3 Quick Pitches for 3 Cheap Japanese Stocks: Nippon Shindo (5753), Nakakita Seisakusho (6496), and Wood One (7898)

Two deep value net-nets and a company that owns 40,000 hectares of New Zealand forestry

3 Quick pitches for 3 cheap Japanese stocks in my basket.

Nippon Shindo (TYO 5753)

Share Price: ¥1,970

Market Cap: ¥4.2 billion

NCAV: ¥8.6 billion

Book Value: ¥11.6 billion (¥5,463 per share)

Price/Book: 0.36x

P/E: 4.3

Dividend: 0.7%

Nippon Shindo specializes in the manufacturing and sale of brass bars, brass wires, and other nonferrous metal products, primarily serving the automotive, industrial machinery, and construction sectors. The company has been around since 1938.

The investment pitch here is simple. This is a deep value double net net (NCAV is double the market cap) and it also owns some land which is likely worth above book value. Earnings have also improved significantly over the years which can be seen here:

I can’t attach a Koyfin chart showing net income as data providers can’t seem to pull correct numbers for Nippon Shindo, which makes this name impossible to find on some screens (like Koyfin). Even Google Finance's financial statements stopped in 2015 for some reason.

That reason may have to do with the company becoming majority owned by CK San-Etsu (TYO 5757) in 2015. They currently own 55.4% of the company. CK San-Etsu is a prime market listed company in Japan which means they’ve shown some willingness to improve corporate governance. CK San Etsu’s share of ownership has increased over the 5 years due to repurchases by Nippon Shindo. Shares outstanding are down ~10% over the last 5 years.

Parent-child listings have faced increasing scrutiny in Japan over the last few years with the Tokyo Stock Exchange requiring additional disclosures for companies that maintain such relationships on public markets. The easy solution to resolve these issues and reduce compliance costs has been to just buy out the listed subsidiary. CK San-Etsu is Nippon Shindo’s obvious buyer. There have been several recent examples of parent companies taking over their listed subsidiaries over the last year. Aeon taking over 2 subsidaries in late February were the most recent.

The company’s primary industrial property is on Osaka Bay and is likely worth more than book value. The facility sits on 37,385 sqm of land and is on the books at just 2.3 billion yen (2 billion of which is the land). While this won’t be sold as its essential to the business, the major fixed asset on the balance sheet is also valuable. Real estate in far flung locations are much more difficult to value, but this sits on Osaka Bay near many other industrial properties.

Conclusion:

This is a full basket sized position for my cheap Japanese basket. There’s a lot to like here including: double net net, good earnings growth, likely undervalued RE, share purchases, and a clear strategic acquirer with CK San-Etsu.

It’s not all positive though. On the downside the dividend is low (0.7%) and the company has an arrangement to reimburse CK San-Etsu for assistance with management and guidance for the company. It isn’t an egregious amount, but it's a bit unusual.

Nakakita Seisakusho (6496)

Share Price: ¥3,135

Market Cap: ¥11 billion

NCAV+Investments: ¥17 billion

Book Value: ¥24.8 billion (¥7,034 per share)

Price/Book: 0.46x

P/E: 6.21 (includes one time gains)

Operating Profit: 8.46x

Dividend: 3.2%

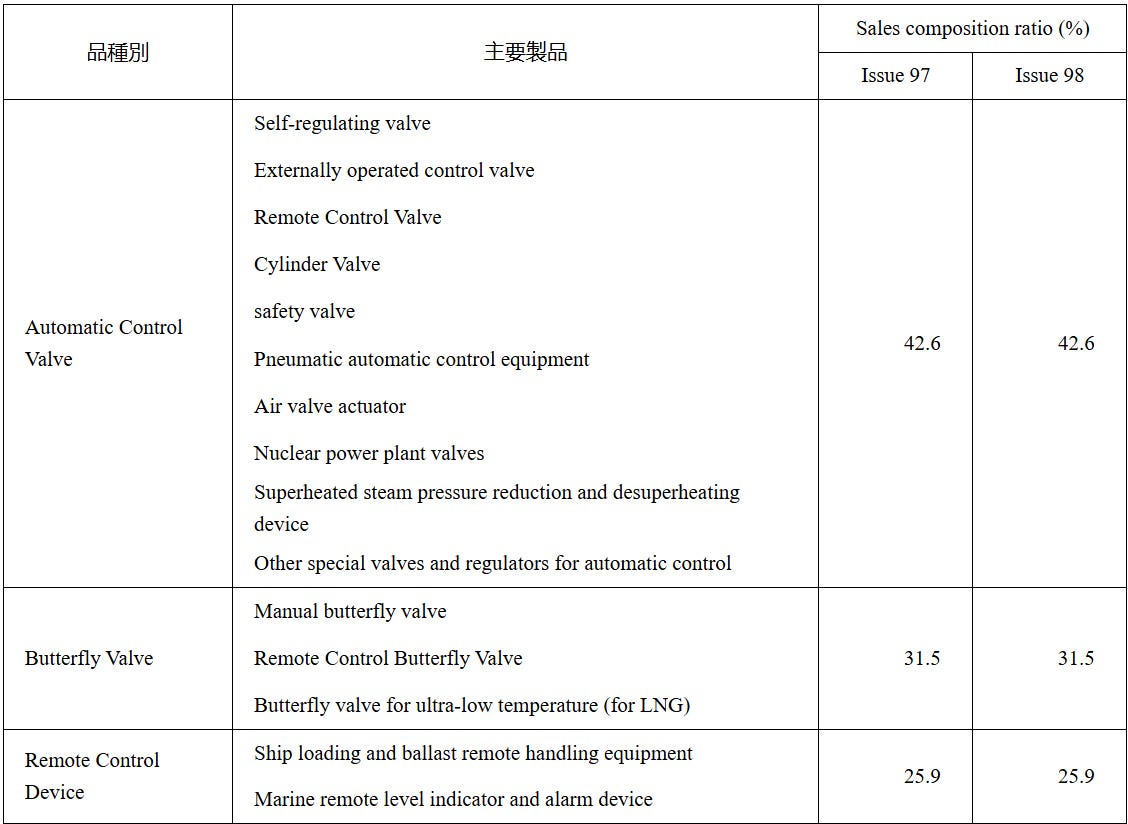

Nakakita Seisakusho is a net-net manufacturer of automatic control valves, butterfly valves, and remote control devices for ships and power plants. They even make valves for nuclear power plants. The company has been profitable every single year since 1977 and have been in business since 1930. I’ve done very little work on this name and bought it on financials and historical profitability alone.

A breakdown of their products/sales:

Nakakita Seisakusho is open to doing M&A to grow their business as they recently acquired Ace Valve in South Korea (price not disclosed). M&A seems like a waste of money when the company’s own shares are so undervalued, but it's still a better use of cash than just letting it pile up. The company also does small scale share repurchases regularly. Since 2015 shares outstanding has decreased ~8%.

Ace Valve is profitable based on disclosed data which is reassuring. I enjoyed browsing Ace Valve’s website which was built in 1998 and even has a hit counter!

Conclusion:

This is a full sized basket position. It’s very cheap and has a long history of profitability. Hat tip to @Japan_cap for bringing it to my attention.

Wood One (TYO 7898)

Share Price: ¥982

Market Cap: ¥9.2 billion

Book Value: 45 Billion (¥4,776 per share)

Price/Book: 0.2x

Dividend: 2.4%

Wood One. is a Japanese company primarily engaged in the manufacturing and sale of wooden building materials, including flooring, doors, stairs, storage systems, etc. The core operating business is lousy, but has been marginally profitable historically. Unlike most names I own, this one is not a net net and has a lot of debt. I considered excluding this one in the writeup, but I own a tiny position and figured I’d write a bit about it.

Wood One’s value lies on the balance sheet where the company currently manages 40,000 hectares of forestry in New Zealand which they mostly acquired in 1990. The company also owns significant art assets (¥7.7 billion book value including a Van Gogh and several Renoirs). Net assets have been growing steadily since the financial crisis.

The New Zealand forestry assets were mostly acquired in 1990 when the company purchased Crown Leases from the government. They invested $40 million NZD initially and another ~$60 million or so in the years after. They divested some of these assets for a gain in late 2012.

Only 12,431 hectares of the forests Wood One owns are freehold with the rest being crown leases. The freehold interest makes them the 32nd largest private landowner in New Zealand.

Conclusion:

I own this name, but it’s a tiny position. I like Nankai Plywood much more (TYO 7887) which is in the same industry but the investment case is much simpler. It has a similar discount to book value and is a net-net. Wood One may have more upside if there are some hidden gems in the art assets or if the New Zealand forestry assets are worth a lot more than book value or if other owned real estate appreciated over the decades. This is a very low conviction bet and sized as such.

The company has never disclosed the artworks they own, but the art is publicly on display at the Wood One Museum. The company obviously has no intention to sell the artwork, but things are changing in Japan. DIC Corporation, which owns over $1 billion in artwork on display in their own museum, did cave to an activist shareholder’s demands to sell them. Unlike DIC though, the Wood One art doesn’t feature any $100 million pieces or anything too expensive. The Van Gogh they own isn’t exactly his best work:

Disclosure: I own shares in all 3 stocks mentioned. These securities could be sold at any point in time without prior notice. This is a small position as part of a broader basket of cheap Japanese companies so I haven’t dug too deep into any individual name. If I missed anything important, feel free to share in the comments. None of this is investment advice. Everything in this post is my own opinion and I could be wrong. Do your own due diligence.

I generally want my writeups to be shorter. Bundling a few ideas into multiple quick pitches may be a good way to do it. No need to state every obvious thing that investors can easily look up on their own if they find the broad themes interesting.

Thanks I like the quick potch format