Investing Alongside Beji Sasaki: Japan's Unconventional Corporate Raider and Value Investor

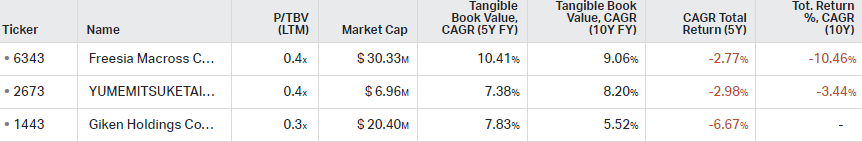

His 3 publicly traded nanocap Investment vehicles Freesia Macross (6343), Giken Holdings (1443), and Yumemitsuketai (2673) have declined as book value has grown and trade at just 0.4x book value.

Beji Sasaki is an unusual investor. He made a name for himself during the bubble economy of the 80s/90s as the ‘takeover man’ and despite not getting too much attention lately, he’s still active in the markets. He takes stakes in public companies and aims to improve profitability and wrest control. He’s an aggressive corporate raider looking to take control of public companies and maximize profits for shareholders, a concept that’s foreign in Japan.

There’s been several writeups about him in the media, most notably a 2017 piece on Bloomberg which is a must-read. There’s also a FT writeup.

Is there an opportunity in investing alongside Mr. Sasaki? Maybe.

Beji Sasaki operates in public markets through three publicly traded nanocap companies he controls: Freesia Macross (6343), Giken Holdings (1443), and Yumemitsuketai (2673). All 3 trade at large discounts to book value (between 0.3x and 0.5x). The largest is Freesia Macross with a market cap of just $30m.

While each of these companies has some underlying business, they are primarily investment vehicles. Yumemitsuketai operates a small-scale mail-order catalog business, and Giken rents construction equipment, but the vast majority of their value lies in the stocks they own. A bet on any of them is a bet on Mr. Sasaki's ability to allocate capital and create value.

At Giken Holdings, once Mr. Sasaki gained control, he fired half of the company's staff and began using its resources to make investments. The company directly owns the following stocks:

As of June 30, 2024, investment securities totaled ¥6.5 billion. The company's market cap is ¥2.91 billion. Other major assets on the balance sheet include ¥4.4 billion in current assets and ¥4.8 billion in land. Total liabilities are ¥6 billion, with the majority as long-term borrowings.

Perhaps the best way to gauge Giken's fundamental performance is to look at its tangible book value over the last five to ten years:

Tangible Book Value (5-year CAGR): 7.83% (BVPS increased from ¥470 to ¥700)

Tangible Book Value (10-year CAGR): 5.52% (BVPS increased from ¥386 to ¥700)

In contrast, the stock performance has been poor:

5-year stock performance: -33% (stock price fell from ¥276 to ¥181)

10-year stock performance: -40% (stock price fell from ¥300 to ¥181)

Despite the growth in book value over the last five to ten years, the stock has been an awful investment.

This is a recurring theme with Mr. Sasaki's two other companies, Freesia Macross and Yumemitsuketai. While their equity investments have performed okay, the underlying stocks have only declined.

To put the tangible book value growth into context, the Nikkei Total Return CAGR has been 11.4% and 8.8% over the last five and ten years, respectively. While Mr. Sasaki's stock picking has underperformed the Nikkei, it wasn't by much.

Freesia Macross has had better underlying book value growth, but accounting gets a bit more complicated since Giken is an equity affiliate. Freesia Macross own’s the following stocks:

Freesia Macross's number one holding, Nippo (9913), is up 10x over the last ten years, which likely contributed to its superior tangible book value growth compared to Giken Holdings and Yumemitsuketai. Mr. Sasaki clashed with management of Nippo (9913) and eventually made a takeover bid for the entire company, but was thwarted by anti takeover provisions (poison pill). Much of Nippo’s gains came after Mr, Sasaki bought his 19.73% stake and submitted a tender offer to buy the remaining shares. While he hasn’t been able to buy any more shares, Nippo has proven to be a great investment.

So why have Mr. Sasaki's public companies performed so poorly despite growing book value? The simplest explanation is that he has done little for his own shareholders. Dividends and repurchases are mostly non-existent, and shareholder communications are lacking. Just try navigating Freesia Macross's website: as of this writing, it doesn't even load, and when it did, it was antiquated. The Giken Holdings website is slightly better but still sparse. Given the minimal shareholder communication and lack of interest in shareholder returns, it's not surprising to see all three stocks perform poorly. For example, Giken's dividend per share is a paltry ¥1, or 0.5%, and there's no expectation for this figure to increase. Mr. Sasaki has shown no desire to reward his shareholders.

This is a shame because Mr. Sasaki's swashbuckling shareholder activism is exactly what corporate Japan needs. In recent years he’s been fighting with the management of a nanocap net-net, Tokyo Soir (8040), which adopted a poison pill to ward off his advances.

Mr. Sasaki doesn't limit himself to passive ownership. Through his three investment vehicles, he controls Solekia (TYO 9867), holding over 50% ownership, and serves as a director. I own Solekia as part of my cheap Japanese basket and consider it to be undervalued. Since Mr. Sasaki took control of the company, the book value per share has nearly doubled from ¥6,200 in December 2016 to ¥11,680 today.

While Mr. Sasaki doesn't seem to have any great ability to pick stocks, he has only marginally underperformed the Nikkei index. This warrants a discount to book value, but the current 0.3x–0.4x book value multiples at which his companies trade seem excessive. For Mr. Sasaki to succeed though, he doesn’t need to be a good stock picker. As things change in Japan, his ability to take over companies, fire staff, and unlock value could prove valuable.

Undervalued Real Estate Assets [Added Section June, 2025]

Freesia Macross also owns real estate which is held at cost on the balance sheet that has appreciated significantly over the years. The corporate headquarters, located in Chiyoda, Tokyo for example sits on 2,235 sqm of land which book is recorded at book at ¥1.16 billion. This is conservatively worth 3x that figure. The entire market cap is just ~¥3.6 billion, so this is a meaningful amount of value not reflected in book value.

The individual address for the HQ does not look anywhere close to 2,235 sqm, but it may encompass the nearby properties as well. Either way, the land is undervalued regardless of where in Chiyoda, Tokyo it is.

The company’s investment properties also don’t reflect their fair market value, but unlike the corporate HQ the company offers a ‘market price’ estimate in their securities report. Book value is ¥4.6 billion with market price being ¥7.3 billion

Real estate seems to be a great ‘bonus’ on an already cheap name trading at 0.4x p/tbv. Still, the main reason I’m not too excited about this name is its likely a value trap, as they’ve shown little regard for shareholders and offer much worse capital returns than practically every other Japanese stock I own.

Yakuza Like Behavior

Not to sound hyperbolic, but organized crime still exists in Japan. An article in Asia Times estimates that 4.5% of Tokyo Stock Exchange–listed companies have ties to organized crime, with smaller companies likely overrepresented. (Side note: This is an interesting 5 part series on Yakuza in modern day Japan)

While there aren't any direct links to organized crime in any of Mr. Sasaki's companies, there are allegations of dubious practices. One that stood out to me when researching his companies is from ex-employees at Giken Holdings, who claim Mr. Sasaki refused to pay local taxes and retaliated against executives who allegedly paid the tax without informing him.

It’s pretty wild stuff:

Another crazy story that sounds yakuza-esque involves 9 employees from Mr. Sasaki’s group companies getting arrested for moving their residences to the corporate HQ to all vote for a specific candidate in the Tokyo Metropolitan assembly election:

Although I don't think there's sufficient evidence to suggest any serious crimes, the allegations and overall impression surrounding Mr. Sasaki are unsettling.

What Could Be

I suspect Mr. Sasaki could have achieved enormous success in the markets if he had prioritized his own shareholders. Being able to issue shares at a premium to book value and use that to fund additional investments is a winning formula that roll-ups have long used. Unfortunately, this isn't possible as Mr. Sasaki's investment vehicles trade at 0.3–0.5x price to book.

While corporate Japan wasn't ready for Mr. Sasaki's type of activism in 2017, things are different today. Attitudes toward shareholder rights and improved profitability have changed drastically over the last few years. Recent efforts for improved governance are being spearheaded by the Tokyo Stock Exchange, and other institutions like the Ministry of Finance and banks are also embracing change through tax incentives and a willingness to lend to finance management buyouts (MBOs).

If Mr. Sasaki changes his tune and begins deploying capital to reward shareholders, I believe the market could value his activism at or even above book value, which would enable him to raise cash accretively to pursue takeovers. That's the bet here. Absent a total change of strategy from Mr. Sasaki, I doubt the market will ever rerate any of his companies. While this possibility seems remote, it would be an obvious win-win. Mr. Sasaki pursued a strategy of corporate takeovers and shareholder activism in the past when Japan wasn't ready for such drastic changes, but the country is ripe for such change today.

Conclusion:

While I'm fascinated with this story and own a token position in Giken Holdings, I don't think Mr. Sasaki will suddenly prioritize treating his shareholders better. Still, the bet here is on Mr. Sasaki's ability to unlock corporate value in small, left-for-dead stocks, not in operating and growing businesses. He’s willing to make unpopular decisions and isn’t afraid to get his hands dirty in firing staff even if it means getting vilified. Market opportunities in Japan seem perfect today for a guy like Beji Sasaki. Especially since other small cap activists like Strategic Capital and Murakami Fund have seen success in recent years.

I am neutral on Freesia Macross, Giken Holdings, and Yumemitsuketai. While book value will likely continue to grow, i’d pass on these stocks given poor shareholder returns. There are better opportunities in Japan. My position is a tiny tracking position for fun.

Disclosure: I own shares in Giken Holdings (TYO:1443). This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments. None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due dilligence.

Perhaps you could benefit from the so-called "smallest firm effect", which seems to be present only in the smallest decile of stocks. see here: https://ideas.repec.org/a/eee/jimfin/v32y2013icp129-155.html

Interesting story!