Nippon Pigment (TYO 4119) - A Deep Value Pigments Manufacturer Trading at 0.25x Book That Did a Big Acquisition and Immediately Recorded More than its Market Cap in Bargain Purchase Gain

Tiny deep value company buys division from uneconomic seller. Stock is cheap with 3% dividend. ¥3,110 share price vs ¥8,522 of NCAV + Investments. Trades at 5x OP and P/E of 7 (EPS forecast of ¥445)

Share Price: ¥3,110

Market Cap: ¥4.90 billion (~$34m USD)

Book Value Per Share: ¥12,724

NCAV Per Share: ¥1,642

NCAV+Investments Per Share: ¥8,522

P/B: 0.25x

Dividend: ¥100 (3.15%)

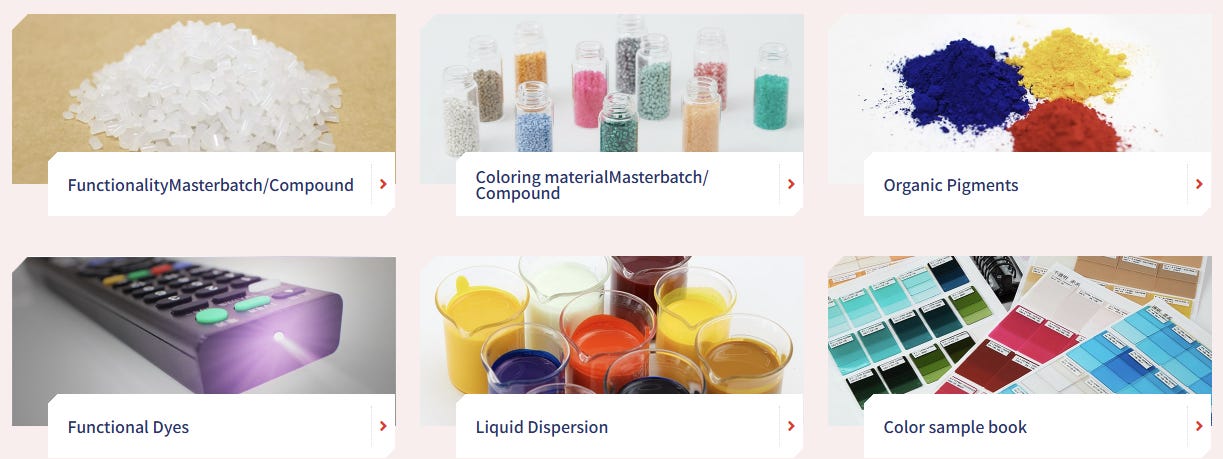

Nippon Pigment (TYO: 4119) is a Japan-based specialty chemicals company that produces resin compounds and colorants (pigments and dyes) primarily for plastics, coatings, and textiles. The company has operated successfully in its niche for over a century. Since going public in 1961, the company has maintained a strong track record of profitability, posting losses in only two of the past twenty years (2009 and 2022). While the company has been profitable, its topline has been declining for 30 years. That’s changing though. The company made a transformative acquisition last year.

On April 30, 2024, Nippon Pigment acquired 97% of Sumika Color (now called PLASiST) from Sumitomo Chemical for ¥1.0 billion. A few months later, Nippon Pigment recorded a one time huge negative goodwill (bargain purchase gain) of ¥6.8 billion. They recorded EPS of ¥4,332 due to the acquisition. Compare that to the company’s ¥3,110 share price today.

This unusual situation occurred because Sumitomo Chemical, a ¥550 billion company affiliated with the ¥4.4 trillion giant Sumitomo Corp, effectively paid Nippon Pigment to take over Sumika Color. In their announcement, Sumitomo Chemical stated that they recapitalized Sumika Color before the sale and identified Nippon Pigment as the ideal owner for long-term operation due to their strong market position. Nippon Pigment, in turn, believes this acquisition will boost growth and enhance its competitive edge. Sumika Color and Nippon Pigment serve the same industries and have similar product offerings.

This wasn’t a market transaction. The division was seemingly sold (given) to Nippon Pigment because Sumitomo Chemical believed it was the best company to operate the division for the long term. I imagine Sumitomo Chemical considered shutting the division down, but that’s not a good look in Japan where shareholder primacy isn’t the dominant belief. So they basically paid Nippon Pigment to take the division off their hands.

Sumitomo Chemical is currently undertaking "intensive performance improvement measures," aiming to restructure and streamline operations to boost profitability. The Sumika Color division was presumably too minor and non-core, prompting Sumitomo Chemical’s decision to exit at a cost.

Yes, this is strange and sounds too good to be true, but given the size of the players involved I don’t think the story is implausible.

When I first stumbled on this announcement I wasn’t eager to buy Nippon Pigment as I was worried that integration would prove difficult and maybe the acquisition would prove to be a big liability. While I’m not certain that isn’t the case, the company reported FY2025 results and their forecast for FY2026 is encouraging:

Historically, Nippon Pigment’s sales averaged around ¥28 billion annually (2020–2024). The Sumika Color acquisition significantly boosts revenue, adding approximately ¥13 billion annually. Additionally, there's potential upside if the acquisition strengthens Nippon Pigment’s pricing power with suppliers and customers.

Before Sumika Color was recapitalized and sold, its financials for the FY2021-FY2023 were not great. The bet here is that after the big recapitalization and synergies with Nippon Pigment it could be a winner. “Could” is the key phrase. I know little about this industry and despite ¥45.8 billion in combined revenues, they seem like a small player compared to bigger players like DIC Corp, though DIC’s offerings are broader.

While FY2026’s forecast looks fine, there’s no certainty that the acquisition will work out in the long run. Still, Nippon Pigment today is just too cheap. Net income for FY2025 came in at 3,327, a bit less than the purchase gain as the company recognized impairment losses across 2 consolidated subsidiaries.

The bet here is that FY27 will begin to show real synergies, as the forecast for FY26, while cheap, isn’t gangbusters cheap. While 5x operating profit and 7x net income is cheap, it’s nothing to get excited about given long term decline in revenues. Nippon Pigment is only a bargain in the context of 7x P/E along with ¥8,522 a share in NCAV+Investment securities. The 3% yield helps, but shareholders will only really win if diviends increase or the company begins doing buybacks. The company has not yet complied with the TSE request for improving their book value yet, but the dividend isn’t terrible.

Bizarre Negative Goodwill Deals

It’s fair to be skeptical here, but this isn’t the first acquisition I've seen in Japan where the buyer immediately recognized a massive one-time gain. My initial thought here was that they probably acquired some environmental liabilities, pension liabilities, or something else that made this deal more fair, as there’s no way anyone would just sell a business for less than free. But keep in mind, these aren’t market transactions.

That acquisition didn’t involve manufacturing or chemicals; it was a mobile game developer. Cave Interactive (TYO 3760) acquired Dera Game back in 2022 for ¥5 billion then recorded ~¥3 billion in one time gains from negative goodwill. This isn’t an employee-heavy business or one that comes with legal liabilities either. While I thought this was a slam dunk deal for Cave Interactive, I wasn’t interested in the stock as the mobile games business is brutally competitive and Cave has burned a lot of investor cash over the years. That acquisition did make them profitable though.

Activism isn’t impossible but the company is too small

While activism isn’t impossible here, Nippon Pigment is just too small for anyone to care. I doubt anyone tries to go activist on a ¥4.94 billion company. Then again, I mentioned in a previous writeup that Tokyo Soir saw an activist despite being even smaller. So who knows. Still, the banks and the business partners association are likely friendly to management, so it won’t be easy. Oh, and the stock is stupid illiquid. More so than most names I’ve written about, so taking any meaningful sized position is basically impossible.

Conclusion:

This is cheap and I own some as part of my Japanese basket. This is only a half-basket sized position as I don’t particularly like the commodity-esque nature of the core business.

Unfortunately shareholder returns have been disappointing over the years. The 3% yield isn’t bad, but share count has been flat over the last 30 years. Still, the stock is up 90% over the last 5 years, so investors did okay. Not so Longer term. Since 2000, the stock is up only 46% (excluding dividends).

So why even bother with a name like this? Because something happened. If the acquisition works well and they improve capital returns, the stock could do great. Even without improving fundamentals, increasing the dividend alone would re-rate the stock higher. Sanyo Industires, which I wrote up in the past, rocketed after doubling their dividend despite flat net income growth.

I use Koyfin for looking at historical data, screening, and visualizing financials. Koyfin offers real value to me and I have been a paid user long before they offered me an affiliate link with a 20% discount. The free version is excellent as well. I don’t charge for access to my writeups. I wouldn’t promote something unless I really loved it and I love Koyfin.

Disclosure: I own shares in Nippon Pigment (TYO 4119). The security could be sold at any point in time without prior notice. This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments. None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due diligence.

Thank you for this excellent write-up. Your hypothesis about Sumitomo "giving away" their subsidiary to protect their reputation is possible. But the recording of negative goodwill could also just indicate that asset value of the acquired company was overstated and/or liabilities understated. Time will tell.

Very interesting transaction! Any idea where the normalized operating margin could get to?