Kawagishi Bridge Works (TYO 5921) - A Deep Value Double Net Net (MCAP $62.5m, NCAV $123m) Construction Steel Producer at 8.3x P/E

Kawagishi Bridge Works is absurdly cheap and almost a double net net (NCAV $123m vs $62.5m market cap). Business quality is low (they manufacture steel construction products), but company has been pretty consistently profitable and has grown tangible book value at 5.46% CAGR over the last 10 years.

This is a largely ignored stock that only has a single mention on Twitter/X.

Company appointed a new president and representative director last month on October 27, 2023, who used to work at Itochu, a related party and major shareholder. New management could lead to changes.

Balance sheet’s ¥3.4 billion in land likely understates its value. This company has been around for 110 years, their land is likely worth significantly more and provides an additional margin of safety.

Kawagishi Bridge Works (TYO 5921) is a producer of construction steel and precast concrete products that’s been around for 110 years. It’s a boring and relatively low quality business, but they’ve been consistently profitable since 2015. Revenues have been flattish and their fortunes are tied to the domestic construction industry.

Share Price: ¥3,125

Market Cap: $62.5m

Net Current Asset Value (Current assets - total liabilities): $123m

Value of Business: -$60m

Forward P/E: 8.32

P/BV: 0.34

Book Value Per Share: ¥9,152

Dividend Yield: 3.17% (¥100 per share, up from ¥80 last year)

Tangible Book Value CAGR 10yr: 5.46%

Management expects revenue for the following fiscal year ended September 30, 2024 to increase by 1.9% with net income per share falling 11.9% to ¥375.48 which gives us a forward P/E of 8.32.

Cash is only $24m on the balance sheet, the majority of current assets are accounts receivable (~$130m). Total liabilities clock in at just $34.66m putting net current asset value at $123m, well ahead of the $62.5m market cap, making this a net-net. It’s almost a double net-net, meaning if the stock doubled, the market would still value the underlying business at nearly $0.

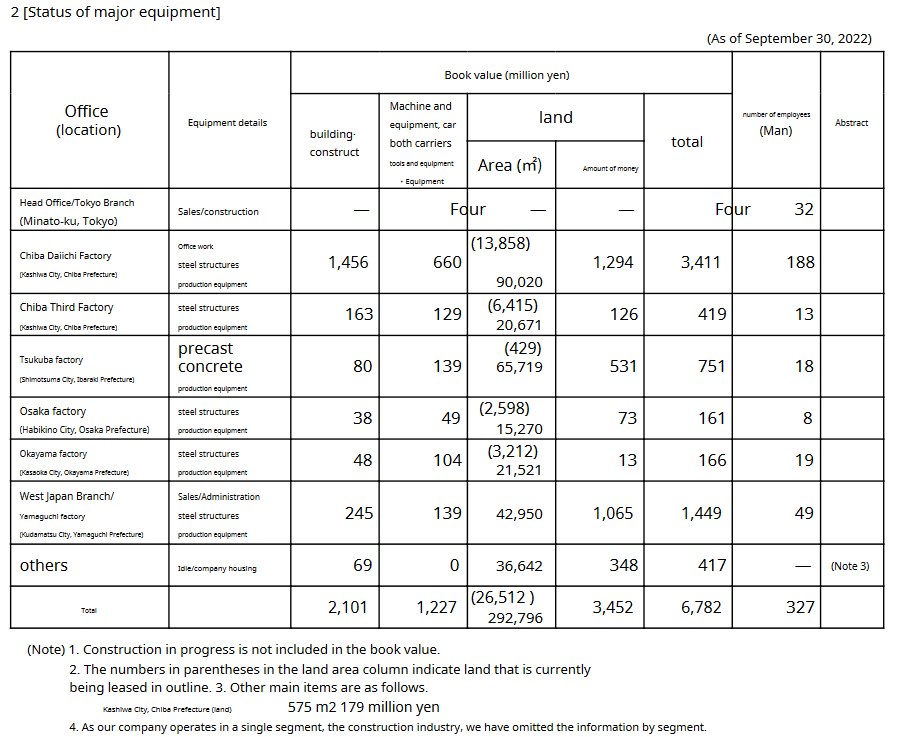

As with many Japanese companies, there may be additional value in the land not fully captured by book value. They’ve been around for a long time, so I suspect the ¥3.4 billion land held on the balance sheet is worth much more. Their most valuable facility for example sits on 90,020 m2 of land in Kashiwa City and is likely worth much more than the ¥1.3 billion (¥14,441/m2) recorded on the balance sheet. The facility is located just 10 minutes (drive) from 2 metro stations! To help visualize that, we have land that can fit 2x Tokyo Domes held at ~$9.5m USD in a dense industrial hub. I’m not banking on any value being realized here, especially since the facilities are required to operate the business, but it’s an additional margin of safety.

The 2 largest shareholders are Itochu and Mitsui, 2 of the largest trading companies in Japan. The company does material business with the steel divisions of both entities. They each also have their own directors on the company’s board.

On October 27, 2023 the company’s board appointed a new president and representative director: Yasuo Kiyotoki, who previously worked for Itochu, a related party. Mr. Kiyotoki has only been with Kawagishi Bridge Works since April 2022.

Does this mean anything? I don’t know. But it could lead to improvements in capital allocation.

Poor Capital Allocation

The only obvious negative (besides the low quality business) is that treasury stock declined ~80,000 shares over the last year, which means the company sold stock that they previously repurchased. This doesn’t make sense given that they have plenty of cash already. Selling stock given the massive discount to book and net-net status is simply terrible capital allocation, especially since the amount involved represented ~2.5% of shares outstanding. Fortunately though, dilution isn’t really an issue as shares outstanding have been largely flat over the last 20 years. Still, the behavior doesn’t make sense and management has not provided an explanation here besides the simple boilerplate language below (the note below the table):

On the positive side, they repurchased 160 shares last quarter. Strange. As with most cheap Japanese companies, I don’t think management is acting with malintent. Management teams in Japan simply aren’t aware of concepts like cost of capital and have had no reason to be conscious of them. That may change with the recent push by the Tokyo Stock Exchange and Ministry of Finance to improve corporate governance.

Conclusion

Kawagishi Bridge Works is dirt cheap, so I own it as part of my cheap Japanese basket. While not the highest quality name I own, it’s one of the cheapest valued at -$60m after netting out current assets. It’s almost a double net-net! Net-nets are common in Japan, but double net-nets are pretty rare.

If the Tokyo Stock Exchange reforms begin to take effect, companies like Kawagishi Bridge Works should benefit most given their massive discount to book value. Even without those reforms, net-nets tend to perform well in the long run.

Disclosure: I own shares in Kawagishi Bridge Works Co (TYO:5921). This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments.

Deeply undervalued net-net Kawagishi Bridge Works (TYO 5921) announced Friday night they're buying back up to 6.9% of shares in a buyback on Monday. Almost a double net-net.

Just another day in Japan where net-nets are doing buybacks.

Kawagishi Bridge Works (TYO 5921) just announced 'measures to realize management that is conscious of capital costs and stock prices'. They announced a 3.34% buyback, 30% payout ratio, and some other iniaitives. Mostly small, but this is an excellent first step. Should go up nicely in JP trading.

https://contents.xj-storage.jp/xcontents/AS70222/a7deccf6/b1b4/4199/8eb8/e50b89f19f87/140120240226542264.pdf