Takigami Steel Construction (TYO 5918) - A Portfolio of Public Securities + Rental Real Estate Worth 3x Market Cap (With an Activist Investor)

Similar to Warren Buffett's Sanborn Maps, except cheaper and with potential for activism (#1 shareholder is an activist). NCAV+Securities+Rental Properties worth ¥18,000 / share vs ¥6,000 stock price

Company is marginally profitable and owns a portfolio of securities (mostly public stocks) and rental real estate worth ~3x its market cap (~¥18,000 /share vs ¥6,000 stock price). These figures assign zero value to the operating business and its fixed assets.

Activist investor is the #1 shareholder with a 17.4%. #2 shareholder owns 11% and will likely align with activist. Insiders don’t own enough to easily block future activism.

Company is largely overlooked with practically zero interest from Japanese retail investors and no mentions on X/Twitter.

Share price: ¥6,050

Market cap: ¥13.3 billion

NCAV+Investments Value: ¥40.6 billion (~¥18,000 /share)

Takigami Steel Construction Co (TYO 5918) is a civil engineering/construction company that’s been around since 1937. The core business here is irrelevant to the investment thesis, but it’s not a money loser. Operating profit has fluctuated between -¥200 million to +¥1,000 million over the last 5 years, but has remained mostly positive. This business is likely worth something, but let's be conservative and value the operating business and its ¥9 billion of fixed assets (land, buildings, vehicles, tools, etc) at 0.

The story here is straightforward. It’s like the Japanese version of Warren Buffet’s Sanborn Maps story, except way cheaper. We have a company with an operating business and a box of investments. We are valuing the operating business and its assets at zero. So let's analyze the box of investments.

Backing out NCAV (net current asset value) of ¥7.75 billion, the market is valuing Takigami Steel Construction at ~¥5.6 billion. That’s a pretty clean NCAV figure too as current assets are almost entirely cash + receivables. What does this ¥5.6 billion get you?

(these are approximations)

¥8.2 billion of Mitsubishi UFJ Financial Group Stock

¥4.6 Billion of Mitsubishi Corporation stock

¥800 million of various other public Japanese stocks

¥4.8 billion of various investment funds/etfs (everything from USD govt bonds to Australian value funds)

¥900 million of bonds

¥8.4 billion of rental properties (balance sheet value, market value is significantly higher)

Total value: ¥27.7 billion (¥19.3 billion of which are easy to value liquid securities). For a full list of investment securities see appendix.

Remember, this assigns ZERO value to the operating business and the ¥9 billion in fixed assets used to run that business. All we did was tally up the investment securities and rental properties on the balance sheet.

Not bad for what the market is valuing at ¥5.6 billion!

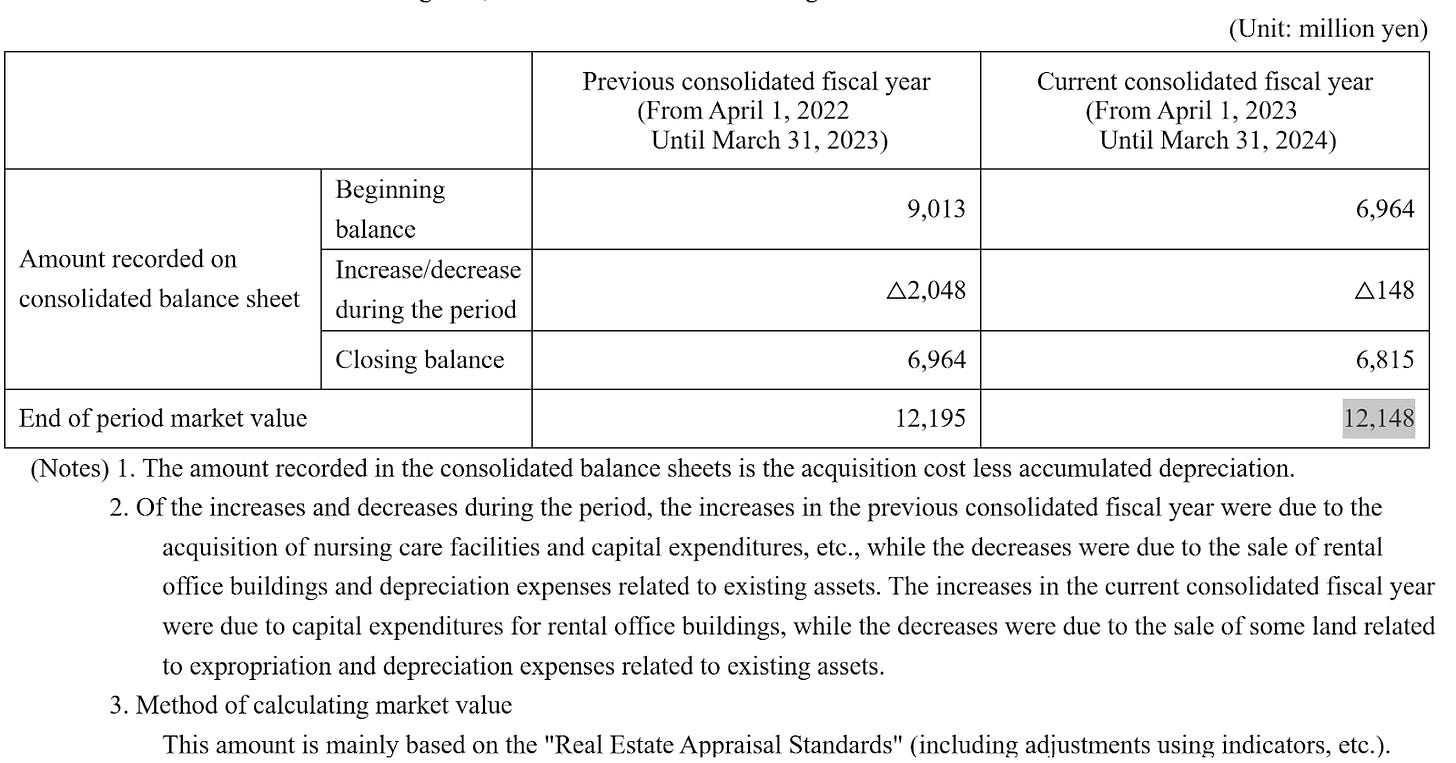

But wait, there’s more! The company discloses the market value for their rental properties based on appraisals annually. For FY ended March 2024, the company’s net rental properties were ¥6,964 million while market value was ¥12,148 million (unrealized gain of ¥5,184 million which is not reflected on the balance sheet). Rental properties for the latest quarter as of this writing were ¥8,400 million, meaning the company bought ¥1,436 million additional real estate. If we use the company’s own market value estimate from the last annual report and add the unrealized gains to the latest balance sheet figure, the rental properties are worth ¥13.6 billion.

Now let’s quickly tally everything up and compare it to the market cap.

Net current asset value: ¥7.7 billion (current assets - total liabilities)

Investment Securities: ¥19.3 billion

Rental properties (market value): ¥13.6 billion

Total value: ¥40.6 billion

Market Cap: ¥13.3 billion

Discount: 67%

I’m ignoring taxes here. Back of the napkin math shows this is stupid cheap.

If equities perform well, underlying value increases too. The weakening yen and inflation can also provide a tailwind to the company’s real estate investments. Book value ends up being an excellent approximation for value as the investment portfolio is marked to market every quarter and the real estate gains mostly offset the other fixed assets that we’re valuing at 0.

I'm glad to see this company invest their excess cash in stocks rather than pile up cash like many other Japanese companies. In fact, the securities report states that some of the company’s real estate was developed from former factory sites. As the core business slows down, the company is willing to develop their land into more valuable rental properties vs investing into the operating business.

What I like most about this investment is its simplicity. The core business can be ignored and we just have a pile of securities which we can easily value. Real estate values are less clear cut but appraisals are likely accurate enough.

Activist Potential

Takigami Steel Construction is a major position for Black Clover, a Japanese value investing activist fund. I actually found this company after stumbling into Mansei (my previous write up) and looking at Black Clover’s other investments. They are the company’s largest individual investor with a 17.4% stake.

Evergreen Investment Business LLP seems to have acquired their 11.42% stake in early 2024 entirely from the now #3 holder Takigami Seiki Kogyo, which is affiliated with the founding family and has previously held upwards of 28%+ of outstanding shares. Evergreen Investments paid ¥8,100 per share for their stake. I have no idea why Takigami Seiki would sell a large stake given the discount to intrinsic value, but I suspect Evergreen will be more interested in unlocking shareholder value than current management. Black Clover and Evergreen combined own 28.83% of outstanding shares which makes activism likely. Insiders don’t have enough shares to block them either. Keep in mind I know nothing about Black Clover or Evergreen’s intentions. I am only speculating.

Practically no one is looking at this

Takigami Steel Construction has zero mentions on X/Twitter and has a total of 7 posts on Yahoo Finance Japan’s message board this year and just 3 posts in all 2023. Japanese retail investors have zero interest in this company and I can’t find any other public writeups on it.

Risks:

Takigami Steel Construction is very illiquid, oftentimes trading just a few hundred shares a day. The company’s intrinsic value is closely tied to the Japanese equity market given the overweight position in Mitsubishi UFJ Financial Group and Mitsubishi Corporation. These are giant blue chip companies, but a big move in them could lead to big gains or losses in intrinsic value.

The biggest mystery is why the previous #2 shareholder Takigami Seiki Kogyo, which is owned by the Takigami family, was willing to sell most of their shares to Evergreen Investment for ¥8,100 per share. I can’t answer this question. I can’t even tell you who’s behind Evergreen Investments. I initially thought they were connected to the family, but the company’s annual report updated their history section saying Takigami Seiki Kogyo was no longer an affiliated company after the sale of shares to Evergreen, which makes me think they aren’t connected. If anyone does some sleuthing and learns more, do share in the comments.

If Evergreen isn’t connected to the family, this type of seemingly irrational behavior is not totally uncommon in Japan. A Japanese private equity company (Integral Corp) recently bought 40% of Mutoh Holdings (TYO 7399) from its founding family for around wherever the stock was trading at, which valued it at 0.5x price to book and net-net valuation. There were some undervalued real estate assets too.

Conclusion:

This is a pretty straight forward investment thesis. We have a bunch of securities worth multiples of the current market cap and the largest shareholder is a value activist fund that has previously clashed with management teams. I suspect we’ll see some value unlocking shareholder proposals at the next annual general meeting of shareholders. Insiders don’t seem to have enough shares to block attempts at unlocking value either.

I own 1,200 shares as a part of my basket of cheap Japaense stocks.

Disclosure: I own shares in Takigami Steel Construction (TYO: 5918). The security could be sold at any point in time without prior notice. This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments. None of this is investment advice. This is an extremely illiquid stock and not suitable for most investors. Everything in this post is my own opinion and I could be wrong. Do your own due dilligence.

Appendix:

Full list of investment securities (Mar 2024, most up to date balance is from Q2 report which is the ¥19.3 billion figure I used in the writeup)

Worth emphasizing here: I know nothing about Black Clover or Evergreen’s intentions. I am only speculating. I don't even know who Evergreen is. My initial thought was it was connected to the family, but the sale was listed in the company's history section in latest securities report saying "Takigami Seiki Kogyo Co., Ltd. is no longer an affiliated company due to the sale of our shares", which made me assume they aren't connected to the family.

nice! I'm usually not into Japan value but this kind of thing is next level! Only a fool does not change his mind