Cover Corp (TYO 5253) - High Growth Opportunity in the Expanding VTuber Sector

Trades at a 35% discount to its primary competitor despite superior underlying growth in viewership. 24x Forward P/E may seem expensive, but its under monetized and the industry is growing rapidly.

Dominant Market Position: Cover Corp, a leading talent management company in the rapidly growing VTuber industry. They’re considered the most prestigious agency and should attract the best talent.

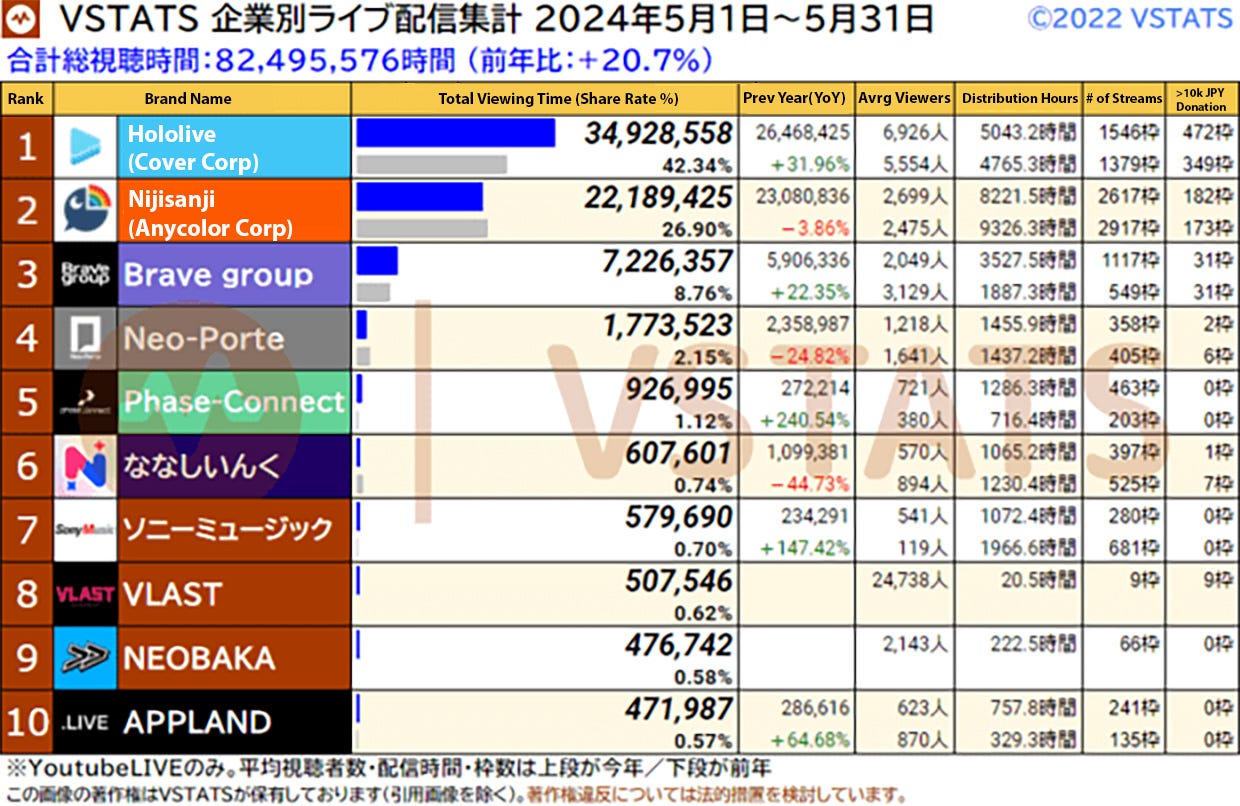

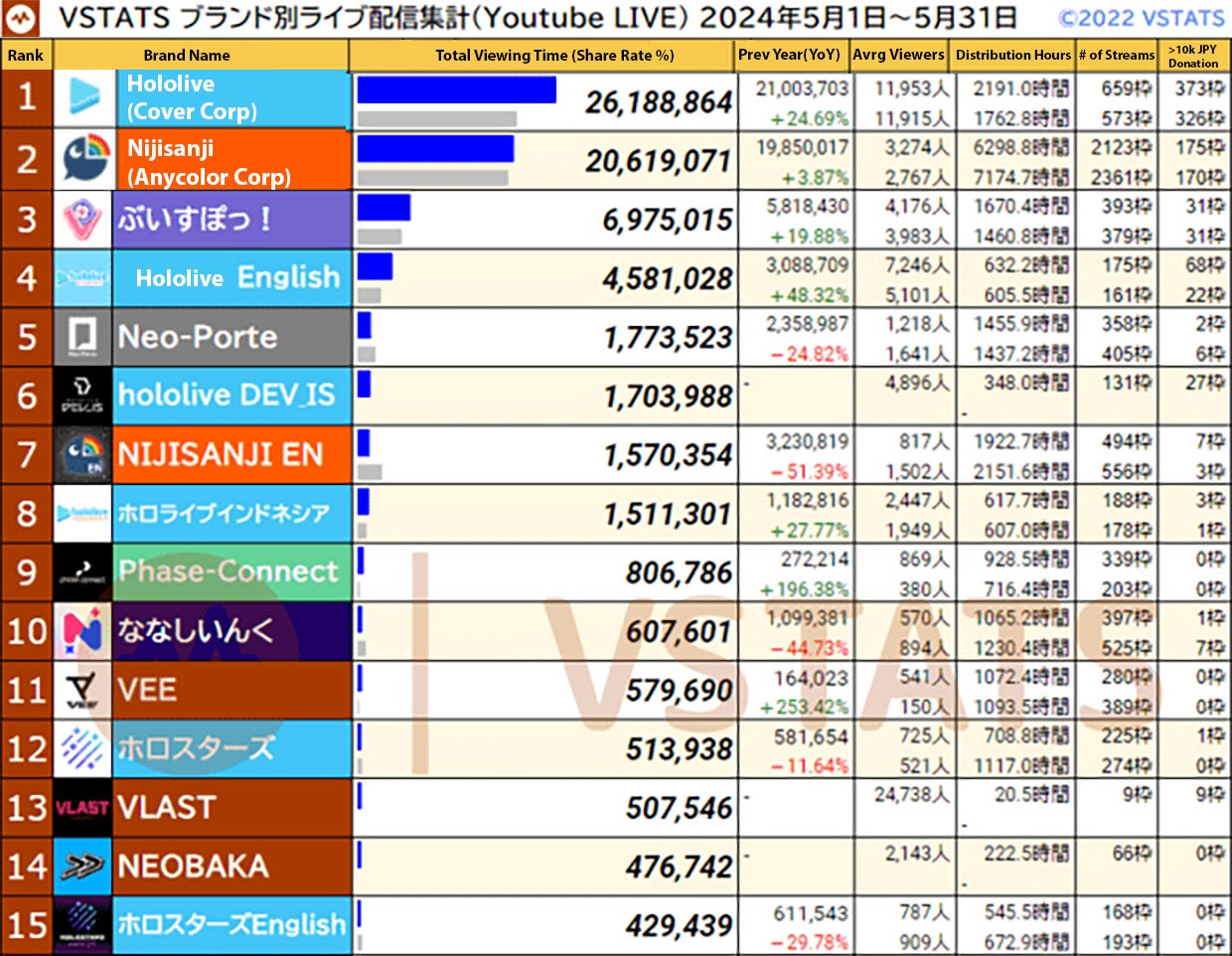

Superior Underlying Performance Metrics: Cover boasts superior key performance indicators (KPIs) compared to their main competitor Anycolor, including higher engagement metrics like subscribers, hours watched, and viewership. They’re also growing quicker. Despite this, the market values Anycolor 35% more than Cover, as Anycolor monetizes more aggressively and is thus more profitable.

Rapid Expansion outside Japan: Cover's expansion into international markets, particularly its successful Hololive English branch, demonstrates its capability to grow beyond Japan. YoY viewership for their English branch was up ~50%. The company is establishing a U.S. subsidiary to better nurture their U.S. growth and improve monetization. A future spin-off of their U.S. division on the Nasdaq could re-rate the stock.

VTuber Industry is Expected to 4x by 2029: While Cover appears richly priced today at 24x forward p/e, the company is not aggressively monetizing its audience. Anycolor’s fwd P/E is just 16.5, and they expect to double their profit by FY2027. With improved monetization and industry growth, Cover does not look expensive to me.

Cover (TYO 5253) is a talent management company that specializes in the new and rapidly growing sector of entertainment called Virtual Youtubers (VTubers). The company has grown revenues from less than $1m 5 years ago to ~$190m last year and is highly profitable. The industry is dominated by 2 large players Anycolor and Cover. In the lucrative Japanese market these 2 players combined own more than 50% of the entire market with the rest being independent creators. Cover operates their VTuber business under the following brands: Hololive, Hololive Indonesia, Hololive English, Hololive Dev_IS, Holostars, and Holostars English.

Cover is a superior bet on the rapidly growing VTuber space vs Anycolor (which I wrote up last year). It has superior KPIs and is cheaper than Anycolor on those metrics. A bet on either is a bet on the continued growth of the VTuber industry. I am bullish on the sector and Cover is the best way to invest in it.

Key Financials:

Market Cap: ¥123b

Share Price: ¥1,980

FY 2025 Forecasts (April 1, 2024 - March 31, 2025)

Revenue: ¥36.5b (up 21% YoY)

Operating Profit: ¥7.3b (up 32% YoY)

Net Profit ¥5b (up 22% YoY)

EPS: ¥82.85

Forward P/E: 24

What is a VTuber (brief introduction)

A VTuber is any performer that uses an avatar instead of revealing their face while producing video content. VTubers are idols + live streamers in anime form and they’re rapidly growing in popularity, especially in the West. They are the new idols of the internet age and unlike Idols in Asia, VTubers have global appeal anywhere anime is popular.

VTubers, like most live streamers on Twitch and Youtube, stream themselves regularly playing games and chatting with their audience. VTubers from large agencies like Cover and Anycolor differentiate themselves by producing professional music videos and animated content.

If you are unsure what VTubers actually are/do, scroll down to the Appendix at the end of this post for some examples.

The business model:

VTuber companies are in the business of creating and cultivating digital idols. There is a profoundly deep connection between VTubers and their fans. So much so that fans refer to their favorite VTubers as their ‘Oshis’, which is a Japanese term meaning ‘a person or fictional character that receives your full love and support’.

I encourage readers to take a look at some of the comments on the videos in the Appendix to get an idea of how strong this connection is. Cover monetizes this connection through live streaming (ads, donations, subscriptions), merchandise sales, and licensing.

Cover vs Anycolor KPIs:

Cover and Anycolor are the 2 dominant agencies in the VTuber market. The market values Cover at ~¥125b and Anycolor at ~¥170b. While Anycolor is much better monetized, Cover’s underlying KPIs are superior. For VTuber companies, revenue and profits are downstream from engagement (as measured by subscribers, hours watched, and viewership). Cover is not only ahead of Anycolor on these metrics, they’re also growing much faster.

Q1 2024 vs Q1 2023 VTuber Stats:

May 2024 vs May 2023 VTuber Stats

Despite Cover’s superior metrics on viewership, Anycolor has been much better at monetization. Just take a look at the table below to see the gap in top and bottom line figures:

There are several reasons for this large gap in profitability.

Revenue mix: 60% of Anycolor's revenue comes from high-margin merchandise sales, compared to 41% for Cover. Cover's merchandise sales are increasing as a percentage of revenue, suggesting this gap will likely narrow. 25.3% of Cover's revenue (versus 14% for Anycolor) comes from live streaming, primarily through subscriptions and viewer donations. This revenue stream has the lowest margins for VTuber companies, as performers receive the majority of this income.

Cover invests more into its talents: Although the revenue split between performers and Cover/Anycolor isn't publicly disclosed, I believe Cover offers a more favorable arrangement for its talents which hurts margins in the short term.

Cover takes more risk: Cover has invested ¥2b cumulatively into their unreleased metaverse platform and continues to invest in it. While I am not optimistic on this project, Cover is willing to try new things.

Cover is not focused on maximizing profits: Anycolor is a leaner and more profitable organization focused on profitability. Despite having less revenue, Cover has 570 employees, while Anycolor has 430 (as of 08/07/2024).

Anycolor’s Customers are disproportionately women: 68% of merchandise buyers for Anycolor are women. Anycolor’s popular VTubers are almost all men and attract female fans. Cover on the other hand has almost all female VTubers, which attract male fans. Female fans may have a higher propensity to purchase merchandise to support their favorite VTubers.

I believe Cover is sacrificing short-term profitability and revenue opportunities for more responsible growth, unlike Anycolor, which pushes monetization more aggressively. Cover also invests more heavily in their business, with ¥1.6 billion in 'tools, furniture, and fixtures' on their balance sheet compared to Anycolor's ¥77 million. Additionally, Cover spent ¥2.4 billion on 'purchase of property, plant, and equipment' last year compared to Anycolor's ¥354 million.

In the nascent VTubing industry, immediate profits are far less important than positioning for long term growth. While I agree with Cover’s strategy, Anycolor’s superior profits today highlight the monetization potential of Cover’s larger audience in the future. Revenue and profits are downstream from viewership, which makes viewership the #1 KPI.

The Japanese VTuber market is much more saturated than the rest of the world and growth outside of Japan is one of Cover’s key strengths. Cover’s ‘Hololive English’ branch grew total time viewed by 48% YoY while Anycolor’s ‘Nijisanji English’ branch shrunk 51% YoY. Anycolor’s English division is suffering from a big slowdown as a result of fan backlash after they terminated one of their popular VTubers. While terminations and drama are to be expected in the industry, Cover has had a better track record managing their talents.

Not only is Cover’s English branch growing faster, but their more mature Japanese audience is also growing at a rapid pace (up 24.69% in May 2024 vs May 2023) while Anycolor’s Japanese audience is up only 4%.

I find it surprising that the market values Anycolor higher than Cover given these KPIs. Last year, Cover's revenue growth was 47.5%, exceeding initial guidance, while Anycolor's growth was 26.3%, below their guidance. As long as Cover continues to achieve superior growth in viewership, its revenue and profits should eventually surpass Anycolor's.

The VTuber Market Potential:

The biggest risk to Cover and Anycolor is if VTubing ends up being a fad, but given huge growth over the last 5 years, this is becoming less likely. Growth could always slow down too, but Anycolor remains optimistic that the industry will see huge growth over the next few years.

If the size of the market does increase ~4x by 2029, Anycolor and Cover’s rapid growth should continue. Anycolor has set ambitious targets for their own growth:

While these growth targets seem a bit ambitious, I suspect Cover’s superior underlying audience growth should allow them to hit these figures easier than Anycolor. If Cover can hit 18b operating profit (vs Anycolor’s forecasted 24b), it would value the company today at 6.8x FY2027 op.

Keep in mind, the VTuber market is just the starting point for Cover and Anycolor. Both want to expand their reach to anime, video games, card games, and more.

VTubers are slowly penetrating mainstream awareness in the United States. Cover announced a collaboration with the Los Angeles Dodgers earlier this month which takes place on July 5th. Dodgers Stadium will offer special Hololive (Cover) tickets and feature Hololive branding in the Stadium as well as offer exclusive merchandise to fans. Gawr Gura, one of Cover’s VTubers, will also be singing “Take Me Out to the Ball Game” at the bottom of the 7th inning through the stadium’s PA system.

While I’m not aware of the economics behind this collaboration (who’s paying who), I suspect it’s some kind of revenue share deal as the Cover branding will bring fans to the stadium. The underlying economics won’t move the needle, but VTubers associating with a major MLB team is interesting!

Competitive Advantage:

Behind every VTuber is a talented performer and Cover is considered more prestigious than their primary competitor Anycolor, which means they’ll naturally be able to attract the most talented creators. Cover has fewer (85 vs 158), but more popular talents. 39 Cover talents have over 1 million subscribers vs just 8 for Anycolor. 8 of the top 10 most popular VTubers worldwide belong to Cover. None to Anycolor. Both companies introduced new English VTubers recently and Cover’s newest talents have vastly outperformed. New Cover VTubers reached ~200K subscribers in 48 hours while the 3 newest Anycolor talents which debuted over a month ago are averaging just 45k subscribers. Cover talents also tend to vastly outperform in actual engagement (concurrent viewership, vod views, etc) vs their subscription numbers.

The most talented performers are ultimately going to apply to Cover and those that Cover passes on will likely end up at Anycolor, at least for their rapidly growing English branch. This will only compound their advantage.

Potential catalyst for re-rating:

While Japan is the most important market for Cover, their growth in English speaking markets has been rapid. Earlier this year they announced a new North American subsidiary called ‘COVER USA’ based in California. This should enable them to better monetize their Western audience while also supporting the division’s continued growth.

While this is extremely speculative, I think this new U.S. subsidiary could lead to an eventual Nasdaq listing. If Cover itself were listed in the U.S., I suspect it would trade at multiples of today’s price, as American investors value growth more than the Japanese. While I don’t think Cover itself would list in the U.S., their COVER USA division could eventually be spun off and listed, which would likely rerate the parent company higher.

Even without a U.S. listing, this new structure should improve monetization. Cover has a lot of American fans, but buying merchandise from the U.S. is prohibitively expensive since all the merchandise ships from Japan. There’s a minimum shipping fee of ~$17 which applies to even small purchases. Inefficiency in shipping merchandise to U.S. fans has not been a top concern for Cover as the majority of revenues are derived from Japan. Still, the poor logistics for getting merchandise to fans has likely suppressed their U.S. sales.

Transition to Prime Market

Cover is currently part of the ‘Growth’ segment of the Tokyo Stock Exchange and a member of the TSE 250 growth index. The company applied to change listings from ‘Growth’ to ‘Prime’, which should result in additional passive buying. While growth names in the U.S. have done well, the TSE 250 growth index is near its covid lows:

While this isn’t relevant to the underlying business, it may provide a short term tailwind to the stock price. Anycolor made the switch from ‘Growth’ to 'Prime' last year.

Recent performance:

While Cover is up ~50% from its closing price on IPO, its down 29% year to date. Both Anycolor and Cover sold off together after one of Anycolor’s English talents were terminated, which led to massive fan backlash against the company. While it hurt market sentiment, Cover should benefit from Anycolor’s loss of prestige in the long run.

Anycolor stock has outperformed recently, as the company announced a large ¥30b multi year stock buyback, which is about ~17% of outstanding shares. If you back out the CEO’s 44% ownership, it’s about 30% remaining shares. ¥7.5b will be spent between June 13 and August 31, 2024.

Dispelling common misconceptions:

‘Isn’t this business kind of like Youtube MCNs (Multi-channel networks) or Adnetworks?

No, MCNs and ad networks are terrible businesses with razor-thin margins that solely sell advertisements on behalf of their clients (YouTube/Twitch channels). In the MCN model, independent creators approach MCNs to sell ads for them. MCNs aren’t picky, they work with just about anyone. These creators are not loyal to these networks and will leave if they find a better deal elsewhere. The MCN networks don’t own any of the content and have little to no control over the channels they represent. They simply sell ads and take a small commission.

VTuber companies like Cover and Anycolor are totally different. They create and own the IP associated with their VTubers. Talent can quit, but they can’t take their VTuber avatars with them. The Youtube account, IP, and all assets are owned by the VTuber agencies.

Thousands of people compete in auditions to become VTubers for Cover. Successfully auditioning and being selected to become a VTuber for Cover practically guarantees a super successful career in live streaming. They’re closer to big talent agencies and music labels like Hybe and JYP in South Korea. In fact, they have very similar gross margins. Cover and Anycolor have ~47% gross margins vs 46% for and 47% for Hybe and JYP Entertainment.

‘Okay, so they’re still middlemen. Why do they even need to exist?’

Becoming a VTuber for a company like Cover virtually guarantees success. Within 24 hours of debuting, the average Cover VTuber launches with 100,000 subscribers and their first stream gets 100,000 concurrent viewers. Cover VTubers can collaborate with other in-house talents to gain even more exposure. The company also produces professional animations and music videos for their creators, which is something most independent creators can’t do on their own.

Performers for Cover are getting a great deal. While the specifics of their revenue share agreements aren’t known, VTubers get to keep most of their streaming revenue (donations, subscriptions, and stream ads) while also earning a smaller cut of merchandise and licensing sales. Most independent creators don’t monetize merchandise, and don’t have the scale to do big licensing deals. Even though Cover’s take rates on these are higher, they still end up being beneficial for everyone.

This is a win-win arrangement as discoverability for new creators is practically impossible given the hyper competitiveness of the live streaming world. Working with Cover guarantees instant exposure and creators are lining up for the opportunity. 3 years ago Cover revealed that 6,000 people applied for just 5 spots on their new lineup. Cover is much bigger today and has worldwide appeal. I suspect for every VTuber they launch today, there are 10,000+ applications. Given Cover’s prestige in the industry, the most talented creators apply to work with them.

Risks to the business:

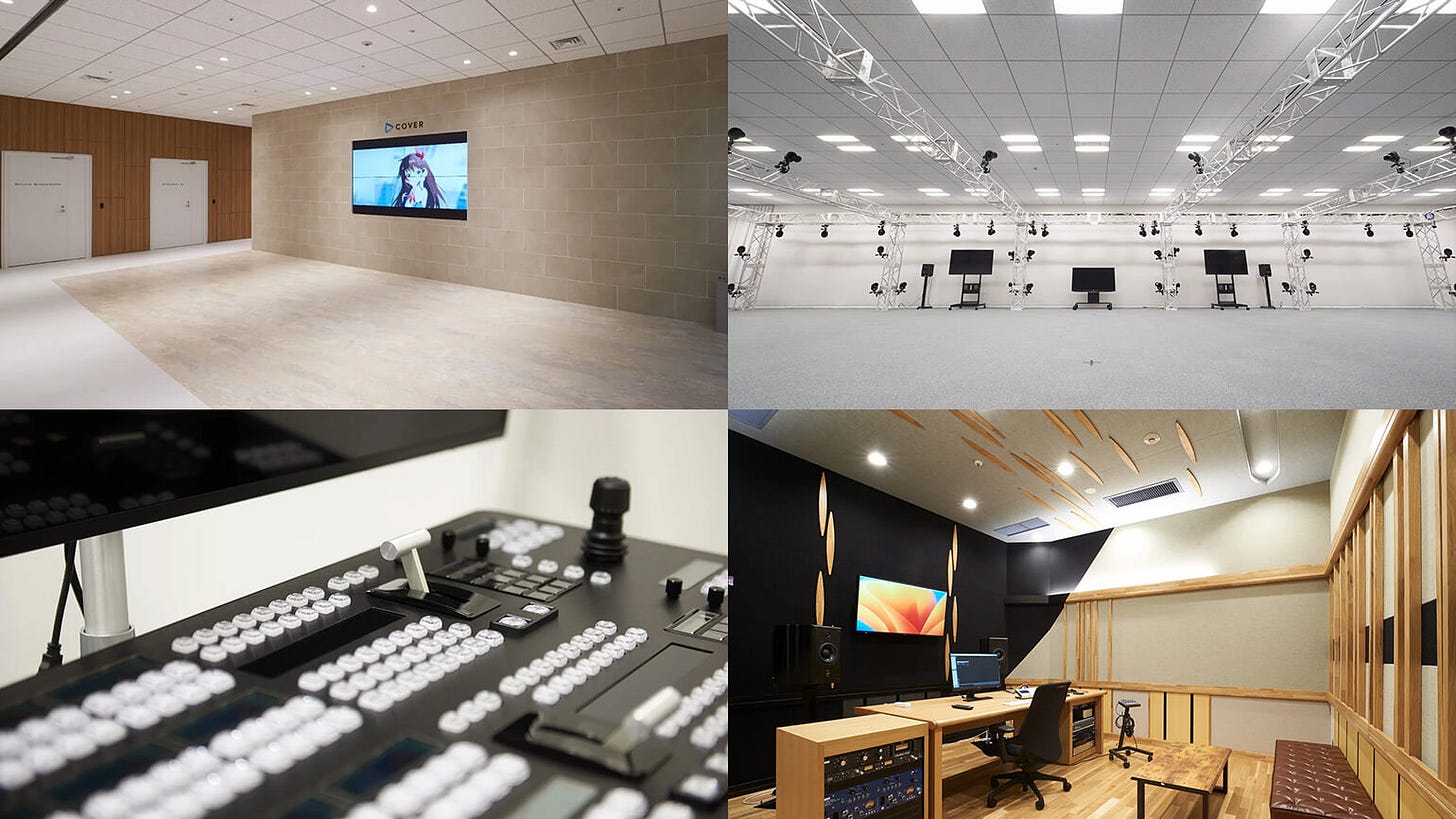

Improved access to professional content production for independent creators: Currently VTuber agencies not only provide professionally produced content, but they also own and operate state of the art motion capture studios which are used by talents. Earlier this year Cover announced their cutting edge studio facility opened. The company spent ~¥2B on specialized equipment for the facility, which is not easily available to independent creators. As technology improves, the tools available to independent creators could diminish the technological advantage of working with an agency like Cover (though technology/production is not nearly as valuable as the exposure they provide).

New entrants: while several companies have tried to launch competing VTuber talent agencies, none have seen much success. Sony has launched 2 VTuber companies (PRISM and VEE), but shut down PRISM earlier this year. VEE, which continues to operate, is about 1/90th the size of Cover (in terms of viewership). GREE launched a new VTuber agency earlier this year called ‘First Stage Production’, but it hasn’t gotten any real traction. I don’t view new entrants as a big concern as these companies are basically competing for talents that Cover has already passed on.

Power Imbalance: As individual VTuber performers grow in popularity, they may be able to negotiate better revenue share terms on merchandise and licensing. In sports, superstar talent often captures the majority of the economics; for example, players like Cristiano Ronaldo can cause sports clubs to lose money due to their high salaries. However, I don’t see this as a significant risk for VTubers, as even the largest VTubers in the world are making just millions of dollars a year and aren’t quite at the "superstar" level. Additionally, Cover owns the IP associated with their VTubers, making cooperation the best path for both parties. Still, there is very real risk of VTubers quitting and relaunching as indies. This has happened numerous times for both Cover and Anycolor. The best way to mitigate this is to ensure a win-win partnership between talent and agency.

Conclusion:

Cover is a pioneer in the rapidly growing VTuber industry. They’re expanding quickly, have a conservative balance sheet with a net cash position, and are already profitable. While paying 24x forward P/E may seem expensive, Cover has room to improve monetization. Anycolor trades at just 16.5x forward P/E, but Cover remains a better bet. A bet on either company though is ultimately a bet on the VTuber industry.

Though the concept of VTubing is new, its foundation is well-established. Cover is transforming the proven idol business model by taking it digital and global.

The fandom being built by Cover and Anycolor is something I don’t entirely understand, but it's clear that this content has resonated with millions. Audiences care deeply about their favorite VTubers. While I don’t normally watch any kind of livestreaming, I did find several Cover VTubers that I enjoyed watching. I spent a lot of time talking to friends that are obsessed with VTubers as well as watching a lot of content myself and I absolutely see the appeal. VTubers are much more fun to watch than regular livestreamers.

Disclosure: I own shares in Cover Corp (TYO: 5253). Everything in this post is my own opinion and I could be wrong. Do your own due dilligence.

Anycolor has been flat since my writeup last year, but I’ve traded around that position and have since sold out completely and currently only own Cover. I’ve been pounding the table on Cover’s relative valuation since its IPO on X.

Further Reading: Cover Growth Opportunities & Strategies Presentation

Appendix (Examples of Cover’s VTuber content):

VTubers stream regularly and if you’d like to see a live stream in action click this link to see which VTubers are currently live and click into one of them. For some curated examples see below:

Example of professional music video (40m views!):

Example of a cover song with professional video (1m views in 24 hours):

Example of a live performance in Japan (sold out seats!):

Example of live performance in Los Angeles, USA (sold out seats!):

Example of a Live 3D Performance (Birthday celebration):

Example of a New VTuber Debut:

Example (VTuber appears on Sony’s ‘The First Take’ program):

Like this comment if you want to see ALTAYCAP stream stock ideas as a cute anime girl from now on. I want a music video on Japanese Net-nets. (In all seriousness, this post was awesome, thank you).

Cover's market cap discount with Anycolor is now gone. It trades at a premium (and rightfully so!). Has been on a tear lately. Morgan Stanley initiated the name with overweight rating and a high target price. They also revised up 1H estimates.

Sharing this clip on Oct 21st may have marked the bottom.. https://x.com/AltayCapital/status/1848154505181094221