Sanyo Industries (TYO 5958) - $60m Net-Net With 5 P/E, 3.8% Dividend, That's Buying Back Shares

A Construction materials company that manufactures flooring, roofing, rooftop ventilators, earth quake resistant components, and more.

Sanyo Industries (TYO 5958) is a manufacturer of construction materials that’s been in business since 1948. Their main products are sheet metal works used for flooring, roofing, aluminium building materials, and rooftop ventilators. They also manufactur earthquake and other disaster resilient components.

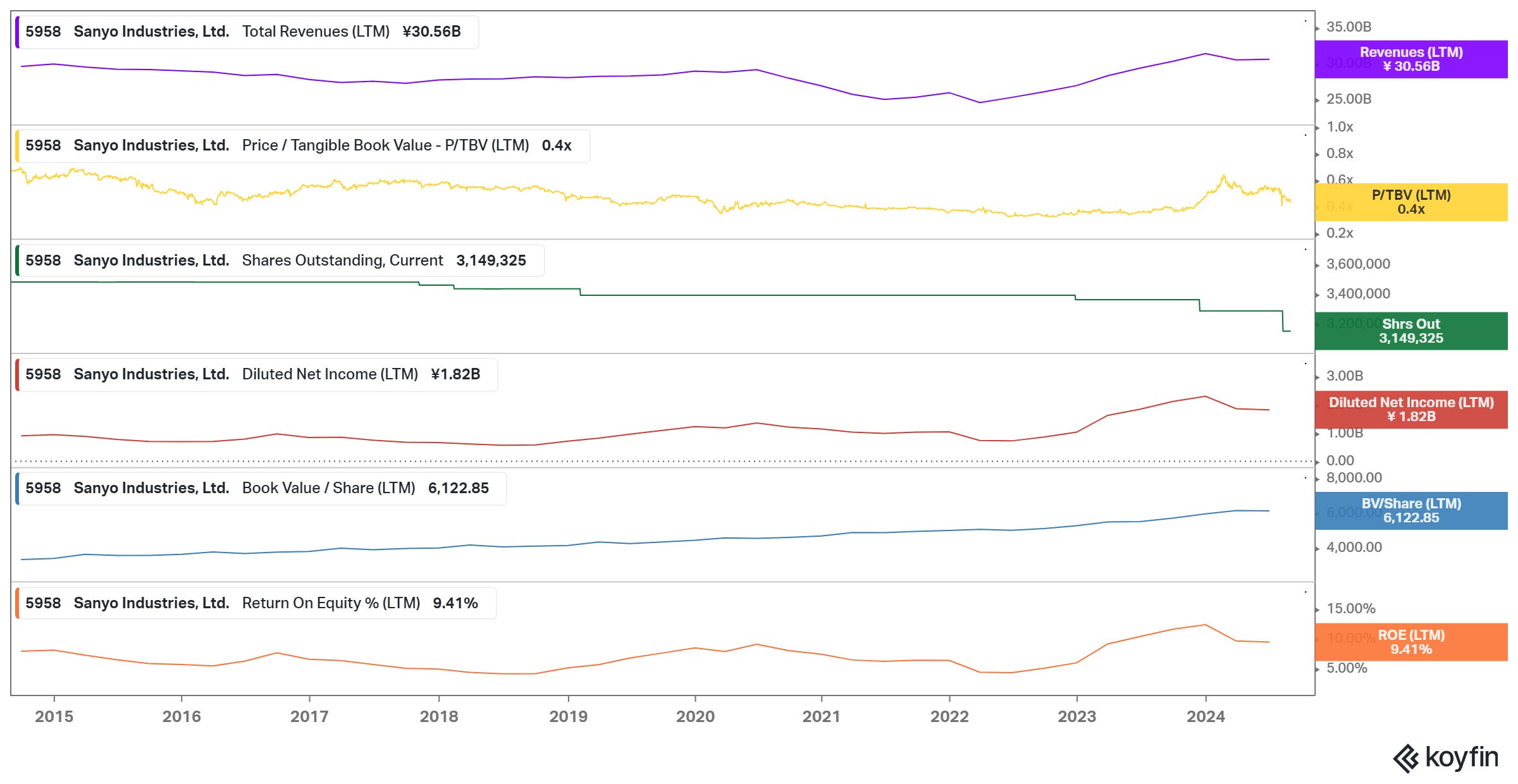

Share price: ¥2,780

Management Forecast P/E: 5.6

P/E (LTM): 4.9

Market Cap: ¥8.76b

NCAV: ¥11.16b (current assets - total liabilities)

NCAV+Investment Securities: ¥12.15b

Dividend Yield: 3.8% (¥105 per share)

Price to Book: 0.45

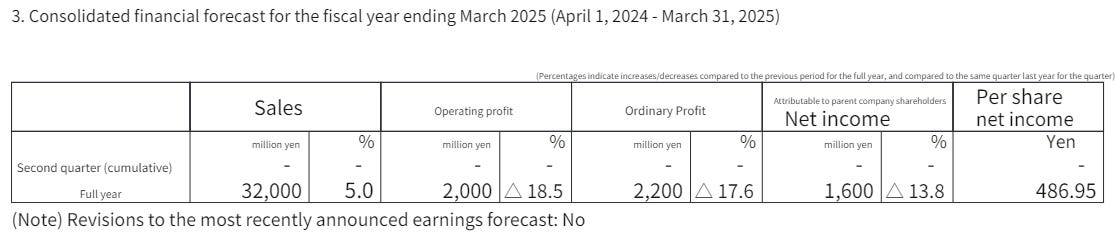

Management forecast for next year is as follows:

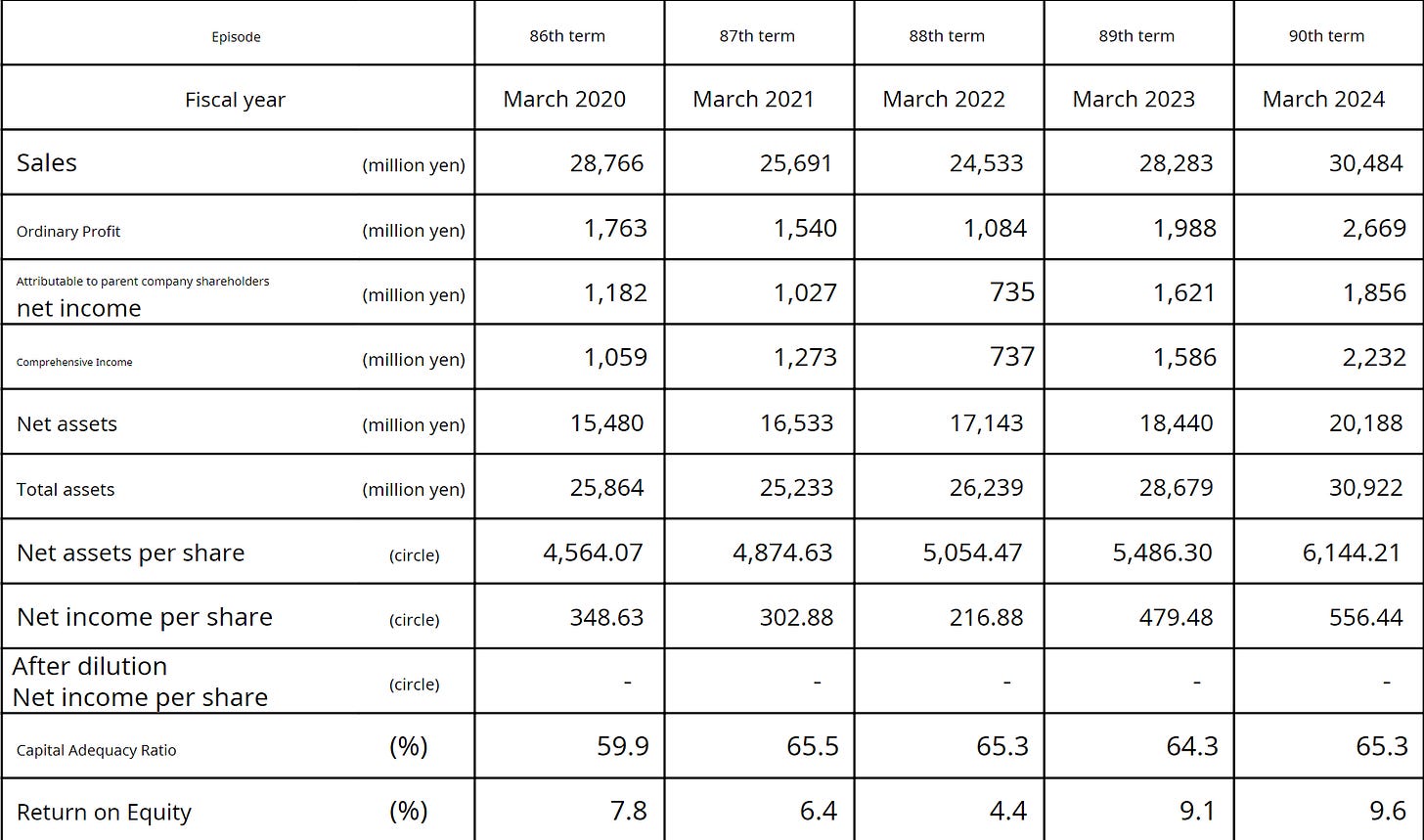

Despite being overcapitalized, return on equity was 9.41% over the last 12 months, which is excellent given that they’re a net-net.

Current assets are largely cash and accounts receivable (86%), which are easy to value and understand. The remaining 14% of current assets are goods, raw materials, and work in progress. The company also has substantial investment securities, rental properties, and other financial assets that we’re ignoring all together. Land assets are also likely materially undervalued. Ignoring all of these other assets, Sanyo Industries is a profitable 5 p/e business priced at less than free.

A Net Net That’s Buying Back Stock

On June 11th, the company announced their plan to improve returns and increase book value to comply with the Tokyo Stock Exchange’s recent push to improve governance. While the contents of the plan were largely boilerplate statements about improving shareholder returns and investing in growth, the company has lived up to its statement about improving shareholder returns. On August 7th the company bought back 4.15% of outstanding shares.

Sanyo Industries also mentioned that their next mid-term management plan which begins in Fiscal 2025 will aim to further increase corporate value. Since July, 2022 shares outstanding has decreased by ~7% while annual dividends increased from ¥70 to ¥105.

On the growth front, the company commited ¥1.5B last year to build a 3D vibration testing facility to simulate earthquakes and other disasters to aid in product development.

The company also mentioned in their response to the Tokyo Stock Exchange that they would expand IR activities to better inform investors.

Young CEO

Sanyo Industries promoted Shigeru Yamagishi to president and CEO in 2021. He joined Sanyo Industries in 2007 when he was just 31 years old. He’s currently 48. He has no relation with the company’s founder. Mr. Yamagishi has spent 17 years at the company and climbed the corporate ladder all the way to the top.

Since his appointment as CEO, the company’s profitability has improved significantly which has led to improved shareholder returns. Industry trends likely played a large role in improved profiability as well, but the recent buyback and the two prior were under Mr. Yamagishi’s leadership.

While this is unscientific, my gut says a younger CEO is a positive. Especially in corporate Japan where things are often stagnant. This company is also one of the few that responded to my emails asking about company disclosures regarding new Tokyo Stock Exchange governance disclosures. (They said they were looking into it and released their plan 3 months after my email).

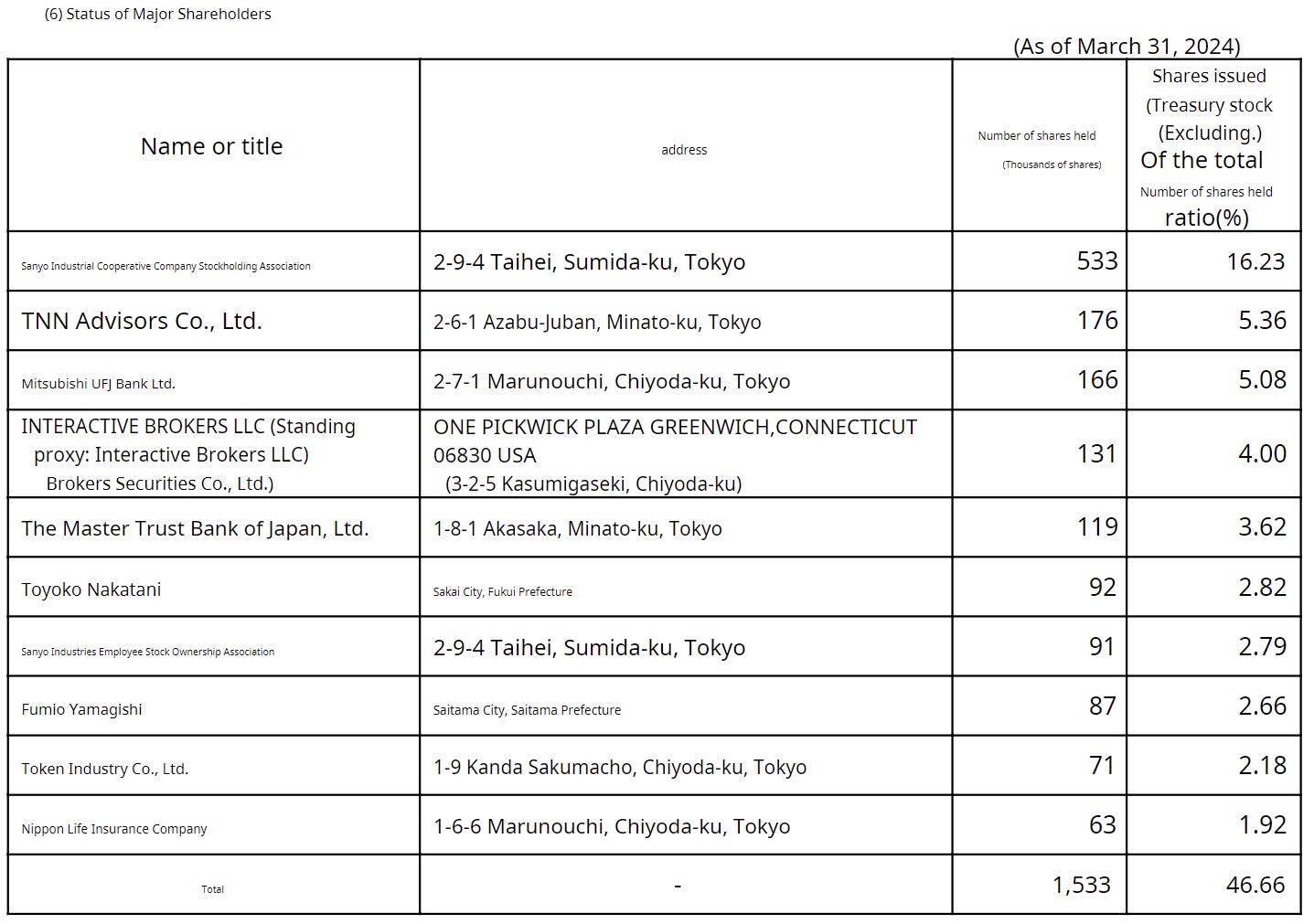

No Controlling Shareholders

While Sanyo Industries is likely too small to attract an activist investor, it’s not impossible. No shareholder controls enough shares to block an activist. TNN Advisors is a relatively new owner (they filed an ownership stake in March, 2024) of the stock and has submitted shareholder proposals in the past. Glad to see at least one fund in the shareholder register. TNN Advisors also happens to own a bit of NKK Switches, another net net I own a tiny position in.

Why Now?

I’ve owned Sanyo Industries for a bit over a year and am up ~40% on it. I’ve added to my position a few days ago after realizing the stock hasn’t recovered much from its August 6 selloff (when the Nikkei crashed 12.8%). The recent buyback proves that management is serious about returning cash to shareholders and hinted that additional shareholder returns could be forthcoming in their next mid term management plan (due to come out by next year).

Conclusion:

Sanyo Industries is a net-net that buys back stock and pays a decent dividend. It’s cheap and I own it as part of my basket of cheap Japanese stocks. I’m a big fan given it’s cheapness and the company’s willingness to return cash to shareholders. The most recent buyback of 4.1% isn’t a lot, but it’s something. Combined with the 3.8% dividend, Sanyo Industries will return 7.9% to shareholders this year assuming no further buybacks. Not bad for a net-net. While I’m not an expert on the construction materials industry, Sanyo Industries seems too cheap.

Disclosure: I own shares in Sanyo Industries (TYO:5958). This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments.

Didn't mention it in the writeup, but this is also a largely underfollowed name in Japan. Yahoo Finance JP board has 2 posts since April. Illiquid, small, ignored. A good hunting ground.

Thanks for the detailed writeup. Interesting. Will put into my watchlist.