Tokyo Automatic Machinery (TYO 6360) - Deep Value Nanocap with Improving Shareholder Returns, 0.4x P/B, and 7.8x Forward P/E

Company is targetting 1x PBR, Committed to 30% Payout ratio (vs 10-15% historically), + upside if the packaging business can expand margins. NCAV+Investments of ¥5,220 vs a share price of ¥2,885.

Stock Price: ¥2,885

NCAV+Investments Value Per Share: ¥5,220

Market Cap: ¥4 billion

Book Value Per Share: ¥6,724.78

P/B: 0.43x

P/E (LTM): 3.18

P/E (Management Forecast): 7.78

Dividend: ¥100 (3.6%)

Tokyo Automatic Machinery Works (TYO 6360, aka TAM) has two core businesses: (1) packaging machines for food and consumer goods, sold mainly in Japan, and (2) production lines for soft contact-lens factories, almost all of which are supplied to long-term partner Johnson & Johnson Vision overseas. TAM also provides engineering, maintenance and spare-parts services. Founded in 1955 and listed in 1966, the company is a seasoned, albeit tiny, industrial player.

TLDR 2 Sentence Pitch:

TAM is just another dirt cheap profitable net-net trading at ~0.4× book value, but the real catalyst is management’s new willingness to lift capital returns and target a 1× P/B. Customer concentration is a risk, but the bet here is that shareholder returns will improve further.

Investment Thesis:

Net net valuation. Net current assets + investment securities were ¥7.3 billion vs a market cap of just ¥4 billion. Upside to this figure, which values the business and other fixed assets at zero, is nearly 90%.

Valuable rental RE. The corporate head office is located on a prime corner in Chiyoda, Tokyo on 485 sqm of land. The company’s own appraisal values it at ¥1.6 billion vs its carrying amount of ¥1.1 billion. This seems conservative. This is a prime location 2 minute walk to Akihabara station and 1 minute to Iwamotocho Station. Most of the value here is derived from rental income from the ground floor which is rented by a large convenience store chain. Ownership of this property is not essential to the business and it would be easy to sell (for a big profit). Adding the appraisal value of this single property to NCAV+Investments get us to 125% upside.

Improved shareholder returns. On Feb 7, 2025 the company released a document highlighting their goals to comply with the Tokyo Stock Exchange’s push for improved corporate governance. The company announced that dividend payout ratios going forward will be 30%, which resulted in their dividend for the FY jumping from ¥80 to ¥240 (stock price today is ¥2,885).

While FY2025 earnings were extremely strong at ¥871 per share, forecast for FY2026 is for an EPS of just ¥356.20. Given that 30% payout ratio is the target, the company expects to pay ¥100 yen per share in dividends. The decrease from ¥240 to ¥100 led to a quick fall in share price. The enthusiasm from the original increase (which was tied to a great year) quickly faded and shares are now flat YTD despite committing to paying out a higher payout ratio than ever before.

The dividend payout ratio for the last 5 years have been 27.5% (FY2025), 15% (FY2024), 10.5% (FY2023), 15% (FY2022), and 10.3% (FY2021). The commitment to aim for a 30% payout is a big deal and is more than doubles the company’s historical payouts.

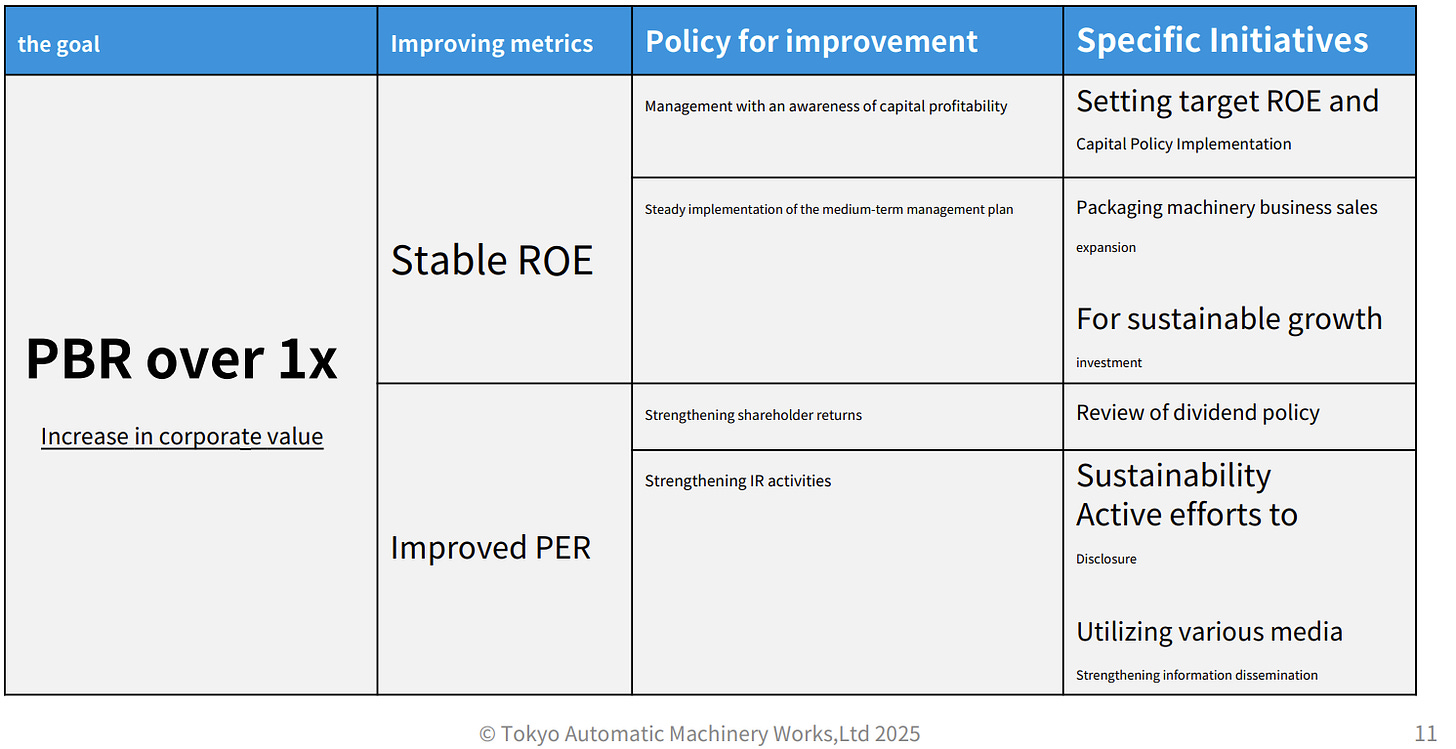

The company mentioned that their PBR is still well below 1 and they aim to address that. They clearly outlined “PBR over 1” as a goal. Growth investments,

While Tokyo Automatic Machinery is a tiny company (¥4 billion marketcap), no entity controls a large share of stock. The top shareholders list is almost entirely financial institutions. There are no obvious blocking shareholders.

Risks:

Customer concentration. Johnson & Johnson Vision is a major customer and makes up a large percent of total revenues and almost all of the company’s profits. This is not new. As far back as the 2006 annual report, they were Tokyo Automatic Machinery’s biggest customer. In FY2024 they were 61.4% of the company’s total revenues and 52.5% in FY2025. While customer concentration is a real risk, this is a multi-decade long partnership. The machines J&J purchases from TAM are bespoke systems jointly engineered, which makes switching costs high.

The product machinery division which supplies contact lens production lines to J&J made up 55% of revenue in FY25 and practically all of the company’s profits. The remaining 45% of revenue is from packaging machinery which has razor thin margins. The company has been working to diversify their customer base and grow the packaging business, but there is currently extreme reliance on J&J for profits. The packaging business supplies machinery to some of the biggest CPG manufacturers in Japan (Calbee, Morinaga, Japan Tobacco, etc), but profits have been razor thin in the segment.

Overearned in FY24&25. Johnson & Johnson spent €100m Euros expanding their contact lens factory in Ireland. TAM benefited from this tremendously but as those orders wrap up, sales and profits will fall, which is why profits are expected to fall so much in FY26 (Operating profit forecast of ¥400 million in FY26 vs ¥1,565 million in FY25). This increased install base of TAM machinery will yield additional parts & service revenue in out years.

Conclusion:

Tokyo Automatic Machinery trades at a deep discount to both net current assets and conservative real-estate marks, while management has pivoted to a 30 % dividend policy and an explicit 1× P/B target. Reliance on a single customer caps position sizing, but the contact-lens end-market is secularly growing (4–6 % CAGR to 2033). While the packaging business has been lackluster so far (in terms of profits), the company has been trying to grow it. They showed off their newest machines at trade shows in Japan and Thailand in June.

I use Koyfin for looking at historical data, screening, and visualizing financials. Koyfin offers real value to me and I have been a paid user long before they offered me an affiliate link with a 20% discount. The free version is excellent as well! I don’t charge for access to my writeups. I wouldn’t promote something unless I really loved it and I love Koyfin.

Disclosure: I own shares in Tokyo Automatic Machinery Works (TYO 6360). The security could be sold at any point in time without prior notice. This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments. None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due diligence.

Appendix:

This is their corporate HQ in Chiyoda, Tokyo. 485 sqm of prime land 2 minutes to Akihabara station and 1 minute to Iwamotocho Station. A major convenience store chain Daily Yamazaki rents out the bottom floor. I suspect the valuation of the entire building in their securities report was based on this rental income alone, while the entire expenses of the building were used to offset that income, despite the upper floors being used for corporate purposes and not rented out. While the company has 266 total full time employees, just 43 work at the head office and it seems like a large building for just 43 people. Either way, this is a prime property that wouldn’t be difficult to sell.

The location of the building on Google Maps can be seen below:

The corporate website was recently renewed and is available in English.

Case Study of Packaging Line used by Tirol Choco Co., Ltd (Released July 11, 2025)

Did not include historical long term financial chart data like I usually do as Koyfin's data provider does not provide data for this one. But historical data is easy to look up in the annual reports.

Nice find, will be putting in tomorrows Best Stock Pitches letter.