Asaka Industrial (TYO 5962): A 350-Year-Old Profitable Nanocap Net-Net Trading at 0.4x P/B, 7x P/E, with Real Estate Worth 260x its Carrying Value

This $10m nanocap trades at a 57% discount to NCAV + investments and holds land valued at just $22,500 on its balance sheet, yet it is worth at least $5.7M.

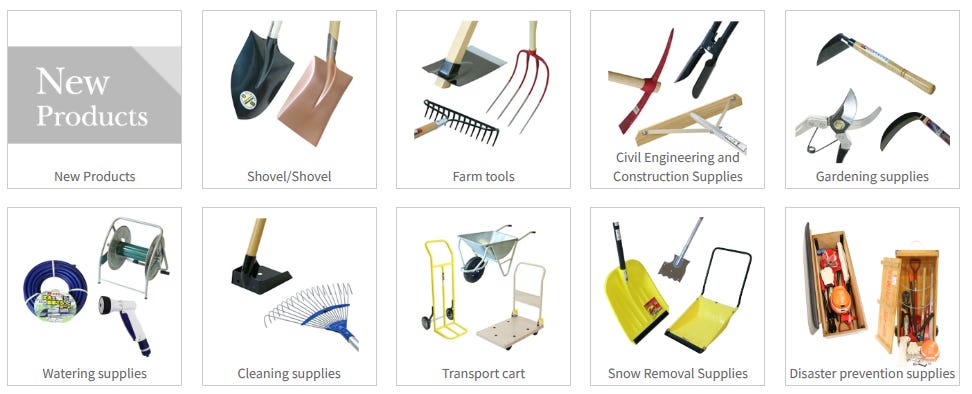

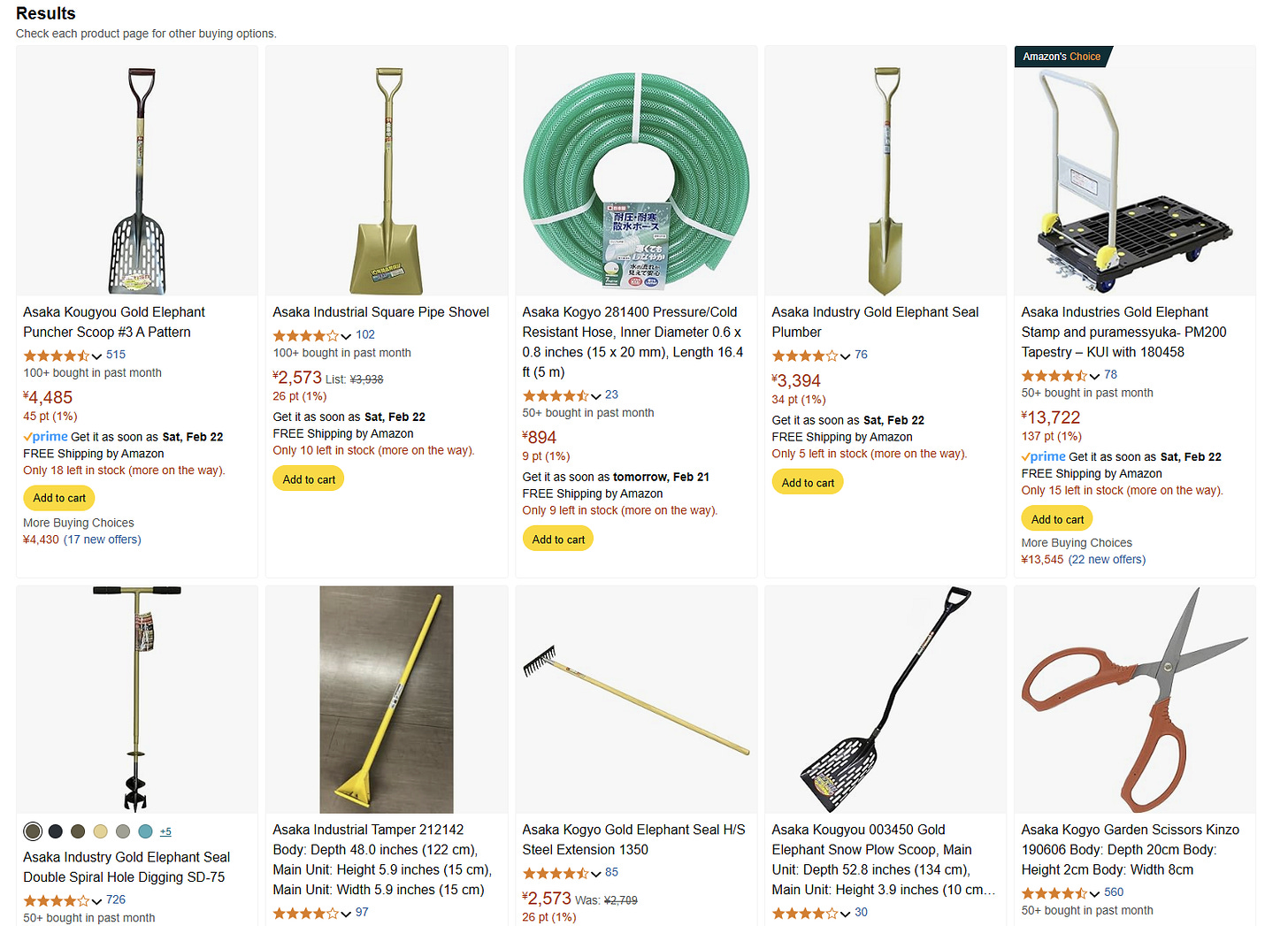

Asaka Industrial is a dirt-cheap manufacturer of shovels, gardening tools, and logistics equipment. According to its annual report, the company was “the first in Japan to produce and commercialize shovels and scoops” back in 1893. The company itself was founded around 1661. We’re buying a piece of history here!

Stock price: ¥1,595

Market cap: ¥1.5 billion ($10 million)

Net current asset value: ¥1.9 billion

Investments: ¥1.6 billion

NCAV+Investments: ¥3.5 billion (¥3,678 per share)

P/E (Forecast): 6.8x

P/E (Last FY): 5x

Dividend: 3%

The company is the #1 manufacturer of Japanese made shovels and spades.

Asaka Industrial is undeniably cheap—both on earnings and assets. But it gets even better.

The company owns two properties in Sakai City, near Osaka—one spanning 9,394 sqm and the other 12,290 sqm.

Yet, on the books, the land portion of these properties are carried at just ¥1.4 million ($9,500 USD) and ¥1.9 million ($12,500 USD), respectively. Combined, that’s just $22,000. Clearly, these assets are worth far more.

The company’s history mentions they built their head office and factory in Sekai City back in 1940. This explains why the land is carried at such a low amount.

The corporate office can be seen below. There’s also an adjacent industrial property not visible in the image.

So what’s the 21,684 sqm of land actually worth? No clue. But when I asked ChatGPT and Deepseek, the most conservative estimate I got was ¥40,000 per square meter—which would peg the total value at ¥867 million (260x its book value).

That ¥40,000 per sqm estimate assumes everything is zoned industrial, which isn’t the case. The corporate HQ clearly isn’t, but we’re being conservative. And that’s not even factoring in the buildings themselves, which also have value.

The value of the real estate doesn’t even matter. It’s just a bonus. Net current assets + investments alone are already double the market cap, and the stock trades at less than 7x this year’s net income.

I doubt there’s much growth here, but management is clearly savvy. For a tiny subscale manufacturer, they’ve done an impressive job staying profitable.

Shareholder Register:

Family members (those with the Asaka surname) own just 8.61% of outstanding shares (among the top 10 shareholders). But Activism is still unlikely as every other top shareholder is likely friendly with management (business partners / cross shareholders).

Activism is also unlikely because the market cap here is ¥1.5 billion. This thing is absolutely tiny and there just isn’t much juice (in absolute terms) to squeeze for any activist.

Zojirushi Trademark

Interestingly, Asaka Industrial has owned the “Zojirushi” (象印) trademark since 1897 and uses it in their logo. This initially confused me as Zojirushi Corporation (TYO 7965) is a much larger $750 million company best known internationally for their ricecookers. They also happen to own 2% of Asaka Industrial’s outstanding shares.

Asaka’s use of the trademark of course applies only to their shovels and spade products to avoid any confusion. While the company website specifically says they own the “Zojirushi” (象印) mark, their products are marked with Kinzoujirushi “金象印”.

Maybe Zojirushi Corporation will just buy Asaka Industrial to avoid any trademark confusion! I jest. But I did find this amusing.

Stock Hasn’t Moved Much

Since 2000 Asaka Industrial stock is down 8% despite improving fundamentals. Besides a huge rally back in 2005-2006, the stock doesn’t move much.

Conclusion:

Asaka Industrial is too small and illiquid for most investors, making it a tough recommendation. But I still own a small position in my cheap Japanese basket partly because I find the company fascinating. It’s the smallest market cap company I own.

In an era where everyone is cutting corners to make the cheapest possible product, this tiny company is doing the opposite– sticking to high-quality, Made-in-Japan shovels.

Disclosure: I own shares in Asaka Industrial (TYO 5962). The security could be sold at any point in time without prior notice. This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into this name. If I missed anything important, feel free to share in the comments. None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due diligence.

Appendix:

Manufacturing process for Asaka Industrial’s Shovels:

Asaka Industrial Products on Amazon Japan

I ended up buying a few hundred more shares today after publishing this article. I should have just bought yesterday lmao.

Do you know the level of export?