Sanko Techno (TYO 3435) - A Near Net-Net $60m Niche Manufacturer of Construction Materials with 40% Market Share, 5 P/E, 3.3% Dividend, and 10.5% RoE

#1 Market share in its core business in Japan. Profitable for 20 of the last 21 years. 13 dividend hikes in the last 14 years.

Sanko Techno Co., Ltd. (TYO 3435) is a construction materials manufacturer that specializes in post-installed anchors and fasteners. This is their core business (84% of sales) and they are the #1 player in Japan with 40% market share. They also have a functional materials division that produces a variety of other products including alcohol detectors, pallet stretch wrapping machines (for logistics/shipping), and circuit boards.

Financial Stats:

Share price: ¥1,126

Management Forecast P/E: 6.8

P/E (LTM): 5.1

Market Cap: ¥8.8b

NCAV: ¥8.1b (current assets - total liabilities)

NCAV+Investments: ¥10.6b

Dividend Yield: 3.3% (¥38 per share)

Price to Book: 0.5

Sanko Techno has maintained an excellent track record of profitability and growth, reporting only one minor net loss in the past 21 years (2009). Over this period, book value per share increased more than fourfold, from ¥505 in 2003 to ¥2,187 today, while the share price rose less than twofold, from ¥650 in 2005 to ¥1,126. Net income and dividend per share also rose over fourfold during this period.

While Sanko Techno is not technically a net-net, it’s still dirt cheap. Backing out net current assets, the market values the company at ¥700 million, or about 0.5 times this year’s forecasted net profit. If we further exclude the ¥2.5 billion in investments on the balance sheet, the business is valued at negative ¥1.8 billion. This is absurd given the core business, despite being overcapitalized, had a return on equity of 10.5% last year.

While Sanko Techno’s fortunes are tied to the domestic construction industry, the company’s top line has often grown even during periods of industry wide declines.

Policy of No Dividend Cuts

While I rarely get excited about dividends from Japanese companies, Sanko Techno has an unusually progressive policy: “no dividend cuts, maintaining or increasing dividends only”.

The company has upheld its policy as they haven’t had a dividend cut in 14 years. The dividend has been bumped every year in the last 14 years except 2021 where it was flat. Management’s dividend forecast for the next 3 years are ¥38, ¥42, and ¥46.

While dividends have grown, buybacks have been minimal. Shares outstanding decreased by 3.2%, from 8,175,000 in 2020 to 7,901,065 today. The company’s mid-term management plan aims to improve its price-to-book ratio, targeting an early recovery to 1.0 or more, though it does not explicitly mention buybacks as a strategy.

Sanko Techno is a growing company with ambitions to be much larger over the next 8 years. The company aims to double their top line from ¥21 billion to ¥50 billion by 2034.

In the past three years, Sanko Techno completed several small-scale acquisitions, resulting in one-time extraordinary profits, indicating they were accretive. The company routinely makes small scale acquisitions and indicates that M&A will continue to play a role in future growth.

The company plans to invest ¥2 billion in a new logistics center, with construction beginning in November and completion expected by March 2026. The facility is expected to improve productivity and allow them to better meet their customer’s needs of smaller, more frequent orders.

Major Shareholders

Hideto Horashita, Sanko Techno’s president and CEO, is the largest shareholder, directly controlling 14.95% of the outstanding shares. While substantial, it is insufficient to block an activist shareholder, although activism is unlikely given the company's small size.

Why Now?

Similar to my last writeup (Sanyo Industries), Sanko Techno’s stock has not recovered from the big Nikkei sell off in early August (-15% since the sell off). This is a stock I’ve owned for more than a year and have recently added to my position.

Conclusion:

Sanko Techno is a dirt cheap almost net-net that pays a decent (and growing) dividend. It’s been profitable for 20 of the last 21 years all while growing both top and bottom line. I also like that it is the #1 player in its niche with 40% market share domestically. While it’s hard to get excited about a company that makes screws for concrete, Sanko Techno is just too cheap.

Disclosure: I own shares in Sanko Techno (TYO:3435). This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments. None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due dilligence.

Appendix:

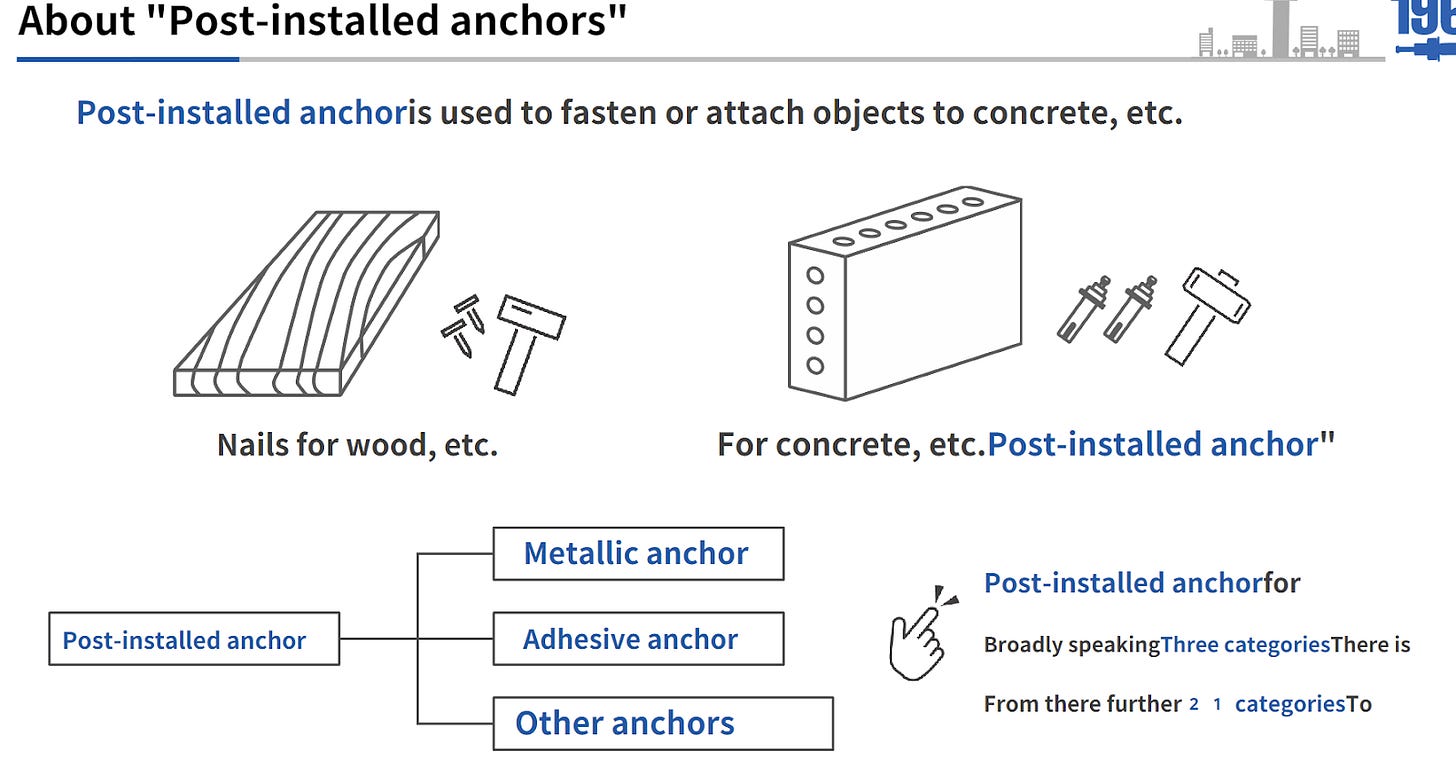

What are post-installed anchors? They’re basically nails/screws designed to be used for concrete. The company’s illustrates it well:

Sanko Techno manufactures post-installed anchors both domestically and abroad (through its wholly-owned Thai subsidiary). The ones produced in Thailand are primarily imported for sale in Japan.

Most recent mid-term management plan:

Longer term (2034), Sanko Techno aims to more than double their top line to ¥50 billion.

FY2025 management forecast:

Further reading: latest mid term management plan (released May 31, 2024). It’s in Japanese but you can upload it here to translate it to English.

I also find it interesting that you seem to be able to find a lot of cheap stocks in Japan. This is probably due to the fact that there are a lot of smaller companies listed in Japan. In general, the Japanese market is not so cheaply valued, see below for one of the better valuation overviews I know of. However, these should be taken with a pinch of salt as there are often good reasons for the valuations.

https://economistwritingeveryday.com/2023/08/17/us-stocks-are-expensive-these-countries-are-not/

https://theideafarm.com/p/2q24-global-valuations

The stock is pretty illiquid. I have seen that the stock price has risen quite sharply today. This was also the case with Sanyo. Perhaps this blog is influencing the stock price (?) This depends e.g. on the reach of the blog. It would also be quite amazing.