isn’t increasing.

The company does pay a dividend though which has slowly been increasing over the years. Since 2016 Keihin paid ¥50 per share in dividends per year, but after FY2023’s results, management forecasts they’ll pay ¥63 per share in FY2024, which comes out to 3.76%.

While capital return policies today are weak, Keihin’s FY2024 Q1 securities report included the following disclosure:

This is the first time Keihin has ever talked about closing the price to book discount and listed it as one of management’s challenges/goals. This is almost certainly due to new rules by the Tokyo Stock Exchange which are aimed at improving RoE and closing P/BV discounts for listed companies. Time will tell if management actually does anything, but at least they’re talking about it.

Keihin also owns about ~¥4B of investment securities, most of which are other publicly listed companies. Given just how cheap Keihin’s own stock is, this seems like a misuse of capital. Ideally they will sell these down and use the proceeds to repurchase shares.

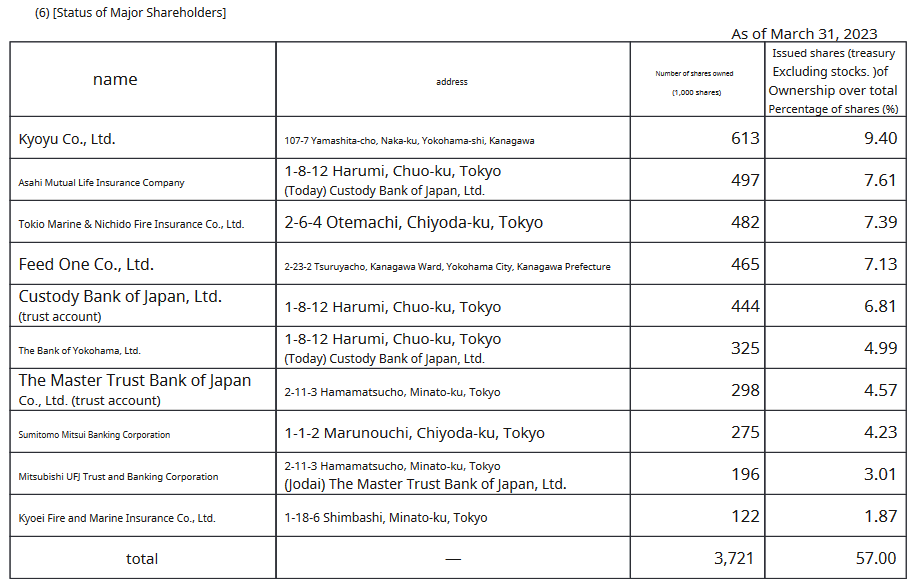

Major Shareholders:

Mr. Hidetaka Otsu is Keihin’s biggest shareholder with 9.4% of the company. He owns these shares through Kyoyu Co. LTD, which is also partially owned by his other relatives. Mr. Otsu is also related to the current chairman of the board and representative director. 7.13% of Keihin is also held by Feed One Co, a publicly listed animal feed company which Keihin does some business with (<1% of sales). Aside from these 2 names, all other major holders are insurance companies and banks.

Given that no single entity owns a huge chunk of Keihin stock, activism is possible here.

One small red flag here is that the #1 shareholder, Kyoyu Co. LTD, has been paid about ¥1.1B for equipment purchases and maintenance last year. While related party transactions are always a bit suspect, nothing here appears too egregious, especially since the sums involved are small.

Conclusion:

Keihin is a rare combination of growth, value, and consistency. It’s not deep value net-net territory, but I like Keihin a lot more than most net-nets in my portfolio. It’s a solid business that earns a good RoE (>11% in the last 2 years). 0.5x P/TBV is simply too cheap for this business.

The opportunity to own Keihin today at these attractive prices is the same reason why so many small Japanese companies are cheap. No one is following these companies and they’re too small for institutional investors.

I’ve looked at several other Japanese logistics companies and the closest one I could find in terms of cheapness was 9306 (Toyo Logistics) at 0.4x P/TBV, but it had a much higher PE, lower and less consistent FCF, and worse RoE (5.94%). Another similar sized peer Sugimura Warehouse Co (9307) trades at even worse multiples.

Other larger cap peers like Shibusawa Warehouse Co (9304) and Sumitomo Warehouse Co (9303) trade at 0.9x P/TBV and higher P/Es.

I own Keihin as a part of my cheap JP portfolio. With a decent dividend yield (3.76%) and a strong history of profitability, I don’t think there’s much downside here. Land values also provide some additional margin of safety.

Disclosure: I own shares in The Keihin Co (TYO:9312). This is a small position for me so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments.

Keihin reported their full year earnings. Missed their own guide, but it was expected given progress on profit/numbers last Q. On the positive side, Net asset value per share increased much more than EPS due to increased valuation of investment securities (other securities. investments in non listed stock/biz). Net asset per share went up from ¥3,745 to ¥4,324. EPS was ¥313 for the yr. Management Forecast ¥321 for next year. Price today ¥1,987.

~3.5% dividend yield

6.2x management forecast EPS

0.46x book

It's cheap and owns a lot of land. I still own this

Nice writeup - I looked into this ticker a little bit today. I haven't gone back far enough on the numbers but I can tell this will be one of those positions that you buy and throw it in your drawer until something happens. It looks like its cheap and has been cheap for a while but the assets are actually improving over time (more and more being represented by cash due to overcapitalization). Thanks!