Yakult Honsha (TYO 2267) a $5.6B Premier Japanese Consumer Staple Brand with 25 Years of Profitability and Steady Growth Trading at 8.3x EV/EBITDA with Improving Capital Returns

Positive Carry (Dividend > cost to borrow JPY), Improving Capital Returns, and Cheap vs Global Peers

Yakult Honsha (TYO 2267) is a $5.6b Japanese consumer staple company specializing in probiotic dairy beverages (Amazon link to product). While on absolute terms Yakult is nowhere near as cheap as most of my Japanese holdings, it’s relatively cheap vs big Western consumer staple companies (many of which I am short).

Yakult Today:

Share Price: ¥2,892

EV/EBITDA: 8.4x

P/E (LTM): 17.7x

P/E (Forecast): 16x

P/TBV ~1.6x

Market Cap: ¥882b

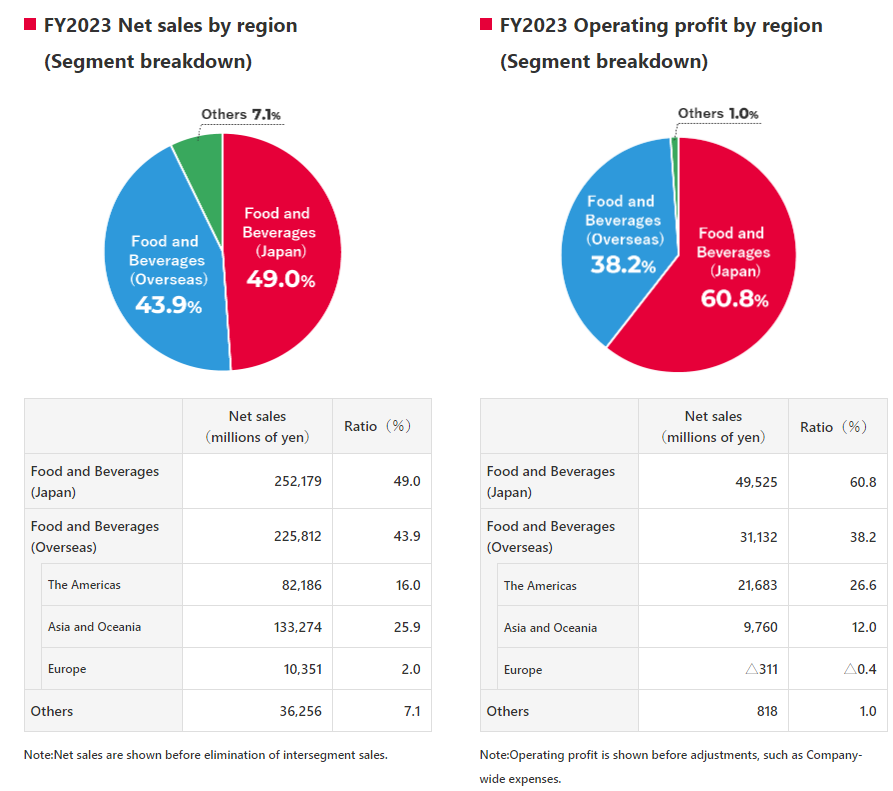

The company earns nearly half of its revenue overseas and is trading at attractive valuations. Fundamentals have improved significantly over the last decade, even though the share price has fallen by approximately 20%.

Yakult’s stock price is down 20% since June 2015 while:

Net Income (LTM) increased from ¥28b to ¥51b

Revenue (LTM) increased from ¥374b to ¥503b

Book Value per share increased from ¥993 to ¥1,811

Dividend per share increased from ¥12.5 to ¥64 (forecast)

Forecast for next year looks solid as well:

Yakult has no net debt and, like many Japanese companies, maintains a conservative balance sheet. Current assets are ¥372b vs total liabilities of ¥227b. They also own ¥78b in investment securities not included in the current assets tally. The company has little to no intangible assets on its balance sheet and has a P/TBV of ~1.6x.

The business itself is remarkably durable. Yakult has been consistently profitable for 25 years, with revenues and profits steadily improving. Return on equity is only 10%, but like many Japanese firms, this is due to the business being overcapitalized. The brand is a household name in Asia and is growing in popularity in North America and Europe.

Positive Carry with Dividend > Borrowing Cost

I find Japanese consumer staples more interesting than Western peers as they’re usually cheaper and dividends more than cover the cost of borrowing yen. Coca Cola for example pays a 3% dividend, but borrowing dollars costs 6% at Interactive Brokers. On the flip side, Yakult pays a ~2.2% dividend but borrowing yen costs only 0.75%, which creates a positive carry. Outside of Tobacco companies, few defensive consumer staple names offer a positive carry. The ones that do are usually highly indebted and often have deteriorating fundamentals. Yakult’s financials have only been improving and 8.4x EV/EBITDA isn’t expensive (vs global consumer staple peers). Other names in the space I like are Ito En Preferreds (TYO 25935) and Ezaki Glico (TYO 2206). Yakult is cheap on EV/EBIT (12.3x) vs larger global peers like Coke (23x), Nestle (19x), Danone (13.8x), and Pepsi (19x). Profits have also grown much faster at Yakult than global peers. Net income is up 110% from ¥23.9b to ¥51b in the last decade vs just 33% for Coca-Cola.

Unlike many of my Japanese net nets, Yakult shares are also marginable with maintenance margin on Interactive Brokers at 15% (vs 100% for every smaller net-net I own).

Let me emphasize: While I believe Yakult is an attractive business, I don't claim to have a deep understanding of it. It's also a large business ($5.6B), so it doesn't have the usual inefficiencies found in micro and nano caps. I own it because it's cheap, and borrowing yen is cheap. If this position earns even 3% per year, I'll be happy, though I expect it to perform much better. Especially given the backdrop of higher inflation and a weaker yen.

Improving Capital Returns

Yakult’s capital returns have also improved significantly since 2019 (dividend is up ~3x) and share repurchases have been more frequent. Just take a look at the chart below showing shares outstanding and dividend per share:

Conclusion

I'm not nearly as bullish on Yakult as I am on Nissin Corp or some of my other positions, but Yakult offers me diversification while only requiring 15% maintenance margin.

While I’m bullish on the underlying business, I haven’t discussed it much since it’s largely a straightforward consumer staple business. However, I will provide links below for those interested in learning more.

Yakult is a defensive name with net cash, growing profits, and 25 years of consistent profitability. I suspect over the next 5 years revenue, profits, book value, and dividend will all be higher.

To learn more about the underlying business check out the links below:

Further reading: Yakult Annual Report (Excellent primer on the business with slides), NYTimes article on ‘Yakult Ladies’ (company has a unique distribution/sales strategy, East Asia Insights writeup on the business (detailed writeup on company and its history), Amazon U.S. Link for Yakult

Disclosure: I own shares in Yakult, Ito En Preferreds, and Ezaki Glico. I am short several U.S. consumer staple companies (KO, PEP, HSY, and others). None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due dilligence.

For some cute/silly FAQ videos on the product, check out the ‘Tell Us! Yakult Man’ series of videos here. One is embedded below:

Altay, I am too stupid to analyze stocks intelligently myself but I was wondering if you have ever looked into Sanoyas Holding Corporation 7022.T. I bought some in March on a Friday at like 180 a share and they announced a share buyback same day I bought and I made 30% the next Monday. I was thinking of a theme of increase in Japan's military budget=Japanese military related companies benefit, shipbuilders/aircraft etc. so I bought Sanoyas and Jamco and sold them for a decent profit. I was drinking a bunch of wine and pondering the remilitarization of Japan theme super drunk and bought them with poor judgement, luckily it worked out, but maybe remilitarization beneficiaries is a theme worth exploring, or maybe I just thought it was a good idea because I was drunk, idk lol.

Thanks Altay for the news. I'll put Yakult in watchlist. Recently bought abit into Nippon Paint. But share price fell (maybe across the board) when Yen becoming stronger.