Asagami Corporation (TYO 9311) is an Example of Widespread Undervaluation of Land on Japanese Balance Sheets. Disparity Between Book & Market Value is 3x Market Cap On Just 3 Properties

Asagami Corporation (TYO 9311) owns 3 warehouses on Tokyo Harbor with land carried on its books at ¥7.9 billion. These properties alone are likely worth closer to ¥29.5 billion. These assets account for less than half of the company’s land assets, but are worth multiples of the current market cap of just ¥7.16B.

Market valuation of the land is based on a comparable property owned by a Japanese REIT that did an appraisal in their 2023 annual filing. Even adjusting my estimate by -50%, shows there’s tremendous land value not reflected on the balance sheet.

The company is trading at just 0.4x p/tbv today. There’s a lot of land value here. When looking at most cheap Japanese companies, I tend to ignore the value of land as its difficult to monetize, but land values provide an additional margin of safety to many deep value names.

The purpose of this post is to demonstrate that land assets are likely undervalued on the balance sheets of many Japanese listed companies. I’ve written about several deep value names that are dirt cheap even excluding land values like Kawagishi Bridge Works.

I have no strong opinion on Asagami, but own a few hundred shares for fun. The business has a strong history of profitability and book value growth, so it’s likely cheap. It’s EXTREMELY illiquid.

In several of my previous posts, I've highlighted that Japanese companies often have land assets significantly undervalued on their books. In this post, I'll explore a company that owns a lot of land, but will focus on 3 warehouse properties valued significantly higher than their book value, with the disparity between book and market value being 3x the entire company's market cap. While the company owns and operates a profitable logistics business and also owns several other properties, we’re going to focus on just these warehouse assets to demonstrate how cheap some Japanese companies are. Notably, the land value of these warehouses represents less than half of the total land value recorded on the company's balance sheet, suggesting further undervaluation in other areas.

While researching a few ideas I came across Asagami Co (TYO 9311) which runs a logistics business that also owns rental real estate. Their largest set of properties are 3 warehouses on Tokyo Harbor, encompassing 15,542 square meters of land, valued at ¥7.9 billion on the book.

Asagami's market cap today stands at just ¥7.16 billion. Currently, the company trades at a price to tangible book value ratio of merely 0.4x, without any adjustments.

Source: Latest annual report.

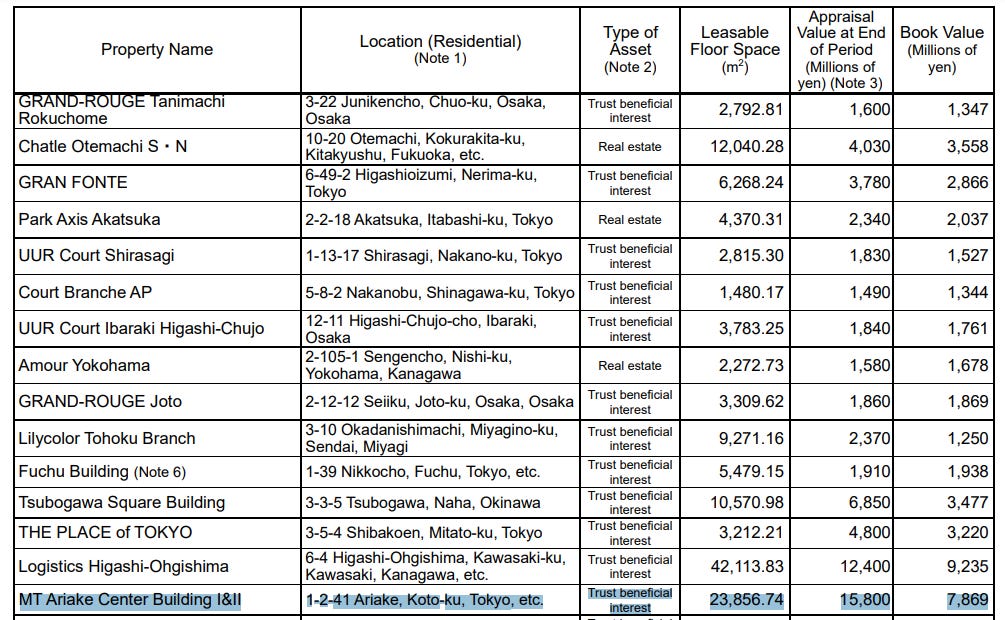

Estimating the true value of these assets poses a challenge, but a nearby comparable property provides useful insights. This property, owned by United Urban Investment, a Japanese REIT, comprises a warehouse/logistics facility on 8,307 square meters of land with approximately 23,000 square meters of floor space. Purchased in 2014 for ¥8 billion, its latest appraisal stands at ¥15.8 billion, equating to ¥1.9 million per square meter (The REIT does a year end appraisal for all of their assets).

You can see the comparable property above which consists of 2 buildings on 8,307 m2 of land and ~23,000 m2 of floor space.

Asagami's warehouses, which are almost 2x the size (land wise) to this comparable property, are recorded at a mere ¥7.9 billion on the balance sheet. Combined, Asagami's warehouses offer an expansive 89,662 square meters of floor area – almost 4x that of the comparable. Valuing Asagami's land at the same rate per square meter (¥1.9 million) results in an estimated value of ¥29.5 billion. This valuation suggests an undervaluation of ¥21.6 billion, almost 3x Asagami's market cap of ¥7.16B.

Asagami's balance sheet reflects some of the land appreciation with a land revaluation adjustment of ¥5.57 billion. The revaluation was done on March 30, 2000, under the Land Revaluation Law, covering all its land assets, not just the three warehouses. The book value for these warehouses is listed as ¥7.9 billion out of the total ¥16.8 billion land assets. Including the revaluation, the net land value for the company amounts to ¥22.37 billion. Even attributing the entire revaluation adjustment to these warehouses, the book value of the land would be approximately ¥13.47 billion, significantly lower than the market value estimate of ¥29.5 billion.

Conclusion:

The point of this exercise wasn’t to demonstrate that Asagami is undervalued. I haven’t done a deep dive into their business, but given their history of profitability and significant land assets, they probably are. After all, even without any adjustments to land values, they’re trading at just 0.4x P/TBV.

Instead, I wanted to highlight that land values are likely understated on the balance sheets of many Japanese companies. Keihin Co, which I wrote about earlier, also owns warehouses in Tokyo in popular industrial areas. When I look at deep value names in Japan, I don’t include land values in calculating NCAV or trying to figure out my upside. Companies like Kawagishi Bridge Works and Marufuji Sheet Piling are absurdly cheap deep value net nets even if we totally ignore their likely undervalued land assets. The land does provide an additional margin of safety though and in the slim chance that fair values are ever realized for Japanese companies, it could prove to be a bonanza.

My expectations for most of my deep value names are much lower and I would be happy cashing out most names even slightly below an understated book value.

Even if the comparable asset appraisal is wrong or the Asagami assets are worse, the idea that land assets are undervalued is directionally correct and only makes these cheap Japanese names even cheaper than first glance.

Disclosure: I own a few hundred shares of Asagami for fun. Nothing in this post is financial advice. My estimates/conclusions could be wildly off. Do your own work

This was a quick writeup. If you think I missed anything, let me know.

Appendix:

Here’s a Google maps image showing 2 of Asagami’s properties (Odaiba International Logistics Center A and B) and the comparable MT Ariake Center facility.

Asagami’s properties are right next to the Aomi Container Terminal while the comparable property is next to East Side Multi-purpose wharf. Asagami’s third warehouse, Fukagawa Logistics Center A, is a bit further away in the other direction.

I enjoyed reading your well written, insightful writeup on Asagami, especially because I began my career (now retired) as a warehouse and land holdings analyst in Japan. It's seems so obscure today. Your reasoning is solid, but in my experience, most of the Japanese market does not care about land in general most of the time, and industrial land in particular. In the 1980s Japan experienced a liquidity boom when they lowered interest rates and created an easy money situation. This caused investors to look at the many companies which had bought land 100 or more years ago and re-evaluate them. The stock prices of stock exchange listed companies including but not limited to warehouses, movie theatres, real estate firms, and railroads, went through the roof. Investors at that time also analyzed the large stock portfolios of listed companies, most of which were carried at book value. Although Japan has easy money now, this has not been happening and I feel that without some kind of catalyst, it may be a long wait for these deeply discounted latent assets to be realized.

thanks for sharing! from your X bio I presume you're based in Turkey? Would you be interested in wiritng about Turkish small caps that're highly illiquid as well. English-speaking Fintwit has extensive knowledge on Pabrai's RYGYO and CCOLA, but there are really interesting holdcos and REITS with hidden tangible assets, which would incidentally come more prominent now that these companies are the brink of inflation accounting.